FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

|

CHAPTER 5: STRONG PEOPLE Strong people are at the heart of a resilient nation — as family members and friends, employees and contributors to their communities — and, during times of economic uncertainty, they are essential in sustaining an economic recovery and a high standard of living. Some witnesses expressed their views on a range of issues facing individuals: a fair personal taxation regime that does not have a high compliance burden, access to health care and an adequate supply of health care professionals as well as support for caregivers and those with particular medical conditions, affordable education with sufficient support for educational institutions and for students, various supports for those in and out of the paid labour force, and retirement savings measures and pension plan provisions that help to assure adequate retirement income. The witnesses requested ...5.1 Personal TaxationThe level and manner of taxation of individuals by a country are important for a variety of reasons. For example, choices about where to live, how much to work and how much to save, among other decisions, may be affected. A number of witnesses spoke to the Committee about a variety of personal taxation issues, including tax reform, compliance and special measures for such groups as those with low income, caregivers of children and other dependants, disabled persons and those with income that fluctuates – at times significantly – from year to year. A. Tax ReformBelieving that Canada should have a personal taxation system characterized by fairness, some witnesses proposed measures that they believe would achieve this goal. For example, each of the following proposals was supported by one witness: a redesign of the system to achieve greater income redistribution; measures to address the relatively higher taxation of wage income than dividend income when payroll deductions are taken into account; consideration of the effect of the tax system on parents who have earned income and on parents who choose to not participate in the paid workforce; use of the family unit for taxation purposes; a review of the effect of the current tax system on single-income families; and a comprehensive review of tax provisions that affect estate and succession planning, particularly in respect of the taxation of transfers of family-owned businesses. A number of witnesses provided the Committee with varying opinions about changes regarding personal income taxation. For example, some witnesses proposed an increase in the tax rate for high-income earners, while other witnesses advocated a phased-in decrease in the tax rate for those earning income in the top two tax brackets. A number of proposals were supported by one witness in each case, including suggestions in relation to: an increase in the number of tax brackets, a more general reduction in personal income tax rates in order to facilitate retirement saving, and a rate reduction for high-income earners in order to encourage immigration and retain workers in Canada. One witness requested a reduction in investment-related tax incentives, such as the capital gains inclusion rate as well as the deduction and deferral of taxation for registered retirement savings plan contributions. Canada’s personal taxation system was compared to that in other Organisation for Economic Co-operation and Development countries by one witness, with a suggestion for changes to Canada’s personal and consumption taxes. Some witnesses made suggestions in relation to specific groups of taxpayers. For example, each of the following proposals was supported by one witness: an increase in the Working Income Tax Benefit to a level that would bring the income of all Canadians with full-time employment up to the appropriate low-income measure, an increase in the personal exemption to reflect the appropriate low-income measure for all individuals living in poverty, and an increase in the ceiling amount of the lowest tax bracket to align with the yearly maximum pensionable earnings stipulated in the Canada Pension Plan. B. ComplianceA number of the Committee’s witnesses argued that the compliance costs associated with filing a personal income tax return are too high, and requested simplification of the Income Tax Act in order to reduce paperwork for individuals and tax administration costs for the federal government. To aid individuals who have complex tax returns, some witnesses proposed that the tax filing date be extended to June 15 to provide individuals with additional time to obtain official documents from third parties, such as investment administrators. In the view of one witness, simplified tax legislation would increase transparency, reduce uncertainty for tax preparers and taxpayers, and decrease the likelihood of aggressive tax planning. C. Measures for Particular GroupsProposals related to caregivers and tax credits were presented to the Committee by a number of witnesses, with some commending the government for tax credits that have been put in place, such as the family caregiver tax credit, the disability tax credit and the Age Tax Credit; other witnesses suggested that these tax credits should be made refundable. Each of the following proposals was supported by one witness: consolidation of caregiver tax benefits to prevent overlap; streamlining of tax benefits to mitigate income and pension accumulation losses when a person leaves the workforce to care for a dependent family member; extending benefit eligibility for caregivers who live apart from the dependent person receiving the care; and removal of the limit on the amount of eligible expenses that caregivers can claim under the medical expense tax credit for a dependent relative. According to some witnesses, specific tax measures in relation to child care and children need adjustments. For example, they advocated direct child care subsidies for parents rather than tax benefits in order to enable workforce entry or re-entry, an increase in the value of the Canada Child Tax Benefit and the National Child Benefit Supplement, and family income-splitting for the purposes of taxation. Recognizing that some individuals have variable levels of income from year to year, a number of the Committee’s witnesses advocated income averaging for self-employed artists, as well as allowing professional artists and creators to use their revenue in the current year in order to establish contribution room for purposes of registered retirement savings plans. They also proposed a tax credit for production of live performances, including theatre, dance and opera, exemptions from taxation in respect of income derived from copyright and residual payments and of arts grants, and tax measures that would enable writers and other creators to earn a better living from their creative efforts. 5.2 HealthA healthy population is an indicator of, and a contributor to, a nation’s health and prosperity. Some witnesses spoke to the Committee about such health-related issues as drugs, caregivers and care facilities, health promotion and disease prevention, mental and oral health, health care professionals and facilities, health-related research and innovation, the future of health care and its costs, and the needs of people with disabilities or other medical conditions. A. DrugsA number of witnesses told the Committee about the need for improvements to Health Canada’s regulatory review processes for drugs and other medical products, including natural health products, and they proposed certain changes. For example, they supported funding for the department’s Natural Health Products Directorate and the Health Products and Food Branch Inspectorate to enable it to implement and enforce natural health product regulations. Each of the following proposals was supported by one witness: natural health products should no longer be defined as drugs under the Food and Drugs Act; funding for the Canada Border Services Agency and the Canada Post Corporation to prevent illegal natural health products from entering Canada; and changes to Health Canada’s approval system by moving to a “management-by-exception” system based on post-market compliance that would allow low-risk and high-risk health care products to be regulated differently. A number of witnesses advocated the creation of a national pharmacare plan to ensure that all Canadians have access to medically necessary drugs, with some proposing a cost-sharing arrangement with the provinces and territories to finance such a plan. One witness informed the Committee about the need to develop an implementation plan to ensure that the elements of the National Pharmaceuticals Strategy of the 2004 Health Accord are realized. Some witnesses made suggestions in relation to Health Canada’s Therapeutic Products Directorate, the proposed labelling requirements regarding pharmaceutical drugs for human use and the production of medical marijuana. In particular, one witness proposed that, in order to support successful implementation of the revised cost recovery framework, resources at Health Canada’s Therapeutic Products Directorate should not be affected by the strategic operating review. Another witness argued that certain changes outlined in the Draft Guidance Document- Labelling of Pharmaceutical Drugs for Human Use should not be implemented, while yet another witness believed that the production of medical marijuana should be closely monitored. Measures that acknowledge and nurture global partnerships, such as support to develop targeted regional biopharmaceutical corridors across Canada, were presented by one witness. B. Caregivers and Care FacilitiesA number of the Committee’s witnesses requested the development of a national caregiver strategy as a framework for directing and coordinating measures to support family caregivers, believing that such a framework could be the basis for a dialogue with the provinces/territories on targeted measures for family caregivers. Proposals supported by one witness in each case included: the introduction of employer incentives to reward family caregivers; funding and support for home care and patient’s medical homes, with each patient having a family physician; the development of advanced access booking systems and strategies for after-hours coverage; and support for health information systems and technology. C. Health Promotion and Disease PreventionRecognizing that physical activity contributes to good health and disease prevention as well as to potentially less frequent or less intensive use of health care services, a number of witnesses advocated changes to the Children’s Fitness Tax Credit, which some believe should be fully refundable for non-taxpaying individuals, and the establishment of a national child’s physical literacy achievement award. The following proposals were supported by one witness in each case: the introduction of an adult fitness tax credit linked to requirements such as healthy eating education and behaviour modification, the development of a monitoring system to improve children’s health and well-being, and funding for participACTION. Some witnesses supported investments in new vaccines, in a permanent, national immunization trust fund that is separate from the Canada Health Transfer and in a national immunization strategy to ensure timely adoption of newly recommended vaccines. One witness highlighted the need to develop a public immunization program against shingles. A number of witnesses proposed strategies to support health promotion and disease prevention. For example, the following measures were supported by one witness in each case: the development of a national activity guide; an education campaign to increase awareness about sodium and the benefits of reduced sodium consumption; and measures aimed at reducing diabetes, including through a pan-Canadian healthy weights strategy, a Canadian diabetes strategy and an Aboriginal diabetes initiative. D. Mental and Oral HealthSome witnesses commented on mental and oral health issues, both generally and in relation to particular populations. For example, a number of witnesses told the Committee about the mental health and addictions program needs of First Nations youth and Inuit communities, and one witnesses highlighted the need for expanded oral health promotion and disease prevention among Inuit and First Nations through the Children’s Oral Health Initiative of the Non-Insured Health Benefits (NIHB) program. A number of witnesses urged the establishment of a national network of depression research and intervention centres as well as investments to support recovery programs for First Nations, military and youth who suffer from addictions. One witness requested a plan that would provide consistent, Canada-wide public health programs focussing on oral health promotion and the creation of a public health system that meets the oral health needs of Canadians. E. Health Care Professionals and FacilitiesSome witnesses shared their views on health human resources, and requested the establishment of a sustainable health human resources plan, including in relation to physicians, and a national health human resources data and analysis centre. One witness advocated the creation of a unique identifier for each Canadian health professional as a means of ascertaining the number of health human resources in Canada, the establishment of a system linking these unique identifiers with patients’ electronic health records, and system improvements that would enhance the integration of health information from different sources. According to one of the Committee’s witnesses, the federal government should increase the GST rebate on all eligible purchases made by publicly funded, not-for-profit health care institutions. One witness proposed the establishment of a national health human resource infrastructure fund to support health professionals in delivering new models of health care, inter-professional practice and research and innovation, while another witness encouraged the government to strengthen and support primary health care through ensuring the existence of a sufficient number of health care professionals and providers as well as infrastructure and governance. Suggestions that were supported by one witness in each case included: the creation of a national health delivery infrastructure fund to provide academic health care organizations with an incentive to enhance their capacity to provide Canadians with timely access to care in a way that uses green and digital technology markets in Canada; a comprehensive set of pan-Canadian health system indicators that demonstrate quality improvement across the continuum of care; the establishment of a national medication management centre to reduce adverse drug events and to enhance patients’ management of their medication; support for data-reporting infrastructure in relation to drugs; and the creation of a link between the Canada Health Infoway and Canada’s digital strategy. Proposals supported by one witness in each case were also made in relation to medical schools and students: the creation of a medical education opportunities fund to promote careers in medicine, the granting of bursaries, the development of databases to understand more accurately the demographic profile of Canadian medical students, funding of such measures as bridging programs to enhance the participation of internationally educated health professionals, targeted education and skills training programs for health care workers, the availability of employment opportunities following graduation was urged. One witness commended the government for current strategies regarding student loan forgiveness in relation to health care professionals who practise in rural and remote areas, and some requested that such loan forgiveness be extended to include such professionals practising in other regions. A number of witnesses requested a more integrated, government-wide policy approach to later-life, serious-illness and end-of-life issues. The Committee also heard a number of suggestions that were supported by one witness in each case, such as investments in order to ensure that all Canadians have access to hospice, palliative and end-of-life care; the need to encourage Canadians to discuss end-of-life care with their relatives; and funding of new, community-integrated palliative care approaches. F. Health-related Research and Innovation

Some witnesses spoke to the Committee about the need to ensure that effective tax policy supports health care as well as health-related research and innovation. A number of witnesses expressed their opinions on the Canadian Institutes of Health Research (CIHR), and supported the acceleration of leading-edge research and innovations into Canada’s health care system through the CIHR Strategy on Patient-Oriented Research; one witness proposed greater support for CIHR. Another witness informed the Committee about the requirement to develop a medical device and technology strategy to help achieve long-term health system goals, while still another witness supported promotion of pan-Canadian sharing of innovative practices in the delivery of health care. In relation to research on chronic diseases one witness informed the Committee about the need for investments that would support research regarding the incidence and patterns of diseases, the use of health facilities, the effectiveness of various interventions and approaches, individual and population health outcomes, and cost-effectiveness. G. Future of Health Care and its Costs

With the 2004 Health Accord expiring in 2014, some of the Committee’s witnesses spoke about negotiations for the next accord and the elements that should be included in it. One witness advocated an increase in health care funding, while another witness supported the inclusion of a home care strategy, reinforced the five principles of the Canada Health Act, and stressed the importance of establishing a consultation process involving all key stakeholders, including those with chronic conditions, and a nation-wide dialogue about the health care system. One witness highlighted the need for tax incentives in relation to public and investor returns in social impact financing, which could attract private capital in the development and implementation of service delivery innovations. A number of proposals in relation to funding for specific programs or agencies were presented to the Committee, with the following suggestions supported by one witness in each case: current support for the Public Health Agency of Canada should be maintained; additional financial and program support to existing initiatives that assist Aboriginal Canadians, including the First Nations and Inuit Health Branch, the NIHB program and Aboriginal Head Start On Reserve Program, should be allocated; additional funds to family support programs, including Community Action Program for Children and Canada Prenatal Nutrition Program, should be provided; and additional funding of Aboriginal health care systems as well as the setting of specific targets to improve Aboriginal mental and physical health should occur. In noting that health care costs continue to rise, some witnesses requested that the federal government promote cost control and productivity in health care. Proposals supported by one witness in each case were focussed on the need for private health care providers, funding linked to the patient, the creation of a registered health savings plan in order to help employers and employees prepare for post-retirement health care expenses, and the purchase of long-term care insurance or contributions to a designated registered savings plan for this purpose. Other suggestions supported by one witness in each case were in relation to the use of actuarial science to ensure objective analysis, the importance of following expert advice on health care design, benefit coverage and funding, the need for consultations on the development of a national continuum-of-care policy, and the value of partnerships between the private and public sectors, such as that between the Juvenile Diabetes Research Foundation and the Federal Economic Development Agency for Southern Ontario. H. People with Disabilities or Other Medical ConditionsSome witnesses made suggestions in relation to people with disabilities or other medical conditions. For example, one witness requested that the federal government renew the Social Development Partnership Program and the Canada’s Community Inclusion Initiative for people living with disabilities. Requests in relation to particular disabilities were also made. For example, a number of witnesses requested renewed funding in order to research spinal cord injury cures, to improve accessibility and inclusivity in relation to people living with spinal cord injuries, and to support new social innovations. One witness supported the creation of a national autism council and a Canadian national autism strategy. To assist in reducing the social, economic and health burden of Canadians living with an acquired brain injury, one witness told the Committee about the need for increased funding for the Brain Injury Association of Canada to enable the creation of a national movement for people living with brain injuries, to support research in the field of brain injuries and to create awareness about such injuries. One witness spoke to the Committee about the need for funding for a national research program in relation to the health of veterans and other members of the military, and incentives for investments in research related to military and veteran health. Suggestions to assist those with disabilities and other medical conditions that were supported by one witness in each case included: the need for a national program to facilitate the early identification of, and intervention in respect of, speech and language disorders in young children, the need for implementation of a preventive treatment program for respiratory syncytial virus among Inuit babies born in remote Nunavut communities, the need for investments in the dissemination of best practices to improve the diagnosis and treatment of respiratory illness, the need for support for the frail elderly; the need for funding to accelerate the early detection of lung illnesses, and the need for measures that would lead to reduced exposure to hazardous pollutants and to sources of exposure. 5.3 EducationEducation is valued for the contribution it makes to enhancing an individual’s quality of life, for the way it improves an employee’s productivity, and for the impact that it has on decisions made by foreigners and foreign businesses about where to live and invest, among other reasons. A number of witnesses shared their views about federal support to the provinces and territories and First Nations for education, support for students, and measures in relation to international students and Canadians studying abroad. A. Federal Support to the Provinces, Territories and First Nations

Some of the Committee’s witnesses presented suggestions in relation to federal support for education, which is provided to provinces and territories through the Canada Social Transfer. For example, a number of witnesses proposed the development of a separate post-secondary education transfer, with funds allocated on a per-student basis, and the creation of a post-secondary education act that is modeled on the principles of the Canada Health Act. One witness advocated the establishment of a post-secondary education advisory council on which provinces would be represented, and another witnesses asked that the level of federal funding for the post-secondary sector be increased. A number of witnesses advocated investments in teaching facilities to ensure that equipment meets industry standards. One witness supported continued federal investments in literacy, numeracy and problem-solving skills — alone or in partnership with provincial and territorial governments and/or the private sector — while another witness made suggestions regarding financial support for the college system. Some suggestions made by the Committee’s witnesses were supported by one witness in each case, including those in relation to: the creation of a national skills strategy to increase post-secondary enrolment, the development of a pan-Canadian strategy to improve the quality and accessibility of post-secondary education, and support for the entrepreneurial mission of post-secondary institutions. The particular needs of Aboriginal students were identified by a number of the Committee’s witnesses. In order to meet those needs, they proposed an increased investment in Aboriginal education, including the removal of the 2% cap on spending increases in relation to Aboriginal Affairs and Northern Development Canada’s Post-Secondary Student Support Program, and adequate financial assistance for every eligible Aboriginal learner. One witness told the Committee about the need to support Métis and Non-Status First Nations learners through an initiative, to be developed by the federal government and Aboriginal organizations, that would extend non-repayable financial assistance to them. Some witnesses requested an increase in core funding for Aboriginal institutions, while a number of proposals were supported by one witness: a fiscal framework that would support First Nations systems in delivering excellence in education, enhanced post-secondary education for Aboriginal Canadians through sustained funding, and the implementation of a national strategy on Inuit education. Some witnesses urged the federal government to take the actions needed to raise the educational attainment rates of First Nations, Inuit and Métis students to national averages as well as to increase the skills of Aboriginal Canadians. One witness asked for the development and implementation of a comprehensive strategy and action plan to close the educational gap between Aboriginal and other Canadians, with regular reports to Parliament and First Nations about the progress being achieved, while another witness told the Committee about the need to engage universities in discussions about successful outcomes for Aboriginal students and underfunding of education for First Nations. B. Support for StudentsSome witnesses presented the Committee with suggestions designed to support students through changes to the Canada Student Loans Program (CSLP). For example, they advocated an increase in the income threshold used to determine eligibility for student loan interest relief, an increase in the number of needs-based grants and low-interest loans, a revision to loan limits, an increase in the payment and interest deferment period, the appointment of an independent ombudsperson to resolve disputes, a reduction in the repayment interest rate, an increase in the maximum amount of debt reduction available to borrowers who are experiencing difficulty in making their loan payments, and a change to the CSLP’s assessment of borrower assets in order to permit an exemption for a single vehicle. A number of the Committee’s witnesses advocated the reallocation of existing federal tax expenditures related to post-secondary education to grants and bursaries administered through the Canada Student Grants Program (CSGP). Other suggestions were supported by one witness in each case, including proposals related to: a tax exemption for the Apprenticeship Incentive Grant, an increase in the maximum amount per student available through the CSGP, maintained — if not increased — support for the Canada Graduate Scholarships Program, measures to encourage young people to remain in — and graduate from — high school, and a review of federal tax measures designed to assist high-need students and under-represented groups, such as students from low-income families, students with disabilities, Aboriginal students and adult learners. The Committee was also presented with proposals designed to help students enter and remain in the workforce, and a number of these suggestions were supported by one witness in each case: career guidance programs, the establishment of a federal work-study program to help students transition from post-secondary education to full-time employment, and expansion of internship programs coincident with the creation of complementary programs, such as industry fellowships and exchanges. One witness encouraged investments in programs supporting the ability of all students to obtain a university education in Canada as well as in programs that support domestic and international students’ ability to obtain affordable and high-quality education in Canada; particular attention was paid to the need to recruit Aboriginal students. C. International Students and Canadians Studying AbroadThe Committee heard about the need to support Canadian students wishing to study abroad and international students wishing to study in Canada. In particular, one witness supported measures to strengthen and promote Canadian education globally and to make Canadian graduate scholarships available to international students, while another witness advocated support for programs and policies to attract international students. 5.4 Job and Other SupportsFor their own sake, and for the sake of their families and communities as well as the nation, citizens need supports to help them be full participants in society, whether in or out of the labour force. Some witnesses provided their comments on measures that support labour force participation, including child care as well as on-the-job training and employment insurance, and on labour shortages as well as supports for those who are not in the paid workforce. A. Child CareAccording to a number of the Committee’s witnesses, access to child care is often a major barrier to entry into, and continued participation in, the workplace for Canadian parents and guardians of young children. Some witnesses stated their appreciation for the Universal Child Care Benefit (UCCB) and the Canada Child Tax Benefit (CCTB). Certain witnesses argued for an increase in both the UCCB and the CCTB and for a new benefit that would provide parents of children aged up to 18 years with a refundable tax credit. Recognizing that child care is often discussed in the broader context of early childhood education and care, a number of witnesses commented on the importance of appropriate levels of support from each level of government, including First Nations, provinces and territories, and municipalities, and suggested that all levels of government work together to identify possible solutions to deficiencies in child care and early learning services. B. On-the-Job TrainingSome witnesses shared proposals in relation to on-the-job training. For example, they supported the creation of a tax credit for employers that engage in workplace literacy and essential skills training, including language training, and a training tax credit creditable against Employment Insurance premiums. One witness proposed a tax credit for formal training expenses for apprentices. A number of witnesses encouraged the government to invest in the digital skills of all Canadians, to advance financial literacy, to promote the importance of essential skills in the workplace, and to provide sustained funding for — and conduct an examination and review of — the current Labour Market Development Agreements with the provinces, territories with a view to allowing a greater ability to access courses at accredited training centres and to ensuring standardized funding formulae among regions. One witness praised the Knowledge Infrastructure Program, and advocated its continuation with a broadened mandate. Some witnesses also discussed the need to increase support for education and skills development, to encourage employers to hire and train workers, and to ensure the provision of skills training programs for post-secondary students and graduates. One witness encouraged the government to invest in, and expand, successful workforce development programs. C. Labour ShortagesAccording to some of the Committee’s witnesses, there are skilled labour shortages in Canada that are expected to worsen with the aging of Canada’s population; the implications for both citizens and employers are expected to become more pronounced over time. They suggested that older workers who have already left the workforce may have the skills required for certain jobs, and one witness urged the government to remove any disincentives to re-entering the workforce, such as the requirement to repay Old Age Security benefits should income earned exceed a certain amount.

A number of witnesses stressed the importance of labour mobility as a means by which to address labour shortages, especially for sectors that tend to employ individuals for short term-contracts. They suggested that the federal government should create a tax credit that would allow transitory workers to deduct employment-related expenses, including some travel expenses, incurred while temporarily relocated. They also proposed a national skills strategy that would address deficiencies among the various funders and providers of labour market programming in Canada, and that would establish solutions for labour market shortages. Some witnesses proposed immigration as another solution for addressing current and future labour shortages, with Canada competing with other countries for foreign students and workers. They argued for improvements to the immigration process that would allow more immigrants with particular job skills to settle in Canada more quickly, and urged the federal government to improve processes at Citizenship and Immigration Canada in order to expedite the process of attaining permanent residency, as well as to improve the Canadian visa application process for workers from emerging countries. They also advocated greater support for immigrants entering the workforce. One witness suggested that the government should allow occupation lists for immigration eligibility to be flexible and to adapt them as needs change in certain sectors of the economy. A number of witnesses spoke to the Committee about the need to improve the integration of immigrants into the labour market once they have arrived in Canada. The following suggestions were supported by one witness in each case: expand existing overseas pre-arrival services for foreign credential recognition that are part of the Canadian Immigration Integration Project, fund mutual recognition programs for professional qualifications, create a research mentorship program for foreign-trained professionals at colleges and polytechnics through funding from regional development agencies, renew federal-provincial immigration agreements, continue funding – at 2011-2012 levels – for settlement and integration services, and expand services at colleges to facilitate international students in becoming permanent residents. Feeling that disabled persons are another group that could help to address labour shortages, particularly if appropriate job supports are provided, some witnesses supported making the disability tax credit refundable. Other proposals were supported by one witness in each case, including those in relation to: a tax incentive for small business owners to undertake certain installations and modifications designed to increase accessibility for persons with disabilities, investments in labour market initiatives that allow people with intellectual disabilities to enter and remain in the workforce when they are able, and development of a national body to oversee and report on the coordination of disability support and service programs, as well as to establish options for those people with episodic disabilities within disability benefit programs. D. Employment Insurance

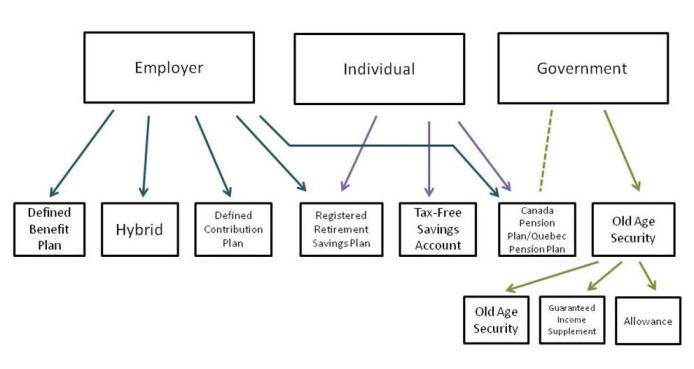

The Committee was presented with suggestions that, in the view of some witnesses, would strengthen the Employment Insurance (EI) program. A number of witnesses supported reform of the EI program to expand eligibility, reduce the number of hours required for eligibility, eliminate the two-week waiting period, increase the compassionate care benefit, base benefit levels on fewer best weeks of earnings, introduce a minimum yearly basic exemption, make the EI hiring credit permanent, and increase the percentage of earnings replaced. Another witness suggested extending EI if the individual is willing to relocate for employment. Some witnesses commented on payroll taxes, one component of which is EI premiums, and proposed no increases in EI premiums or Canada Pension Plan (CPP) contribution rates. One witness proposed a baseline amount of earnings below which workers would be considered to be temporarily hired, with the corresponding requirement that employers make the necessary payroll contributions, while another witness suggested the creation of a board of referees for the Northwest Territories and Nunavut, and yet another witness proposed that the government contribute to the EI fund. E. Support for Those Not in the Labour ForceSome of the Committee’s witnesses advocated an anti-poverty strategy, program spending measures aimed at providing employment opportunities for Canadians facing poverty, and national strategies with measurable targets, timelines and indicators aimed at poverty reduction and housing security, particularly for individuals with disabilities. 5.5 PensionsWith the aging of Canada’s population, ongoing concerns about the level of personal indebtedness in Canada and historically low interest rates on investments, there is an increasing public policy focus on how Canadians will support themselves in retirement. Some witnesses commented on three prevalent sources of retirement income in Canada: personal savings, occupational pension plans, and retirement benefits provided through the Canada Pension Plan/Quebec Pension Plan (CPP/QPP) and Old Age Security (OAS) programs. A. Personal SavingsA number of suggestions in relation to existing and proposed measures designed to enhance retirement savings were provided to the Committee, with the following proposals supported by one witness in each case: increases in the contribution limits for Tax-Free Savings Accounts and registered retirement savings plans (RRSPs), taxation of RRSP withdrawals according to the nature of the underlying income, the creation of a retirement savings grant for young Canadians with limited federal matching of their retirement contributions, an exemption from the application of the GST for portfolio management services in relation to retirement savings plans, a trust that would provide parents with tax benefits should they wish to leave a portion of their estate to their children for retirement purposes, an expansion in the list of stock exchanges in relation to which RRSP-approved investments could be made, and the addition of variable benefits to the definition of “qualified pension income” in the Income Tax Act to permit non-periodic payments to be split with a spouse or common-law partner. Some witnesses supported income splitting at age 55 with respect to three additional sources of pension income: registered retirement income funds (RRIFs), pension plan funds that have been transferred to a locked-in plan and amounts transferred from RRIFs to a retirement plan of a spouse. In order to provide Canadians with clarity about the nature and magnitude of their retirement savings, one witnesses suggested that the Canada Revenue Agency should send taxpayers a personalized “check up letter” indicating the current status of their retirement savings and a projection of estimated retirement income. B. Employer-Sponsored Pension Plans

A number of witnesses commented on a range of employer-sponsored retirement plans, including group RRSPs. In particular, one witness said that contributions made by employers to group RRSPs should be exempted from payroll taxes and that these contributions should be locked in until retirement, while another witness suggested that individuals should be permitted to transfer severance income into an RRSP without any effect of their contribution room. A number of witnesses made requests in relation to pooled registered pension plans (PRPPs), which they felt would lead to increased retirement savings should PRPPs be implemented. In order to ensure sufficient and gradual use of the proposed measure, some witnesses suggested a feature that would automatically enrol both employers and employees, but that would give them the opportunity to opt out should they so choose. Other suggestions in relation to PRPPs, each of which was supported by one witness, were: the locking-in of funds until retirement, a gradual and automatic increase in contribution limits over time, a requirement that a person’s RRSP contribution room be unaffected by his or her initial contribution to a PRPP, the ability to transfer assets between PRPPs and RRSPs without tax implications, the addition of a section to the Income Tax Act that would designate PRPPs to be a form of tax-registered savings vehicle and thereby regulated federally, and a requirement that most administrative responsibilities related to the PRPP be handled by a third-party administrator.

Some witnesses urged the government to take one of three actions: provide a temporary employer-employee savings grant, supplement initial contributions to the proposed PRPP measure, or provide a temporary tax credit to employers for their contributions to the PRPPs of their employees. One witness also urged the federal government to confirm that group RRSPs are “qualifying alternatives” to PRPPs, and another witness asked that the minimum 150-unit-holder rule to qualify for “mutual fund trust” status be reduced to a minimum of 50 unit holders and that individuals who invest directly or through an insurance segregated fund be designated as one unit holder. Some witnesses commented on pensions for federal public sector employees, and suggested the removal of the early retirement provisions in the federal public service pension plan, and the calculation of retirement benefits on the basis of the person’s salary over the course of his or her public service career. One witness also suggested that federal public sector defined benefit pensions be replaced by PRPPs. C. Canada/Quebec Pension Plan and Old Age Security ProgramsSome witnesses spoke to the Committee about issues related to the Canada Pension Plan/Quebec Pension Plan (CPP/QPP). For example, they supported an increase in the replacement rate for those with earnings below a certain amount, a doubling of CPP benefits, an ability for individuals to increase their contributions in order to compensate for periods of unemployment, the introduction of a dropout provision for certain caregivers, and an increase in CPP/QPP survivor benefits. Other witnesses advocated either the status quo or reduced CPP/QPP contributions. One witness told the Committee that the federal government should create an administrative department where a hospital, nursing home or funeral home could send a death certificate in order to avoid situations where CPP/QPP benefits are paid after death. Some witnesses commented on Old Age Security programs and argued for increases in, and extension of, benefits to all low-income persons aged 60 to 64 years. The Committee believes that people should be healthy, well-educated and fairly taxed. It is important that a nation’s residents be healthy not only for their own sake and the sake of their family, but also in order that they can reach their potential and fully contribute in their workplace, if any, and in their community. Consequently, we make recommendations related to health care, education, personal taxation, job supports for selected groups, and retirement income and savings. It should be noted that our recommendation in one of the areas noted below – pooled retirement pension plans – is the subject matter of Bill C-25, An Act relating to pooled registered pension plans and making related amendments to other Acts. Therefore, the Committee recommends that: The federal government, contingent on a return to balanced budgets, continue to reduce personal taxes through measures like income splitting and doubling the contribution limits for Tax-Free Savings Accounts (TFSAs). The federal government review the tax filing due date and methods for individuals, including exploring alignment with the small business tax filing due date for improved efficiency, and explore increased use of new compliance mechanisms like telephone audits. The federal government convene an expert panel to review, modernize and simplify the personal tax system. The federal government continue to support improvements to health human resources and health research for all health professions, including nursing, through the continued and growing use of innovative new technologies, such as electronic health records. The federal government continue its review of the Registered Disability Savings Plan to ensure it meets the needs of Canadians with severe disabilities, and their families. The federal government continue to work collaboratively with the provinces and territories to renew the Health Accord. The federal government continue to work with provinces and territories to address shortages of doctors, nurses and other health care professionals – especially in rural and remote areas. The federal government continue to conduct research to promote military and veteran health. The federal government study the treatment of personal vehicles under the Canada Student Loans Program’s assessment of borrower assets. The federal government make progress in engaging in a new approach to providing support to First Nations and Inuit post-secondary students to ensure that students receive the support they need to attend post-secondary education and engage in the labour market. The new approach should be effective and accountable, and coordinated with other federal student support programs. The federal government continue to support and promote the skilled trades, to better allow Canadians to take advantage of opportunities in such areas – including helping skilled workers with tax incentives or other incentives to move between provinces with greater ease. The federal government continue to help foreign-trained workers, including skilled immigrants and Canadians with international training or education, make contributions to Canada’s labour market and economy, including providing loans for recent immigrants to pay for skills training and accreditation. The federal government continue to support all Canadian Forces members as they transition from military to civilian life, especially through initiatives like the Helmets to Hardhats Program, while continuing to explore ways to improve reservists’ employment opportunities. The federal government continue to work cooperatively with provinces and territories on retirement income and pensions issues, and specifically implement the Pooled Retirement Pension Plan. The federal government review public sector pensions to ensure their ongoing cost and sustainability. The federal government review the rules surrounding Registered Retirement Income Funds (RRIFs) and Registered Retirement Savings Plans (RRSPs) to better support retirement savings. |

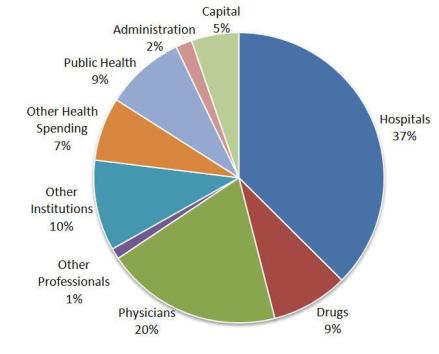

Notes: Data are projections. “Capital” refers to the physical infrastructure of hospitals, clinics, first aid stations or residential care facilities. Expenditures on “hospitals” and “other institutions” include: salaries of healthcare professionals, including physicians, for services provided in the institution; administration; drugs and provincial and territorial medical insurance plans.

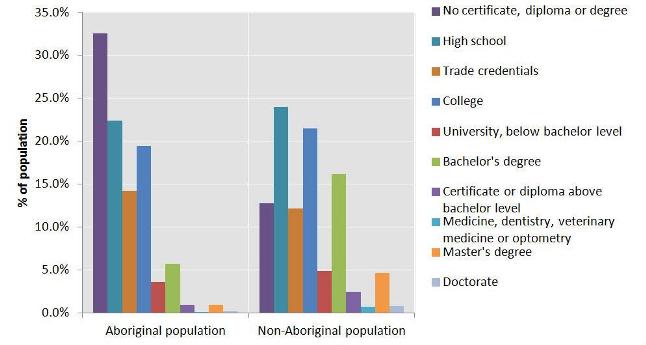

Notes: Data are projections. “Capital” refers to the physical infrastructure of hospitals, clinics, first aid stations or residential care facilities. Expenditures on “hospitals” and “other institutions” include: salaries of healthcare professionals, including physicians, for services provided in the institution; administration; drugs and provincial and territorial medical insurance plans.  Source: Figure prepared using data from Statistics Canada, “2006 Census: Data Products.”

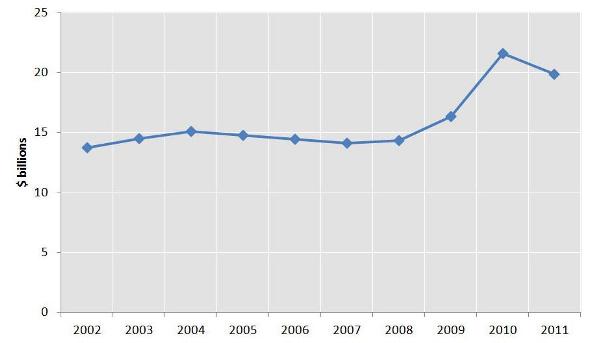

Source: Figure prepared using data from Statistics Canada, “2006 Census: Data Products.” Note: Data reflect year ended 31 March.

Note: Data reflect year ended 31 March. Notes:

Notes: