FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

|

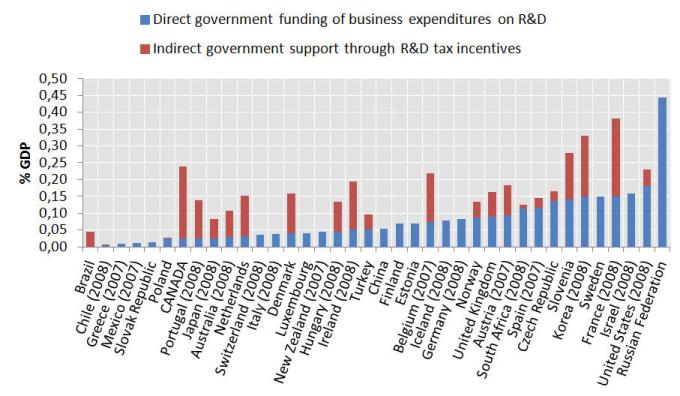

CHAPTER 3: STRONG BUSINESSES Businesses that are strong are better able to withstand global uncertainty as well as to contribute to the sustained and future well-being of Canada. In that context, some witnesses provided their views on a number of corporate issues that they believe would contribute to business strength: adequate access to financing, fair and competitive corporate taxation, capital cost allowances that reflect the useful life of assets, a move towards fewer regulations that are reasonable and determined transparently, trade-related taxes that do not inhibit commerce, trade agreements that enhance market access, and research and innovation that help to assure high levels of productivity and the ability to provide consumers with the products they want. The witnesses requested ...3.1 Access to FinancingTimely access to affordable financing is important to every business: to those that want to become established, to those that want to expand in order to meet consumer demand for their product, and to those that want to enter new markets or pursue new product lines. Some witnesses provided the Committee with their thoughts about various tax credits, capital gains and preferred shares, access to foreign capital, co-operatives, social enterprises and financing-related measures for particular sectors. A. Tax CreditsWhile a number of witnesses recognized that access to capital may be more problematic for businesses in certain sectors, they also noted that access to financing may be especially difficult for businesses in particular stages of development. In that context, they advocated the creation of tax credits for angel investors and for those who invest in businesses in the later stages of product development and commercialization, which could be beneficial for the information and communication technology sector, among others. As well, some witnesses highlighted the need to increase the Labour-sponsored Funds Tax Credit limit for a taxation year. B. Capital Gains and Preferred SharesOne witness told the Committee that the favourable tax treatment of gains realized from the sale of shares may encourage small and medium-sized enterprises (SMEs) to distribute dividends to shareholders rather than to retain capital in the business for expansion, and argued for a decreasing capital gains inclusion rate that would be correlated with the length of time that the shares are owned. In noting that the Income Tax Act contains a special tax regime for dividends received by preferred shareholders that results in a higher rate of taxation in relation to these dividends than on dividends received through other methods, some witnesses supported a reduction in this higher rate as a means of enabling companies to raise capital through preferred shares. C. Access to Foreign Capital

In order to allow businesses to access the capital that is available to a subsidiary in a foreign jurisdiction, one witness informed the Committee that intra-corporate loans from foreign subsidiaries of Canadian parent companies should be permitted to occur without adverse tax consequences, such as withholding taxes, taxation of interest and foreign exchange gains, and attribution of income. Tax-free repatriation of profits from a foreign affiliate was also supported by that witness. One witness highlighted that it is easier for Canadian corporations to raise funds with a single securities authority. D. Co-operativesSome witnesses made suggestions in relation to co-operatives. For example, they advocated the creation of a federal co-operative development fund, which would provide repayable loans to co-operatives in partnership with the private sector, and argued that the temporary co-operative development initiative, which provides grants for business planning and technical assistance, should be made permanent. Furthermore, they spoke to the Committee about the creation of a tax credit for co-operative members and employees who invest in producer- and employee-owned co-operatives. Specific mention was made of producers in the agricultural, fisheries and forestry sectors. E. Social EnterprisesRegarding social enterprises, some witnesses shared their view that investment funds and tax measures are needed. In particular, they advocated the creation of national and regional investment funds that would partner with financial institutions to help social enterprises raise capital and the implementation of targeted tax incentives. One witness argued for the development of seed funding and micro-credit for social enterprises. F. Sector-Specific MeasuresA number of the Committee’s witnesses made requests in relation to the financing needs of businesses in particular sectors. For example, some witnesses said that access to venture capital in Canada is one of the biggest challenges faced by companies with products that take a long time to develop and commercialize; particular mention was made of the biotechnology and mining sectors. In relation to biotechnology, one witness urged expansion of the flow-through share measure to include all junior biotechnology companies, while another witness argued for inclusion of businesses in the knowledge-based sector in the measure and for the flow-through share measure to be made permanent. Regarding the mining sector, for businesses that currently qualify for the flow-through share measure, one witness requested an increase in the annual limit of Canadian development expenses that may be converted to Canadian exploration expenses, and advocated expanded eligibility for the conversion by increasing the capital ceiling. As well, some witnesses suggested that the Mineral Exploration Tax Credit should be made permanent. 3.2 Corporate TaxationAs in other developed countries, corporations in Canada are liable for the payment of taxes on their income. A number of witnesses presented the Committee with their views about a variety of aspects of corporate taxation, including the general corporate income tax rate, the small business deduction, taxation of affiliated companies and international taxation, the deductibility of expenses and the taxation of capital gains. A. Corporate Income Tax Rate

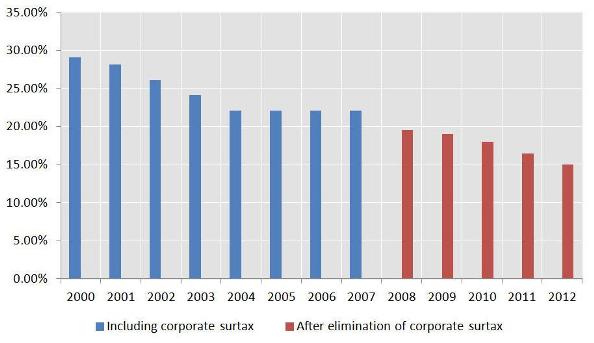

The Committee’s witnesses held varying views about the general corporate income tax rate and, more specifically, about the rate reduction to 15%, scheduled for the 2012 taxation year. A number of witnesses supported implementing the scheduled rate change, which would lead to increased investment and competitiveness. Holding the view that corporations are the major beneficiaries of public infrastructure, one witness called for suspension of the scheduled federal corporate tax rate reduction in 2012 to enable federal funding of infrastructure improvements. Some witnesses disputed that view and submitted studies showing that corporate taxes are borne by workers through reduced salaries and job losses, and by consumers through increased prices. A number of proposals in relation to corporate tax rates were suggested by one witness in each case, including: the provinces should maintain an overall federal-provincial tax rate of 25%, the general corporate rate should be increased by one percentage point, the 22% general corporate rate that existed for the 2007 taxation year should be reinstated or the scheduled rate change should be repealed, a special tax on corporate income exceeding a certain level should be introduced, income earned by privately owned businesses that have annual income below a specified amount should be taxed at a lower rate, and the “alternative minimum tax” should be eliminated or limited in its application.

B. Small Business DeductionArguing that small, privately owned Canadian businesses in capital-intensive industries cannot use the lower tax rate associated with the small business deduction because the capital threshold makes them ineligible, a number of witnesses supported an increase in this threshold for capital-intensive businesses, such as automobile and recreational vehicle dealers as well as vintners, and a review of the fairness of the small business deduction. One witnesses suggested a general increase in the capital threshold, which has not changed since its introduction in 1994, and indexation of the threshold to inflation. Some witnesses proposed technical changes to the small business tax rate rules. For example, they called for the exclusion of lien notes and inventory from the definition of “taxable capital” for purposes of establishing eligibility, flexibility for associated companies, elimination of the phasing out of eligibility for businesses with capital between certain amounts and an increase in the income limit to which the lower tax rate applies. For businesses that use retained earnings to finance expansion, one witness advocated an increase in the income limit to which the lower tax rate applies. Another witness urged a review of the rate’s application to personal services businesses, while yet another witnesses focussed on the need for a rate review in relation to rental property owners. C. Business Group Taxation and International Taxation

According to some witnesses, the Canada Revenue Agency (CRA) does not always permit affiliated companies to transfer losses, although businesses can transfer losses between associated companies in certain instances and during corporate reorganizations. From that perspective, they argued for taxation of corporate groups rather than taxation on the basis of an individual corporation, thereby enabling losses, profits and other tax attributes to be transferred among profitable and unprofitable entities. A number of witnesses supported a tax-loss or tax-attribute transfer system for corporate groups that is similar to the regime in the United Kingdom. Holding the view that a country’s tax system is one factor considered by multinational companies in determining whether to invest in a jurisdiction, some witnesses suggested that the federal government should implement the recommendations in the 2008 report of the Advisory Panel on Canada’s System of International Taxation in order to provide tax benefits that would result in increased investment in Canada and abroad. For example, they argued that dividends received from foreign affiliates of Canadian corporations should be exempt from taxation. One witness said that Canada and other countries should work together to determine a minimum taxation rate for income earned by large corporations, and other witnesses called for tax reform in an effort to reduce tax evasion and avoidance. D. Deductibility of Expenses in Certain SectorsIn order to increase investment in shale gas development, one witness told the Committee that natural gas drilling and costs incurred to create a functional well should be deductible for a limited time at a higher straight-line rate rather than at a lower rate on a declining-balance basis. One witness informed the Committee that the list of eligible costs related to rental construction that are deductible from taxable income was reduced in the 1970s and 1980s, and suggested that the list should be restored to its original state for individuals who own rental real estate. E. Capital GainsA number of witnesses made sector-specific comments about the taxation of capital gains. For example, they suggested that the capital gains deduction limit for small business shares should be indexed to inflation. In relation to owners of rental residences, one witness said that – like other businesses that purchase replacement capital – these owners should be able to purchase replacement rental property without incurring a capital gain or loss until the property is not replaced within a certain time period. 3.3 Capital Cost AllowanceThe capital cost allowance (CCA) allows businesses to depreciate the cost of an asset used to generate income over the economic life of that asset. In discussing the CCA, a number of the Committee’s witnesses commented on the accelerated allowance for machinery and equipment and the CCA in relation to such sectors as broadband, heat and energy generation, wood buildings, agricultural equipment, information and communication technology, rail cars and shipbuilding. A. Accelerated Capital Cost Allowance for Machinery and EquipmentSome witnesses highlighted the temporary two-year accelerated CCA for machinery and equipment, and suggested that the measure should be extended to allow for long-term business planning. They also advocated an expansion in the list of machinery and equipment eligible for the accelerated CCA; particular mention was made by one witness of machinery and equipment that use clean energy and/or have reduced emissions, while another witness highlighted diesel-powered mobile equipment and heavy-duty off-road vehicles. As well, in the view of one witness, businesses should be permitted to carry back losses that result from the application of the accelerated CCA to the previous seven taxation years. B. Sector-Specific MeasuresA number of the Committee’s witnesses made suggestions for improving the CCA regime for assets used in specific sectors. In general, these proposals were designed to promote investment and to better align the economic life of an asset with the depreciation rate. In relation to next generation broadband networks, some witnesses supported a temporary straight-line deduction for the equipment most closely associated with broadband networks in classes 8, 42 and 46 of the Income Tax Act while, regarding access to high-speed networks, they advocated a temporary 100% CCA rate for investments in next generation broadband networks by network suppliers in designated underserved areas. They also argued for a suspension in the half-year rule, which limits the CCA to 50% of the normal rate, for newly purchased broadband network assets. One witness told the Committee that, when compared to the rate applied to similar assets in other classes, equipment listed in classes 43.1 and 43.2 of the Income Tax Act — equipment used in the efficient generation of energy and/or heat from alternative and conventional sources — have a relatively higher CCA rate. The witness suggested that the equipment in class 43.1 should be reviewed and expanded, and that the temporarily increased CCA rate for class 43.2 should be extended. Recognizing that, in the past, the CCA rate for buildings constructed using wood was higher than the rate for buildings constructed using concrete, one witness advocated changes designed to assist the rental housing sector. The witness argued that the CCA rate for wood-constructed buildings should be increased to 5% or, in the alternative, that the rate for wood-constructed buildings should be increased to 6% and the rate for concrete-constructed buildings should be increased from 4% to 5%. The witness also suggested that rental property owners should be able to deduct losses occurring as a result of the CCA deduction from other sources of income. According to one of the Committee’s witnesses, increases in the CCA rates for agricultural equipment could lead to investments that would improve food safety, lower input costs and reduce carbon emissions. Consequently, the witness supported increases in the CCA rate for aeration and bin temperature monitoring systems, on-farm fertilizer storage, global positioning system equipment, more efficient tractors and tractors with lower greenhouse gas emissions. In order to reflect the short life of computer equipment and railway cars before replacement is required, a number of the Committee’s witnesses commented on CCA rates in this regard. One witness proposed an increase in the CCA rates for information and communication technology equipment, while another witness argued for an increase in the rates for railway cars owned by railway companies, rail leasing companies and private car owners. Regarding the shipbuilding industry, one witness suggested that owners of shipbuilding operations should be eligible for both the federal program that subsidizes loans for shipbuilding and the accelerated CCA rate for Canadian-built ships in order to permit companies to claim the full value of the capital cost allowance in the current taxation year. 3.4 Regulations, Regulation Making and the Regulatory Burden, and Tax Compliance and SimplificationRegulations and the statutes that enable taxation govern a wide variety of business activities in Canada. A number of the Committee’s witnesses spoke about regulations to address the demutualization process for insurance companies as well as about the making of regulations, the regulatory burden and new regulations. They also highlighted a variety of issues relating to tax compliance and simplification. A. Specific Regulations for DemutualizationOne witness indicated that regulations are required for the demutualization of property and casualty mutual insurance companies, and proposed measures that should be included in proposed regulations: giving each policyholder a vote on demutualization; requiring mutual insurance companies to prove, before demutualization is permitted, that other alternatives were considered and that demutualization would serve the best interests of all policyholders; and either treating all policyholders equally with respect to the distribution of the surplus in the event that demutualization occurs or prohibiting distributions to policyholders by requiring the distribution of the surplus to the mutual and co-operative sector or to the charitable sector rather than to policyholders. B. Regulation Making, the Regulatory Burden and New Regulations

In order to reduce the regulatory burden on businesses, some witnesses called for enforcement of the Red Tape Reduction Commission’s recommendations to ensure that federal departments and agencies are held accountable and that success is clearly measured, such as through a reduction in the number of regulations. A number of witnesses made proposals regarding the regulation-making process, and the following suggestions were supported by one witness in each case: ensure both greater transparency when regulations are drafted and communication to the public about the objective and compliance costs of new or amended regulations, consider sunset clauses for regulations not in force, and repeal an existing regulation each time a new regulation comes into force. Some witnesses made suggestions designed to reduce regulatory compliance costs for businesses. Proposals that were advocated by one witness in each case included: all federal departments and agencies should adopt standard language for business information reporting, such as eXtensible Business Reporting Language (XBRL), the income threshold in accordance with which employers are required to remit payroll deductions should be increased, paper forms should be replaced with electronic information transfer, and a single government contact for businesses should be created. In an effort to reduce the cost associated with collection of the Goods and Services Tax/Harmonized Sales Tax (GST/HST) for small businesses, one witness informed the Committee that the income threshold for registration and collection of the GST/HST has not changed since 1991, and advocated an increase in the threshold. Some witnesses commented on the regulatory burden in specific sectors, and the following suggestions were supported by one witness in each case: review, streamline and harmonize the regulatory process for new agricultural bioscience businesses among provinces and territories, ensure that licensing fees for the wireless communications sector are competitive with those in other countries, and maintain the number of personnel in Transport Canada’s civil aviation office in order to ensure timely approval of new aerospace products. The compensation practices of employers were highlighted by some witnesses, and the Committee was told that the federal government should take a variety of compensation-related actions regarding the Canadian workforce. Each of the following proposals was supported by one witness: enact measures to require equal pay for work of equal value; introduce a national standard for the provision of a guaranteed livable income; ensure that shareholders are able to vote on executive compensation; require all corporations traded on Canadian stock exchanges to disclose the median salary of their employees; ensure, within a workplace, that the ratio of executive pay to the average employee salary does not exceed 30 to 1; reduce the threat of labour disruptions in the federal jurisdiction by considering and implementing initiatives that would settle disputes before disruptions to the economy occur; and remove the right to strike for public service employees. A number of witnesses commented on the regulation of payment systems in Canada, and the following proposals were advocated by one witness in each case: add provisions to the 2010 Code of Conduct for the Credit and Debit Card Industry in Canada that would recognize emerging forms of payment, such as mobile and contactless and that would better recognize cash as a means of payment; make merchant fees for debit card transactions a flat amount; eliminate higher merchant fees for premium credit card transactions; ensure that credit cards issued to federal employees for transactions related to their work are used only for certain types of transactions; permit the debit card payment network to continue to act as a not-for-profit corporation; and amend financial regulations to increase minimum payment requirements for debt resulting from credit card use. C. Tax Compliance and SimplificationWith one witness indicating that businesses spend $12.6 billion each year on tax compliance activities and that federal administrative costs exist as well, a variety of suggestions for reducing compliance costs were made. For example, one witness highlighted the need to automate the tax filing process, extend the tax filing date, provide the CRA with greater authority to waive or reduce tax penalties in order to expedite tax settlements, and oblige tax authorities to help businesses comply with tax legislation. Another witness urged the CRA to assess tax returns in a timely manner, while yet another witness suggested shifting the compliance burden for services provided by a non-resident to the non-resident service provider. Regarding tax simplification, some witnesses proposed a task force to review, simplify and modernize the Income Tax Act and other tax statutes as well as withdrawal of long-standing government-proposed amendments to the Income Tax Act. One witness suggested that sales tax regimes should be harmonized across all provinces and territories. 3.5 Trade-related Taxes, Agreements and FacilitationThe United States, Canada’s largest trading partner, is continuing to experience economic difficulties, with implications for the bilateral trade relationship. Other trade relationships and trade issues are also of interest at this time. A number of witnesses shared their views about duties, tariffs and excise taxes, trade agreements, import prices, selected transportation infrastructure that facilitates trade and travel, and internal trade in relation to wine. A. Duties, Tariffs and Excise TaxesIn speaking about foreign trade zones, which are geographical areas in or adjacent to a port of entry where commercial merchandise receives the same customs treatment as if it were purchased outside the domestic country, some of the Committee’s witnesses requested that the federal government change the tax measures relating to foreign trade zones. One witness spoke to the Committee about the Canada Border Services Agency’s Duty Deferral Program and the CRA’s Export Distribution Centre Program, which exempt imported goods that are ultimately exported from the payment of most duties and taxes, regardless of whether they are further manufactured in Canada. In relation to the Duty Deferral and Export Distribution Centre Programs, the witness proposed: simplification through the creation of a single point of contact between the government and the company; expansion, such as through reducing or removing restrictions on the percentage of goods that can be sold into Canadian markets; increases in the extent to which goods can be processed in Canada while still qualifying for the programs; a broadening of the qualification criteria so that more companies can access the programs; the identification of new foreign trade zones; funding for marketing activities designed to promote these zones as well as the programs; and the ability to defer payment of the GST/HST for purposes of the Duty Deferral Program. One witness emphasized that the North American Free Trade Agreement allows individual consumers to purchase items, such as boats, in the United States for importation into Canada with lower duties applied than is the case when a Canadian business imports the same item. As a result, the witness proposed either an increase in the duties applied to items personally imported into Canada from the United States to match the duties paid by businesses importing such goods, or a reduction in the duties paid by businesses. Another witness advocated a general decrease in the duties applied on goods imported by Canadian businesses from other countries to reduce their overall costs. One witness told the Committee that the lack of arrivals duty free in Canada’s airports is placing those airports at a disadvantage, and suggested that the Customs Act and the Duty Free Shop Regulations should be amended in order to allow arrivals duty-free stores to be created and located in customs-controlled areas in Canadian airports. The Committee was informed by one witness that the $100 air conditioning excise tax on new vehicles, which was initially introduced as a luxury tax, should be repealed. That said, the witness suggested that, if the tax is not repealed, the revenue associated with the tax could be used to address environmental concerns related to ozone-depleting substances found in air conditioning systems. To help Canadian spirit manufacturers compete with foreign manufacturers, one witness suggested that the federal excise tax on spirits should be reduced. B. Trade Agreements

A number of the Committee’s witnesses stressed the importance of pursuing trade agreements and aggressively negotiating with trading partners in order to reduce barriers to trade, including tariffs. One witness highlighted non-trade barriers, such as those in relation to biotechnology and genetic modification. A number of trade-related proposals were supported by one witness in each case, including: discussions occurring in the context of the Regulatory Cooperation Council related to the alignment of regulatory approaches in a range of sectors should include harmonization of common external tariffs, such as imported passenger vehicles; the joint study in relation to a possible comprehensive economic partnership agreement between Canada and Japan should be finalized in order to ensure that negotiations for an agreement are completed as quickly as possible; a review of science-based regulations in potential treaty-member countries during trade negotiations; and free trade agreements with the European Union (EU) and India, as well as an increased focus on the Asia-Pacific region, should occur. C. Import Prices

Some witnesses called for repeal of two measures related to the price of imported educational books: the parallel importation provision in the Copyright Act and a related provision in the Book Importation Regulations allowing book importers to apply a mark-up on books sold to retailers in Canada if the book is not imported through an approved distributer. They felt that the mark-up on imported books and the restriction on parallel importation provide a benefit to foreign-owned publishing companies and internet distributors. D. Movement of People and GoodsA number of suggestions to ensure the efficient transportation of goods for export were supported by one witness in each case, including: that the federal government consider funding for a second phase of the Asia-Pacific Gateway Corridor Initiative; that full responsibility for all day-to-day management, operational and financial issues of Ridley Terminals, a federal Crown corporation, be given to a private-sector consortium; and that the port in Prince Rupert be expanded in order to increase the exportation of Canadian resources. Shipping on the Great Lakes was a concern of some witnesses. The Committee heard proposals in relation to renewal of the fleet of ice breakers operated by the Coast Guard and explore upgrades to port infrastructure located on the Great Lakes St. Lawrence Seaway in order to meet future shipping needs. Regarding shipping by truck and rail as well as shipping in other regions, some witnesses requested increased support for more expeditious border clearances and inspections for more efficient north-south trade, such as new infrastructure to streamline operations and increase efficiency at the Detroit-Windsor crossing so that commercial truck inspection wait-times are reduced. A variety of measures were supported by one witness in each case, including: new infrastructure that enables north-south trade in North America, federal purchase of the privately owned Ambassador Bridge, creation of a North American perimeter, and establishment of federally mandated performance metrics and a commercial dispute-resolution process in order to increase railroad shipping competition. One witness informed the Committee about the tax treatment of certain international shipping companies and their non-resident investors, and made two proposals: that the rules in the Income Tax Act for defining international shipping be modernized, and that applicable residency rules exempting shipping companies and their non-resident investors from Canadian taxation be expanded to include alternative business structures, such as joint ventures and partnerships. The high cost of aviation travel to and from Canadian airports when compared to similar flights in the United States was emphasized by a number of witnesses. They presented proposals designed to reduce fees, taxes and rents with a view to increasing the international competitiveness of Canadian airports, airlines and destinations. Some witnesses argued for a comprehensive review of the aviation cost structure in Canada so that a competitive regulatory regime could be implemented. E. Internal TradeA number of the Committee’s witnesses advocated a reduction in overall internal trade barriers. They noted that the Importation of Intoxicating Liquors Act prohibits wine from being imported from another province or territory by an individual unless it is purchased by a provincial or territorial government-related entity, and supported a legislative amendment to permit consumers to purchase specified quantities of Canadian wines directly from wineries and to have the wines legally shipped/transported across provincial or territorial boundaries for personal consumption. 3.6 Research and InnovationResearch institutes and businesses need support at various stages of research and development, beginning with discovery through to post-commercialization. Some witnesses commented on a variety of issues in relation to data availability, federal research grants and the federal granting councils, collaborative research, scientific infrastructure, intellectual property, and private-sector research, development and commercialization support. A. Data AvailabilityIn speaking about the importance of publicly available, reliable data for research and other purposes, a number of witnesses requested measures designed to increase the quality and quantity of Canadian data. The following proposals were supported by one witness in each case: the federal government should increase Statistic Canada’s base budget by 10%, the government should reinstate the long form census, and Statistics Canada should evaluate its sampling methodology to determine methods for securing information about the contract services and staffing sector. One witness specifically mentioned the need to continue Statistics Canada’s National Longitudinal Survey of Children and Youth, and another witness mentioned the continuation of Statistics Canada’s quarterly statistics on fertilizer, production, exports, inventories and shipments to Canadian farmers. B. Federal Research Grants and the Federal Granting CouncilsWhile acknowledging the existence of sustained federal support for research programs, some witnesses advocated higher spending for the Natural Sciences and Engineering Research Council of Canada (NSERC), the Canadian Institutes of Health Research (CIHR) and the Social Sciences and Humanities Research Council (SSHRC). Proposals included increasing the granting councils’ funding to levels comparable to those of similar agencies in the United States, directing any increased funding to the promotion of innovation and/or to financing the full direct and indirect costs of research, and providing sector-specific funding, such as that for mining research through the NSERC. Inadequate funding for the Canada Graduate Scholarship (CGS) program was also identified by some witnesses. They advocated a return of the funding growth rate to the rate that existed prior to the introduction of federal stimulus spending, higher funding based on enrolment in graduate studies, and reallocation of a portion of funding to other doctoral scholarships and postdoctoral fellowships. Other suggestions that were made by a number of the Committee’s witnesses in relation to federal research grants and the granting councils included: a requirement that all research funding be provided through the federal granting councils, the removal of barriers to commercialization — including intellectual property rights — that are contained in qualification criteria for grants and other incentives, a commitment by the granting councils to support the development of professional and transferable skills in graduate students to ensure their competitiveness in both academia and the labour market, and a review of research-related programs and policies to assess their efficacy, with revisions made as required. Some witnesses told the Committee that funding for basic research should continue to be a priority for the federal government. They suggested funding increases of between 5% and 20% for basic research programs, depending on the witness, and for Genome Canada. C. Collaborative ResearchIn commenting that federal program spending should promote more collaborative research among academia, the private sector, the not-for-profit sector and the government, some witnesses made suggestions about the need for strengthened partnerships between researchers and businesses in an effort to close the innovation gap between discovery and commercialization. They also argued that a greater share of the government’s industrial research and development (R&D) spending should be allocated to project-specific initiatives that partner the private and public sectors, and proposed that 5% of federal investments in R&D be allocated to applied research partnerships between colleges and SMEs. As well, one witness supported the development of best practices within technology transfer offices at universities. With a view to maintaining Canada’s international competitiveness in research and the nation’s reputation as a top destination for international researchers, a number of witnesses advocated an expanded mandate for the Canada Excellence Research Chairs program, the allocation of funds to encourage the mobility of students engaged in research to and from Canada as well as across sectors, and the creation of a global research fund and a global partnership fund in order to promote international research collaboration. One witness proposed the adoption of a scheme, similar to the international education strategy described in the 2011 federal budget, for international research collaboration. Some witnesses requested additional funds to promote the creation of new innovation clusters, encouraged the government to provide more internships and fellowships with a commercial focus as well as more non-tax incentives and funding mechanisms for businesses to hire advanced research graduates, and urged more private-public partnerships in agricultural research and in the natural gas sector. A number of proposals were supported by one witness in each case, including: the need for collaboration between Transport Canada and the private sector in programs such as ecoTECHNOLOGY for vehicles, the need for colleges to make connections between foreign-trained professionals living in Canada and innovative businesses, the need for interaction between entrepreneurs and the students and firms associated with colleges, and the need to support programs that enhance research implementation, including the creation of a Canadian commercialization network to help small business creation and partnerships with the industrial sector. D. Scientific InfrastructureA number of witnesses spoke to the Committee about program spending and policies that they believe need to be developed for scientific infrastructure in Canada, and some witnesses argued for a national policy on data accessibility and management that contains a commitment to long-term access and that protects intellectual property. Proposals that were supported by one witness in each case included a digital economy strategy that takes into account artists’ concerns about copyright and revenue, and the development of digital infrastructure to facilitate R&D analytics and other empirically based and quantitative research. One witness made particular mention of the 2010 digital economy strategy consultation held by the federal government. Some witnesses requested continued investments in Canada’s Advanced Research and Innovation Network and in research infrastructure. A number of suggestions were supported by one witness in each case, including: increased funding for the development of a working model of a cross-disciplinary repository for research data across Canada, funding for national digital resources that would promote digital literacy and a workforce qualified in the sciences, technology, engineering and mathematics fields, and funding for public libraries and for access to the Internet through the federal Community Access Program. Some of the Committee’s witnesses supported increased, multi-year funding for the Canada Foundation for Innovation (CFI) and the program in relation to the indirect costs of research; in the latter case, mention was made of the need for support at a level that is more comparable to other developed countries. A number of proposals were made by one witness in each case: investments in world-class infrastructure through sustained investments in the CFI, a CFI funding increase to 15% of the amount provided to the federal granting councils, and enhanced funding for all essential government research programs, with these programs exempt from further spending reductions. E. Intellectual PropertySome witnesses provided a variety of suggestions in relation to Canada’s intellectual property (IP) regime. Proposals that were supported by one witness in each case included: the implementation of a patent term restoration regime similar to that in other countries in order to allow innovators to have an extended period of protection to compensate for regulatory delays, changes to the Patented Medicines (Notice of Compliance) Regulations to give innovators an effective right of appeal and to prevent multiple litigations by innovators, and provisions to allow damages to be awarded to generic pharmaceutical manufacturers. While one witness argued that a Comprehensive Economic and Trade Agreement (CETA) between Canada and the EU should not include the EU’s proposed amendments to patent rights, other witnesses asserted that the CETA negotiations and any subsequent agreement would promote competitiveness with businesses in other Group of Seven nations. One witness told the Committee about the need for improvements to the Data Protection Regulations under Canada’s Food and Drug Regulations in order to ensure that Canada retains its international competitiveness with terms that are similar to those in other countries. Some witnesses advocated strong protection in relation to arts and culture, and for Copyright Act changes that would not inhibit certain revenue streams for artists. Regarding academic research, one witness told the Committee that the creator-ownership policy at the University of Waterloo allows professors and students to claim IP rights in relation to their creations, and suggested that federal granting councils should encourage universities to adopt a similar policy by making the adoption of such a policy a condition for obtaining grants from federal granting councils. F. Private-Sector Research, Development and Commercialization Support and Tax CreditsWith a number of witnesses generally agreeing that fiscal and policy support for Canadian research should be a public policy objective, some witnesses made particular mention of the agriculture and agri-food industry, and suggested support for research, development and technology transfer, a national strategy for agri-food R&D, the application of check-offs or other types of mandatory payments to fund agricultural research, baseline funding levels for departmental research activities, and the treatment of royalty income generated by successful government innovation. Suggestions that were supported by one witness in each case included: proposals in relation to the granting of federal R&D funding on a competitive basis to initiatives that help to create sustainable jobs, an expanded mandate for the Industrial Technologies Office, and sector-specific R&D support, in relation to which witnesses mentioned the manufacturing industry, the mining industry and the aerospace industry. Suggestions for federal program spending were also made in relation to the commercialization of innovative products and processes. One witness spoke about the need for a program of loans to assist innovative small and medium enterprises in developing a new product, process or service that will be commercialized, while another witness supported R&D funding that is more strategically targeted in order to promote commercialization. Some witnesses spoke to the Committee about sector-specific commercialization measures, with the following proposals supported by one witness in each case: an accelerated innovation and commercialization strategy for small and medium enterprises (SMEs) in the medical technology sector, a strategy for the clean technology sector, technology demonstrators to showcase innovations in the aerospace industry, more funding for demonstrations of alternative fuels, clean energy and energy efficiency, and the creation of a cleantech accelerator fund to support the development, demonstration and commercialization of clean technology.

While one witness suggested that federal expenditures on R&D-related tax credits should be reduced because businesses are not performing R&D activities, another witness argued that the report of the Expert Panel on the Review of Federal Support to R&D should be reviewed prior to changes being made to tax measures, such as the Scientific Research and Experimental Development (SR&ED) investment tax credit. Some witnesses provided comments about the SR&ED investment tax credit and its administration. For example, in relation to administrative matters, they requested that the measure be delivered in a more predictable and timely manner, that CRA officials become more knowledgeable about the research priorities of the various sectors that apply for the SR&ED credit, that the measure be modeled as a fee-for-service program similar to the Canadian Intellectual Property Office, and that administration of the measure be moved to a department, such as Industry Canada, where officials would be more familiar with technical issues. Regarding the design of the SR&ED investment tax credit, a number of witnesses proposed that the credit be expanded in terms of its eligibility to include such other activities and expenses as collaborative research and process innovations, be claimable by investors involved in limited partnerships, be available at a rate than exceeds 35%, be deductible against both income and payroll taxes or — in the alternative — available as the existing credit or as a refundable wage credit, be refundable — including in the year of investment — and be available at a 35% rate for all businesses and not just for Canadian-controlled private corporations. One witness suggested expanding the SR&ED investment tax credit to include foreign R&D expenses, while another witness called for the inclusion of clinical trials. Other suggestions in relation to private-sector R&D support included a request from one witness that the federal government use third-party organizations to facilitate efficient and effective administration of government R&D programs, and from another witness that out-dated regulations and conditions-of-license in the telecommunications industry, which require that a percentage of annual revenues be spent on pre-defined R&D activities, be eliminated. In the Committee’s view, strong businesses contribute to a nation’s prosperity. In order to be strong, and to prosper to the full extent of their abilities, businesses need appropriate taxation and regulatory regimes, programs and tax measures that support particular industries, domestic and international markets for their goods and services, and research and development, both generally and in respect of specific sectors. With these needs in mind, we make a variety of recommendations designed to help businesses succeed and thereby create jobs and contribute to the nation’s prosperity. For these reasons, the Committee recommends that: The federal government continue to ensure a competitive tax system to attract investments and jobs – including implement all planned corporate tax rate reductions as scheduled to 2012. The federal government explore further ways to enhance the international competitiveness of Canada’s business tax structure, including: continuing to consult on potential new rules for the taxation of corporate groups, examining the impact of sections 105 and 102 of the Income Tax Regulations on access to skilled service in Canada by non-residents, and continued implementation of the recommendations of the Advisory Panel on Canada's System of International Taxation. To combat tax evasion, the federal government explore requiring all firms and individuals in the construction industry to register for a business number and increasing the number of auditors. The federal government continue to provide strong support to protect, sustain, and promote Canada’s traditional industries — like mining, forestry, and manufacturing — by maintaining support and tax incentives to assist them. The federal government study the issue of intergenerational transfers of family businesses, including farms, to ensure tax fairness. The federal government continue to review and reduce unnecessary regulations, especially through the Red Tape Reduction Commission. The federal government continue its work in the development of a national securities regulator in order to better protect Canadians. The federal government continue to take all necessary actions to ensure the resilience of banking systems and financial markets at home and abroad, including implementing Basel III reforms. The federal government convene an expert panel to review, modernize and simplify the federal corporate tax system. The federal government continue to open up new markets to Canadian goods and services by working toward the completion of trading agreements with foreign governments, and also working to eliminate trade barriers involving the US-Canada border. The federal government continue to recognize the need to promote the trade and export of Canadian goods and services abroad, such as in natural resources and financial and educational services. The federal government encourage the provinces and territories to review and remove internal barriers to trade, including support for amendments to allow for a personal exemption for winery-to-consumer sales and shipments from province to province. The federal government review the aviation cost structure to ensure Canada is competitive with its international competitors. The federal government continue its strong support of research and development in Canada, especially such successful programs as the Vanier Canada Graduate Scholarships, Banting Post-Doctoral Fellowships, Canada Foundation for Innovation and Canada Excellence Research Chairs. The federal government continue to review the report of the Expert Panel on Federal Support to Research and Development to help the government’s efforts to modernize programs in support of innovation, and improve Canada’s productivity in the global economy, while also upholding Canada’s reputation as a top destination for global research talent. The federal government continue to ensure increased effectiveness and efficiency of spending on agriculture research, development and technology transfer, including a return to market-based grain-based ethanol production. |

Source: Figure prepared using data from Brett Stuckey and Adriane Yong, A Primer on Federal Corporate Taxes, Library of Parliament, Ottawa, 2011,

Source: Figure prepared using data from Brett Stuckey and Adriane Yong, A Primer on Federal Corporate Taxes, Library of Parliament, Ottawa, 2011,