FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

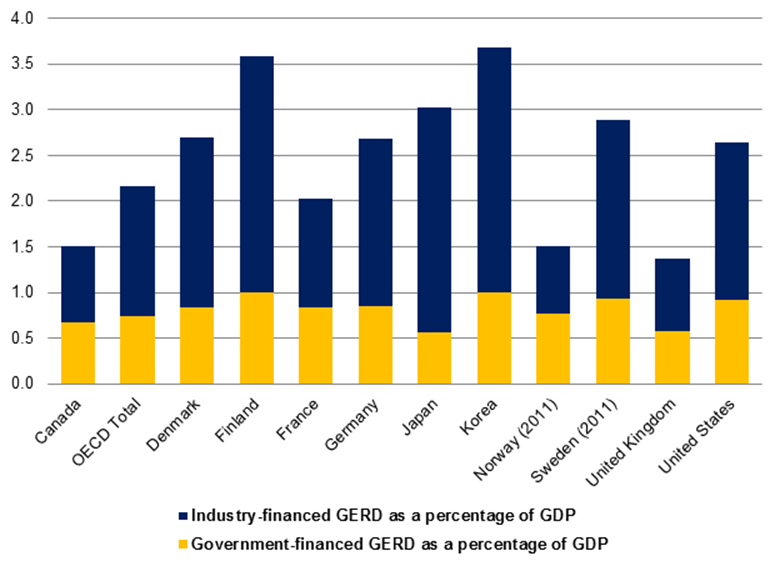

Chapter four: Supporting research and InnovationA. Background1. OverviewAccording to the OECD’s glossary, research and development (R&D) is “any creative systematic activity undertaken in order to increase the stock of knowledge, including knowledge of man, culture and society, and the use of this knowledge to devise new applications”; it includes both applied and basic research. Also according to this glossary, innovation is “the implementation of a new or significantly improved product, or process, a new marketing method, or a new organisational method in business practices, workplace organisation or external relations.” While there is a direct link between applied research and innovation, the link between basic research and innovation is more tenuous. Figure 11 shows the amount of gross expenditures on research and development (GERD) by government and the private-sector as a percentage of GDP in select OECD countries for 2010. Figure 11 – Gross Expenditures on Research and Development as a Percentage of Gross Domestic Product, by Source, Selected Organisation for Economic Co-operation and Development Countries, 2010 (%)

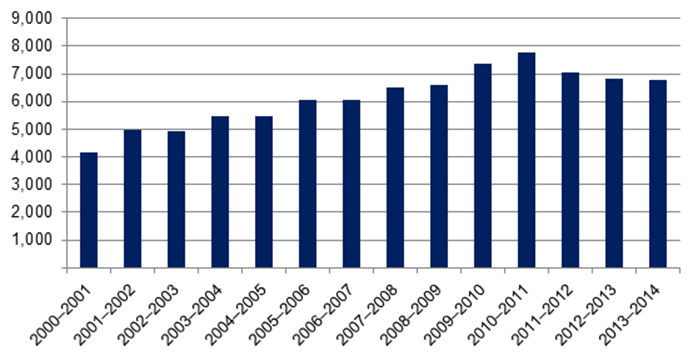

Source: Organisation for Economic Co-operation and Development, Main Science and Technology Indicators, accessed 4 December 2013. Figure 12 shows the evolution of federal expenditures on R&D from 2000–2001 to 2013–2014. These expenditures increased at an annual average rate of 4.1% over that period, although this average masks disparity within the period. For example, over the 2005–2006 to 2010–2011 period, such expenditures rose at an average annual rate of 6.1%; over the 2010–2011 to 2013–2014 period, they declined at an average annual rate of 4.4%. Recently, the Minister of State for Science and Technology said that these variations over time can be explained by an increase in expenditures in the context of the 2009 federal budget’s stimulus program, with a subsequent decrease in these expenses. Figure 12 — Federal Expenditures on Research and Development, Canada, 2000–2001 to 2013–2014 ($ millions)

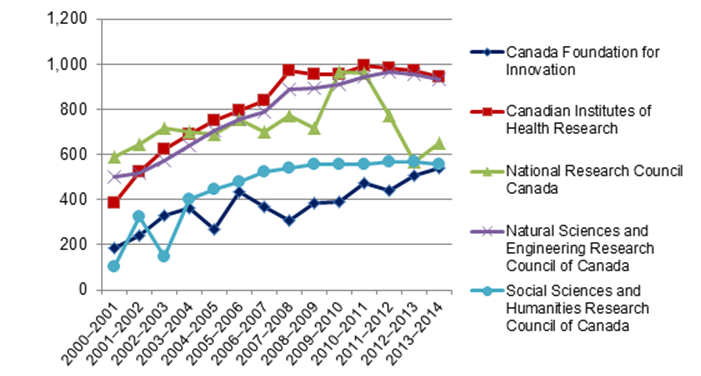

Source: Figure prepared using information obtained from: Statistics Canada, Table 358-0163, “Federal expenditures on science and technology, by major departments and agencies,” CANSIM (database), accessed 28 October 2013. 2. Scientific Research and Experimental Development Investment Tax CreditThe largest single source of federal government support for industrial R&D is the Scientific Research and Experimental Development (SR&ED) investment tax credit (ITC), which is designed to encourage Canadian businesses of all sizes and in all sectors to conduct R&D in Canada that will lead to new, improved or technologically advanced products or processes; innovation could be the result. In general, the federal fiscal cost of this tax measure is about $4 billion annually, with more than 18,000 claimants each year; more than 75% of the claimants are small businesses. The 2012 federal budget announced a number of changes to the income tax treatment of expenditures incurred in respect of SR&ED carried on in Canada. These changes will affect the SR&ED ITC rates and the types of expenditures that are eligible to be claimed. The general 20% rate will be reduced to 15% for taxation years ending after 2013. After 2013, the ITC rate for SR&ED expenditures exceeding the $3 million threshold will be 15%. For capital property acquired on or after 1 January 2014, capital expenditures will no longer be considered a deductible SR&ED expense; this change will also apply to leased property, including equipment. 3. Federal Granting Councils and Other Entities Focused on Research and InnovationCanada’s three federal granting councils — the Natural Sciences and Engineering Research Council of Canada (NSERC), the Social Sciences and Humanities Research Council of Canada and the Canadian Institutes of Health Research — were created to fund academic research and scholarships, and to administer programs that further collaboration between academia and the private sector. Moreover, the Canada Foundation for Innovation (CFI) invests in infrastructure, such as laboratories and equipment, that is needed to conduct advanced research; funding is awarded to institutions on the basis of merit as assessed by an independent process. Finally, the National Research Council Canada provides firms and governments with scientific and technical services, support for innovation and strategic research. Figure 13 shows the evolution of federal expenditures on R&D in the five departments or agencies that had the highest such spending in 2013–2014. Figure 13 — Federal Expenditures on Research and Development in the Five Federal Departments or Agencies with the Highest Such Spending in 2013–2014, Canada, 2000–2001 to 2013–2014 ($ millions)

Source: Figure prepared using information obtained from: Statistics Canada, Table 358-0163, “Federal expenditures on science and technology, by major departments and agencies,” CANSIM (database), accessed 28 October 2013. B. Changes Proposed by Witnesses Invited to Address “Supporting Research and Innovation”The witnesses invited by the Committee to speak about the topic of supporting research and innovation focused on tax incentives to encourage, as well as federal funding for, research and innovation. 1. Tax IncentivesThe Aerospace Industries Association of Canada argued that the non-refundable portion of the SR&ED ITC should be modified to allow companies to exchange earned tax credits for cash contributions from the federal government that would have to be used to fund R&D capital projects. Deloitte LLP requested that the government make the ITC fully refundable, while the Information Technology Association of Canada suggested that — instead of the changes made by the 2012 federal budget — the qualified pool balances used to calculate the total qualified SR&ED expenditures for ITC purposes should be increased from 15% to 17% or that the changes made in the 2012 federal budget to capital expenditures for R&D should be reversed. As well, Deloitte LLP proposed two tax measures that could be implemented to increase research and innovation in Canada: a “patent box” tax incentive and an angel tax credit. The “patent box” incentive would apply a lower tax rate on income derived from the exploitation of R&D and the ownership of intellectual property rights, and the angel tax credit would be similar to that in British Columbia, whereby — up to a certain dollar amount per year — 30% of the money invested in a company is returned to the investor in the form of a tax credit. 2. Federal FundingThe Canada Foundation for Innovation encouraged the federal government to increase its support for research and technology development through enhanced funding for the granting councils, and advocated stable and predictable annual funding for the CFI. Sunnybrook Health Sciences Centre proposed that, collectively, the budgets of the granting councils be gradually increased by $300 million over the next three years. It also suggested that, in relation to the Indirect Costs Program (ICP), a single rate be used. Polytechnics Canada argued in favour of making the College and Community Innovation Program, which is managed by NSERC, eligible for the ICP. In commenting on other federal funding for R&D, Sunnybrook Health Sciences Centre proposed that a proportion of FedDev’s budget be invested in medical research, and Polytechnics Canada suggested that the government should allocate a larger proportion of R&D funding to improve the services that are provided to individuals, such as students in schools and patients in hospitals. U15-Group of Canadian Research Universities and the Association of Universities and Colleges of Canada advocated a research excellence fund that would involve an initial investment of $100 million, with this amount rising over four years to reach $400 million annually; in their proposal, this fund would be called “Advancing Canada Research Excellence”. In an effort to bring the ICP more in line with similar programs in other countries, the Association of Universities and Colleges of Canada supported an increase in the proportion of indirect costs that are covered under the ICP. The Information Technology Association of Canada called for the establishment of a successor program to the Digital Technology Adoption Pilot Program following its expected termination in 2014. In its opinion, industry participants should be asked for their input regarding program design and implementation with a view to ensuring greater success in increasing the productivity of small and medium-sized enterprises through the adoption of digital technologies. C. Changes Proposed by Witnesses Invited to Address Issues Other Than “Supporting Research and Innovation”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. Fiscal Sustainability and Economic Growth WitnessesFinancial Executives International Canada and the Investment Industry Association of Canada proposed that the federal government allow companies engaged in innovative activities to issue flow-through shares as a means to access capital. In their view, with these flow-through shares, SR&ED expenses and the associated ITC would be transferred to the shareholders. Like Deloitte LLP, the Chartered Professional Accountants of Canada supported the implementation of a “patent box” tax incentive. Mr. Page advocated a study on the causes of weak productivity growth in Canada, with particular attention to the manner in which innovation, investment and human capital affect productivity growth. 2. Vulnerable Canadians WitnessesIn speaking about the need for increased funding of the indirect costs of research, the Fédération Étudiante Universitaire du Québec asked that the average reimbursement rate for indirect research costs under the ICP be increased to 40% of the amount of direct research grants. 3. Prosperous and Secure Rural and Urban Communities WitnessesMouvement Desjardins noted that the venture capital fund announced in the 2012 federal budget could be modelled on existing programs created by caisses populaires to assist business development in local communities. The Sunnybrook Health Sciences Centre requested a federal contribution of $30 million, with an additional $30 million from the private sector and the provincial government, for a new facility specialized in brain disorders and diseases; the facility would have educational, research and patient care functions. 4. Employment Opportunities for Canadians WitnessesIn noting that Canadian companies have accumulated unused tax credits under the SR&ED ITC program, Canadian Manufacturers & Exporters advocated the creation of a “swap” program where such credits could be exchanged for a contribution from the federal government with respect to investments related to R&D. Like Deloitte LLP and the Chartered Processional Accountants of Canada, Canadian Manufacturers & Exporters requested the creation of a “patent box” tax incentive. Regarding infrastructure procurement in Canada, Canadian Manufacturers & Exporters highlighted that other countries require bidders to use local resources; it suggested that projects approved under the Building Canada Plan should provide a “level playing field” for Canadian manufacturers through a reciprocity policy. The Canadian Energy Pipeline Association proposed that the government support pipeline technology research and collaboration by ensuring that departments, such as Natural Resources Canada, have sufficient resources to support these efforts and by providing an investment of up to $5 million over three to five years for technology and collaboration, perhaps through a CanmetENERGY program. D. The Committee’s RecommendationsThe Committee recommends: 26. That the federal government continue to support basic research and development, including through the federal granting councils and the Indirect Costs Program. 27. That the federal government continue to support applied research. In doing so, the government should examine the benefits of current programs that support research and development infrastructure in Canada, like the NextGen Biofuels Fund or Forestry Industry Transformation Program, and should look at new initiatives that focus on strengthening the capacity for digitally enabled research and partnerships with universities. |