FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

|

CHAPTER 2: STRONG FEDERAL FINANCES When Canada’s businesses, communities and people are strong, the federal government receives comparatively more tax revenue, thereby enabling it to continue to provide the services that businesses, communities and people need to remain strong without having to increase the debt burden on future generations. As well, with a strong economy, federal spending on some programs may be relatively lower and the collection of tax revenue may be relatively higher, thereby enabling the government to provide the services that people value. Some witnesses shared their view that jobs and the economy should remain a priority. Their opinions about the Canadian economy and about a variety of issues related to federal spending are included in this report. The witnesses requested ...2.1 The Canadian EconomyIn a small, open economy like that of Canada, global occurrences — both positive and negative — can have significant economic impacts, as was evident during the recent global financial crisis. A number of witnesses provided suggestions relating to the Canadian economy, some of which concerned economic growth and others which were intended to stimulate business investment, either directly or indirectly. A. Economic Growth

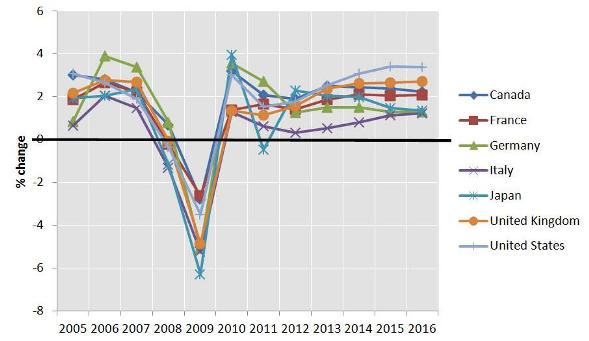

Some witnesses indicated that Canadian economic growth has been negatively affected by international factors, including Middle East unrest that is affecting energy prices, natural disasters that affect supply chains and global trade, and the ongoing sovereign crisis in some European countries. A number of witnesses said that the Canadian economy is expected to grow more slowly in 2012 than was previously expected; their projections for gross domestic product (GDP) growth ranged between 1.5% and 2.5%, rates that are lower than the 3% growth that Canada experienced in 2010. Certain witnesses proposed measures that they believed would stimulate the Canadian economy. For example, each of the following suggestions was advocated by one witness: the creation of an advisory board of chief executive officers and entrepreneurs who would provide advice to the federal government on the challenges that businesses face with respect to technology, regionally coordinated economic development bodies, the maintenance of low levels of inflation, the creation of an economic development strategy, the development of government strategies to advance knowledge in such areas as agriculture, energy and the environment as well as the integration of new technologies and business models into these areas, and the adoption of gold as legal tender in Canada.

Two witnesses commented on alternative interpretations of economic concepts. One witness supported measures of employment that would consider unpaid but productive work, while another witness spoke about a measure that would divide the economy into various forms of capital — human, natural, infrastructure, financial, etc. — and would measure changes in the value of each type of capital from year to year. Some witnesses spoke to the Committee about the importance of financial literacy among Canadians in light of record high levels of personal debt. B. Business InvestmentAccording to a number of the Committee’s witnesses, business investment is the most important contributor to Canadian economic growth in the short to medium term; that said, in their view, businesses need to be confident about the potential for growth in the Canadian economy before they are likely to increase the amount of their investments. Some witnesses suggested measures that they felt would assist certain industries and, therefore, help to restore business confidence. For example, a number of witnesses supported continued funding for sectoral councils, one witness proposed the implementation of an internationally competitive automotive investment incentive program and the development of a value-added manufacturing strategy in order to expand Canada’s manufacturing industry, and another witness urged the establishment of a private-public sector task force to study the foodservice and restaurant sector and to make recommendations to foster the sector’s growth. Decisions about government budgets, especially during times of economic uncertainty, can be controversial, with some believing that governments should increase spending in order to stimulate economic growth, and others feeling that increased spending would lead to higher debt and economic hardship in the future. A number of the Committee’s witnesses shared their views on federal spending, budgetary decision making, federal procurement practices and transfer payments to the provinces and territories. A. Federal Spending

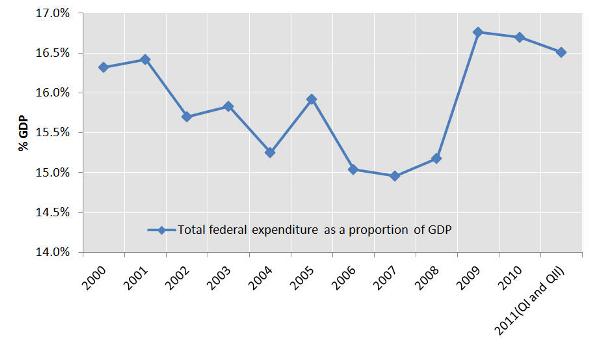

Some witnesses supported the current goal to return to balanced budgets by 2014-2015, praised the government’s ability to do what is necessary to protect jobs in the economy, and asserted that the government should maintain its fiscal track and its spending at the 2011-2012 level as a share of GDP, and perhaps adopt, as a guideline for spending increases, the rates of increase in the population, prices and GDP. However, other witnesses argued that the federal government should abandon the goal of budgetary balance in the short to medium term, and should instead focus on stimulating the economy — or on being prepared to do so — should economic circumstances worsen. A number of witnesses proposed that the federal government should cancel the strategic operating review and increase federal spending on public-sector jobs, with the allocation of sufficient funds for wage increases and for the protection of pensions and other benefits for federal public servants. A number of the Committee’s witnesses advocated additional federal spending reductions, which would mean an earlier return to budgetary balance, and one witness suggested that reduced federal spending could occur through the provision of certain services by families, charitable organizations and other non-governmental organizations. A variety of proposals aimed at reducing administrative and operational expenses were presented to the Committee, and each of the following suggestions was supported by one witness: clarification of the jurisdiction of federal, provincial and territorial, and municipal governments in order to avoid duplication, ongoing scrutiny of government programs, consideration of tax expenditures in reviews of spending, minimization of travel expenses incurred by federal employees through a policy requiring them to use the least expensive options, discretion in identifying documents that require translation, and enforcement of a policy that all internal and external correspondence be electronic, unless otherwise required. Other proposals to reduce spending that were made by one witness in each case were focussed on abolition of the Senate of Canada, adherence to fixed dates for elections every four years, reduced financial support for visits from the monarchy, elimination of funding for the Canadian Human Rights Commission and the Canadian Human Rights Tribunal, and termination of all special interest funding. B. Budgetary Decision MakingA number of witnesses provided suggestions regarding the way in which they think budgetary decisions should be made. For example, some witnesses proposed that certain decisions should be assessed in terms of the impact that they could have on various demographic groups, and urged the development of a policy that would require federal spending to be of equal benefit to each group affected by such a policy decision. Some witnesses proposed that the government should decentralize departments and create more offices outside of Ottawa. In order to inform public policy and budgetary decisions, a number of witnesses said that the government should find ways to collect and publish disaggregated data that demonstrate the differences among various socio-economic categories in order to identify and characterize those at structural and/or systemic disadvantages. C. Federal Procurement Practices

In speaking to the Committee about federal procurement practices, a variety of proposals were made, with each of the following suggestions supported by one witness: formulate government requests for work in terms of desired outcomes rather than in terms of specific tools to be used, discontinue the use of placement agencies, reduce bilingualism requirements in the procurement processes for services, limit the use of consultants for special assignments, implement social value weighting in all tenders, include community benefit agreements on all major contracts, use procurement as a tool to promote innovation and require that all construction projects financed with federal funds be tendered without any precondition regarding contractor-union involvement. D. Transfer Payments to the Provinces and TerritoriesA number of the Committee’s witnesses provided their views about federal transfer payments to the provinces and territories. While some witnesses felt that such payments for health, education and social services should be eliminated or drastically reduced, others felt that the amount of such payments should be maintained at their current level or increased. One witness argued that a national standard of services should be applied equally across the country. The Committee was told by one witness that the federal government should work with the provinces and territories and Canada’s large urban centres to develop a new fiscal framework that would provide these centres with greater revenue-generating capacity. According to this proposal, any additional expenditures should be balanced with cost savings in other areas so that there would not be a net cost for the measure, and the framework should include sufficient governance, transparency and accountability provisions so that municipalities would be able to improve their delivery of infrastructure and services to their constituents. The Committee holds the opinion that strong federal finances are a pre-requisite for resiliency and a requirement in order to support businesses, communities and people. It is important that future generations not be burdened with debt, which requires a focus on budgetary balance. As stewards of taxpayers’ money, governments should ensure that spending is effective and efficient. Recommendations are made by us in each of these areas, with a view to ensuring a continued ability to stimulate growth, as needed, and a sustainable financial future. We also make a recommendation about financial literacy, which is the subject of Bill C-28, An Act to amend the Financial Consumer Agency of Canada Act. From that perspective, the Committee recommends that: The federal government continue to implement the Next Phase of Canada’s Economic Action Plan to support jobs and economic growth. The federal government continue to promote financial literacy. The federal government limit new spending commitments in the upcoming federal budget. In the context of the current fiscal realities, massive new spending would be fiscally irresponsible. However, the government should continue to closely monitor the global and domestic economic situation and, if the Canadian economy weakens significantly, respond as necessary in a flexible and measured manner to support Canadian jobs and economic growth. The federal government continue in its plan to return to balanced budgets in the medium term, including following through on its deficit reduction action plan in order to achieve at least $4 billion in ongoing annual savings by 2014–2015. The federal government continually review spending to eliminate waste and inefficiencies to optimize value for taxpayers’ money, including auditing every department on a rotating basis to ensure ongoing efficiency. In meeting its commitment to return to budgetary balance, the federal government not raise taxes or cut transfers to persons, including those for seniors, children and the unemployed, or transfers to other levels of government in support of health care and social services, equalization, and the gas tax transfer to municipalities. |

Note: Data beginning in 2011 are projections.

Note: Data beginning in 2011 are projections. Note: “QI and QII” presents the first and second quarter respectively. “GDP” is gross domestic product.

Note: “QI and QII” presents the first and second quarter respectively. “GDP” is gross domestic product.