FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

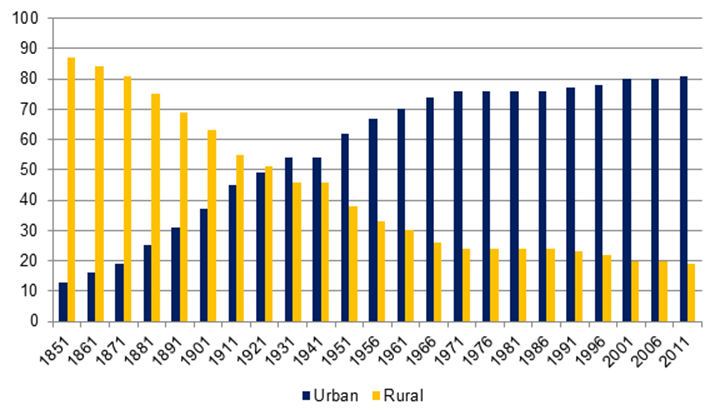

Chapter five: Ensuring prosperous and secure Rural and urban communitiesCommunities face a variety of challenges in ensuring the well-being of residents and contributing to the prosperity of businesses. For example, rural and remote communities with limited opportunities for economic development may experience a reduction in their population. Large urban centres where housing prices rise rapidly may have inadequate affordable housing, and a number of Canada’s rural and urban communities have aging infrastructure. Communities that rely on tourism may experience difficulties if tourism-related revenue decreases. Moreover, businesses — including co-operatives — in rural and urban communities may require assistance in order to create jobs and contribute to the community. In this context, the Committee invited selected witnesses to speak about the federal actions that should be taken to ensure prosperous and secure rural and urban communities in Canada. A. Background1. Rural and Urban PopulationAccording to the 2011 Census, more than 6.3 million Canadians were living in rural areas at the time of the survey; rural areas are those with fewer than 1,000 inhabitants and a population density below 400 people per square kilometre. This number has been relatively stable since 1991, while the number of Canadians living outside of rural areas has been rising steadily. Consequently, as shown in Figure 14, the proportion of Canadians living in rural areas has been dropping, and — in 2011 — fell to 18.9%, representing fewer than one in five Canadians. At the same time, the proportion of Canadians residing in urban areas — areas with a population of at least 1,000 and a density of 400 or more people per square kilometre — has been rising, and was 81.1% in 2011. Figure 14 – Proportion of the Population Living in Urban and Rural Areas, Canada, 1851–2011 (%)

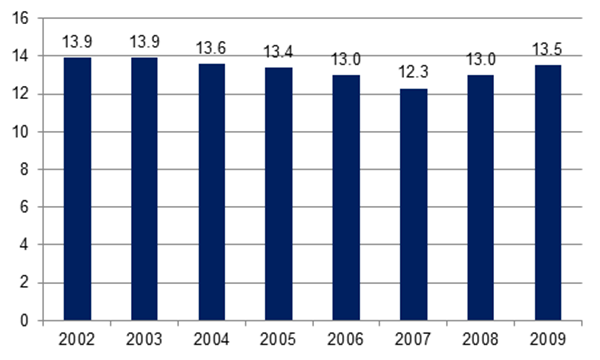

Source: Figure prepared using information obtained from: Statistics Canada, “Population, urban and rural, by province and territory.” In 2011, the proportion of the population living in rural areas was below or near the national average in four provinces: Quebec (19.4%), Ontario (14.1%), Alberta (16.9%) and British Columbia (13.8%). The proportion of the population living in rural areas was highest in the Atlantic provinces and in the territories in that year. However, in all provinces and territories, the proportion of the population living in rural areas declined between 2006 and 2011. According to the 2011 NHS, nearly 7 in 10 Canadians lived in one of Canada’s 33 Census Metropolitan Areas (CMAs) at the time of the survey, and more than 1 in 3 Canadians lived in 1 of Canada’s 3 largest CMAs: Toronto, Montreal and Vancouver. While municipalities are created, regulated and sometimes eliminated by provincial and territorial governments, the federal government has had a direct relationship with Canadian cities through, for example, measures in relation to homelessness and infrastructure. The federal government supports urban and rural communities through various departments, agencies, Crown corporations, funds and strategies, including the regional development agencies, the Business Development Bank of Canada (BDC) and the Canada Mortgage and Housing Corporation (CMHC). Additional sources of support are indicated below. 2. Housing and HomelessnessAccess to adequate, affordable and suitable housing allows individuals and families to improve their quality of life and contribute to society, whether in school, the workplace, the community or their household. As well, it may reduce the incidence of — and the social and financial costs related to — poverty, homelessness, family violence, poor health and crime. According to the CMHC, 13.5% — or 1.4 million urban households — were in “core housing need” in 2009, a rate that was both higher than the 2007 rate of 12.3% and the highest rate since 2004, as shown in Figure 15. Figure 15 – Urban Core Housing Need, Canada, 2002–2009 (%)

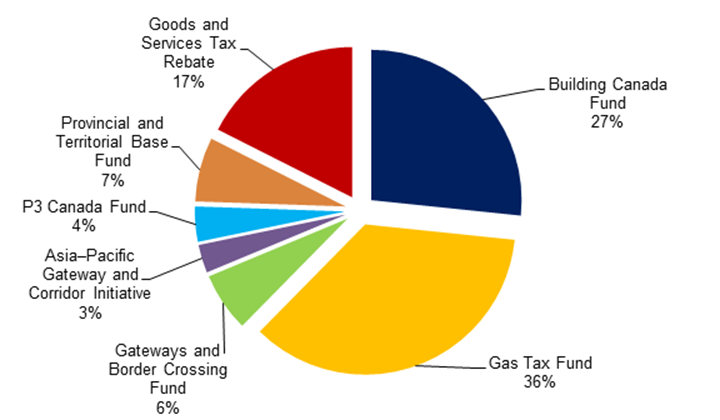

Source: Figure prepared using information obtained from: Canada Mortgage and Housing Corporation, Canadian Housing Observer 2012, 18 December 2012, p. 5-7. Moreover, in 2011, there were approximately 605,000 low-income households living in social housing. Statistics Canada does not collect information on homelessness. To reduce the number of individuals in housing need, the federal government allocates funding through the Investment in Affordable Housing (IAH) initiative, under which provinces and territories invest an amount that is equivalent to the federal contribution, and ensure the delivery of affordable housing programs. Funding previously allocated to renovation programs for low-income households — such as the Residential Rehabilitation Assistance Program — and to increase the supply of affordable housing — the Affordable Housing Initiative — have been combined under the IAH since 2011. As well, through the CMHC, the federal government makes annual investments in social housing for low-income households on- and off-reserve. Historically, federal support to address homelessness included the Supporting Communities Partnership Initiative (SCPI), under which selected urban communities were funded to develop multi-sectoral community plans. Initially, the initiative was designed to provide sufficient emergency shelters; subsequently, it was directed at efforts to build and operate second-stage and transitional housing. After several renewals of SCPI, a new federal program — the Homelessness Partnering Strategy (HPS) — was established in 2007. The HPS also provides funding to remote and Aboriginal communities for projects designed to prevent and reduce homelessness. 3. InfrastructurePublic infrastructure includes highways, bridges, public transit, water supplies, solid waste and wastewater treatment facilities, sanitary and storm sewers, energy generation plants, schools, hospitals, telecommunications, and cultural and recreational facilities. It is widely recognized that adequate infrastructure is essential for the current and future success of individuals, businesses, the Canadian economy and the nation. While the federal government is sometimes the proponent of an infrastructure project, it generally supports provincial and municipal infrastructure projects through funding programs managed by Infrastructure Canada. Public-private partnerships (P3s) are another funding method for public infrastructure initiatives. PPP Canada has the mandate to assess projects for their P3 potential; it also administers the P3 Canada Fund. As shown in Figure 16, a number of federal infrastructure programs are part of the Building Canada Plan, which covers the 2007–2014 period. Figure 16 – Distribution of Funding Allocated under the Building Canada Plan, by Initiative, Canada, 2007–2014 (%)

Source: Figure prepared using information obtained from: Infrastructure Canada, “Building Canada plan.” Other federal infrastructure programs include: for the 2003–2013 period, the Canada Strategic Infrastructure Fund; for the 2004–2014 period, the Municipal Rural Infrastructure Fund; and, for the 2009–2014 period, the Green Infrastructure Fund. 4. TourismAccording to the Canadian Tourism Commission (CTC), in 2012, Canada’s tourism sector generated $81.9 billion in revenue and contributed $32.3 billion — or almost 2.0% — to Canada’s GDP. In that year, the sector was Canada’s second-largest service export, is estimated to have generated $22.7 billion in government revenue and employed 614,600 people, as shown in Figure 17. In addition to its economic contributions, the sector provides a variety of other benefits, such as enhancing the country’s image and global reputation as an attractive vacation, business and immigration destination; as well, the sector showcases Canada’s historical, geographic, cultural and artistic assets, all of which have the potential to increase the well-being and social cohesion of Canadians living in urban, rural and remote locations. Figure 17 – Employment in the Tourism Sector, Canada, First Quarter 2005–Second Quarter 2013 (thousands)

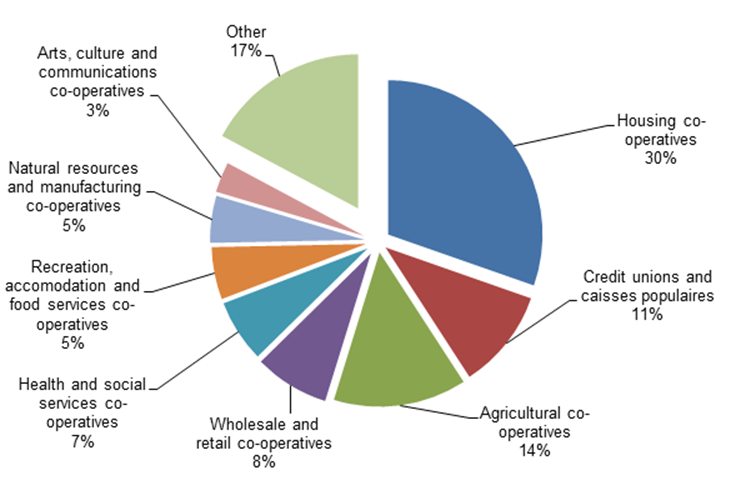

Source: Figure prepared using information obtained from: Statistics Canada, Table 387-0003, “Employment generated by tourism, quarterly (jobs),” CANSIM (database), accessed 13 November 2013. A number of federal departments and agencies support the development of Canada’s tourism sector. On 6 October 2011, the federal government announced the Federal Tourism Strategy, which aligns the tourism activities of the relevant federal agencies and departments, and focuses on four priorities: awareness through marketing and research; access and movement of travellers; product development and investment; and worker skills and the supply of labour. The 2013 federal budget proposed two sources of direct funding in support of the tourism sector: the Temporary Resident Program; and the inclusion of tourism and tourism-related sectors, such as culture, sport and recreation, in the list of categories eligible for financing under the Gas Tax Fund. 5. Co-operativesCo-operatives create jobs and support growth in communities across Canada. As shown in Figure 18, while co-operatives are particularly prominent in the housing, agricultural and financial sectors, they are also involved in a number of other sectors, such as retail, health and social services, recreation, accommodation, food services, manufacturing, and arts and culture. According to Industry Canada, in 2009, co-operatives, caisses populaires and credit unions employed 156,000 people and served 18 million members. Figure 18 – Co-operatives, by Area of Activity, Canada, 2009 (%)

Source: Figure prepared using information obtained from: Industry Canada, Co-operatives in Canada in 2009. Prior to 2013, Agriculture and Agri-Food Canada’s Rural and Co-operatives Secretariat provided federal oversight of non-financial co-operatives. In 2013, policy oversight for co-operatives was transferred to Industry Canada as a result of recommendations in the September 2012 report of the House of Commons Special Committee on Co-operatives, entitled Status of Co-operatives in Canada. The Department of Finance and the Office of the Superintendent of Financial Institutions are responsible for federal legislation and supervision of federally incorporated credit unions. Caisses populaires and non-federally incorporated credit unions are governed by the provincial/territorial regulator in the province/territory in which the credit union conducts business. According to Industry Canada, in 2009, there were approximately 900 caisses populaires and credit unions operating in Canada; these institutions had close to 11 million members. B. Changes Proposed by Witnesses Invited to Address “Ensuring Prosperous and Secure Rural and Urban Communities”In speaking to the Committee about ensuring prosperous and secure rural and urban communities, the witnesses invited to address this topic made proposals relating to federal support for rural communities, housing and homelessness, infrastructure, tourism and co-operatives. 1. Rural CommunitiesThe Solidarité rurale du Québec called for the federal government to re-establish and adequately fund the Rural Secretariat, which was previously in Agriculture and Agri-Food Canada but has been abolished; the Saskatchewan Association of Rural Municipalities also expressed support for the Rural Secretariat, and argued for sufficient resources to enable it to advocate on behalf of rural communities across all federal departments. The Solidarité rurale du Québec also requested the creation of a national rural policy to ensure the prosperity of rural areas; in its view, such a policy could be modelled on a similar policy in Quebec. Finally, it asked the government to invest in rural communities, and to provide them with tools to assist in their development. In speaking about the Species at Risk Act, the Saskatchewan Association of Rural Municipalities indicated that the legislation could stifle the growth and prosperity of Canada’s agricultural sector, and proposed that the government consider the legal and financial implications for agricultural producers, as well as the health and safety implications for rural residents, before adding a new species. Moreover, in its view, normal agricultural activities should be made a permanent exception under the Act. 2. Housing and HomelessnessIn highlighting that affordable housing is needed for municipalities to attract a labour force and thereby sustain their growth, the Calgary Chamber of Commerce requested that the federal government extend existing affordable housing programs, and work with cities and communities to lower barriers to investment in the construction of new rental housing. Regarding social housing and homelessness, the Federation of Canadian Municipalities proposed that the government renew its investments in social housing units, develop a long-term plan to “close the gaps” in the housing system, reduce the Canadian economy’s vulnerability to housing-market distortions, and implement “housing first” programs and other models for providing permanent shelter to homeless people. Mr. Hulchanski mentioned that federal funds for affordable housing have not been spent, and encouraged the government to implement the affordable housing investments announced in the 2013 federal budget. He asked that these investments be made pursuant to a national housing strategy developed in collaboration with provinces and territories, municipalities, the private sector, Aboriginal people and non-governmental organizations. The Canadian Real Estate Association proposed two changes to the Home Buyers’ Plan: an increase in the withdrawal limit, with the increase achieved through indexation to inflation in $2,500 increments; and expanded eligibility to include Canadians who experience a significant life change, such as job loss, divorce or the death of a spouse. Furthermore, it requested that the tax deferral of income from the sale of real property in which depreciation was previously claimed be permitted for small investors when they sell an investment property and reinvest the proceeds from the sale in a similar property within one year. 3. InfrastructureRegarding the new infrastructure funding commitments announced in the 2013 federal budget, the Calgary Chamber of Commerce argued that large urban centres should be allowed to set their own priorities when determining which projects to fund. In noting that infrastructure problems can be found in any Canadian community, the Federation of Canadian Municipalities requested that a fair and predictable share of the Building Canada Fund be invested in local streets, bridges, water systems and public transit. As well, in its view, the Fund should include clear, national objectives and a reporting mechanism to ensure that every dollar “delivers value” for taxpayers. Both the Federation of Canadian Municipalities and the Saskatchewan Association of Rural Municipalities proposed that the new Building Canada Plan include a component for small communities. Moreover, the Saskatchewan Association of Rural Municipalities proposed that, in relation to the new Building Canada Plan, a lower population threshold exist in order that small communities would not be competing with larger municipalities for the same funds. In speaking about the P3 Canada Fund, the Saskatchewan Association of Rural Municipalities highlighted that, as it is difficult for rural-based industries — such as oil, gas and potash — to qualify for funding, the eligibility criteria for funding should be expanded to include less densely populated areas. The Saskatchewan Association of Rural Municipalities commented on the need for improved access to high-speed Internet service in rural areas in order to expand the delivery of education and health care, as well as to increase economic development opportunities, and made two suggestions: modify the existing 700 MHz spectrum auction rules to ensure that spectrum that is unused after two years is available to rural service providers; and ensure that the rules for the 2500 spectrum auction and the 3500 MHz spectrum licence renewal require licence holders to use the spectrum, or “lose it.” Regarding specific infrastructure projects, the Saskatchewan Association of Rural Municipalities requested that Western Economic Diversification invest in the North East Quad Bridge Project so that a non-traditional bridge design pilot can be implemented. The Agence métropolitaine de transport called for the federal government to collaborate with the Government of Quebec on the construction of a new bridge to replace the Champlain Bridge. In its view, a light rail system should be built on this bridge, and $1 billion should be allocated from the national infrastructure component of the Building Canada Fund announced in the 2013 federal budget. 4. TourismIn indicating that the federal government should make tourism a priority, the Tourism Industry Association of Canada proposed that $35 million per year for three years be allocated to the CTC to create a marketing campaign targeted to specific “sister cities” in the United States. Moreover, it asked for the reintroduction of a visa waiver for citizens of Mexico. 5. Co-operativesIn arguing for federal policies that support or do not hinder co-operative financial institutions, Credit Union Central of Canada proposed that the government apply a co-operative “lens” to all of its initiatives. In its view, by applying such a lens, the government could review the fairness of credit union taxation and of allowing Farm Credit Canada (FCC) — which is owned by the government — to compete directly with small co-operative financial institutions. As well, it argued that the activities of FCC should be reviewed in a manner that is similar to BDC. C. Changes Proposed by Witnesses Invited to Address Issues Other Than “Ensuring Prosperous and Secure Rural and Urban Communities”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. Fiscal Sustainability and Economic Growth WitnessesThe Conference Board of Canada suggested that the federal government should invest in infrastructure and pursue collaborations with the provinces and cities with respect to public-private partnership financing. Like the Tourism Industry Association of Canada, the Association québécoise de l’industrie touristique urged the government to prioritize tourism, and advocated a funding increase to the CTC for the creation of a U.S. “sister cities” marketing campaign. As well, it supported a review of the structure of costs related to air transportation, with the aim of ensuring competitiveness. 2. Vulnerable Canadians WitnessesIn commenting that the Mineral Exploration Tax Credit (METC) leads to investments in mining projects in rural and remote communities, PearTree Financial Services argued that the METC should be made permanent and expanded to other sectors. Moreover, it proposed that the federal government undertake an evaluation of the fiscal impact of the tax incentives provided through flow-through shares and the METC to determine whether the measures increase net federal revenue. 3. Research and Innovation WitnessesThe Green Budget Coalition made a variety of proposals in relation to energy and the environment. For example, it suggested that the Canadian Exploration Expenses deduction should be allowed to be claimed only when the exploration efforts are unsuccessful, and that the METC flow-through share arrangements should not be renewed for mining corporations. As well, the Green Budget Coalition encouraged the federal government to establish a five-year water fund that would include annual amounts of: $60 million for alleviating land-based runoff in areas under federal jurisdiction; $25 million to address aquatic invasive species; and $5 million for the Great Lakes–St. Lawrence River adaptive management plan. Furthermore, the Green Budget Coalition suggested that the government should amend the ITA to provide that Classes 43.1 and 43.2 of Schedule II would apply to expenditures on energy storage investments for capital cost allowance purposes. It also advocated a 30% ITC for emerging storage technologies. The Green Budget Coalition also proposed the establishment of a fund to provide financing for energy projects to develop alternative sources of home and building energy in off-grid communities where diesel is currently used. In its view, the amount of the fund should be between $10 million and $15 million. Finally, the Green Budget Coalition requested that the government introduce legislation that would require nuclear power companies, as well as businesses engaged in oil and natural gas drilling, to set aside sufficient funds to cover potential costs related to environmental damage caused by accidents. The Forest Products Association of Canada asked that the government increase funding for the Investment in the Forest Industry Transformation program, and renew the program for six years with a total budgetary allocation of $500 million. It also advocated continued support for innovation in the forest sector, and urged the government to consider using the unspent amount in the NextGen Biofuels Fund to support the sector. In the view of the Conféderation des syndicats nationaux, the government should increase funding to the Canadian Broadcasting Corporation/Radio-Canada. 4. Government Efficiency WitnessesAccording to the Cambri Development Group Inc., the definition of the term “residential condominium unit” in subsection 123(1) of the Excise Tax Act should be amended to include a strata plan registered either under the laws of a province or under the First Nations Land Registry or other federally registered land registries. It also argued that the Harmonized Sales Tax paid by a developer before its condominiums are sold should be reviewed and assessed so that the purchasers of these condominiums are not denied the First-Time New Home Buyers’ bonus available in British Columbia. 5. Employment Opportunities for Canadians WitnessesUnifor suggested that, as an alternative to public-private partnerships, the federal government should support major increases in infrastructure spending at the federal, provincial/territorial and municipal levels including through additional support and by co-funding projects. In speaking about the safety of pipelines for communities through which they run, the Canadian Energy Pipeline Association supported trisector collaboration among governments, the research community and the oil and gas sector to improve the safety of pipelines in Canada. In noting that transportation systems are essential in ensuring the mobility of goods and people, especially in urban communities, the Quebec Employers’ Council advocated replacement of the Champlain Bridge, with the new bridge funded through a toll applied on those who use the new bridge. D. The Committee’s RecommendationsThe Committee recommends: 28. That the federal government continue to promote the importance of health, sport and physical literacy by continuously supporting organizations such as ParticipACTION and Special Olympics Canada. 29. That the federal government examine tax provisions in relation to real estate, such as the deferral of previously claimed depreciation on income properties. 30. That the federal government continue to explore ways to make Canada’s aviation cost structure more competitive, with a focus on tourism and its economic benefits to Canada. 31. That the federal government continue to promote tax incentives to encourage the development and use of clean energy generation. 32. That the federal government continue to explore methods to encourage value-added domestic production in the energy sector. 33. That the federal government consider making the 15% Mineral Exploration Tax Credit for flow-through share investors, which is currently a temporary measure, permanent in order to support junior mineral exploration. 34. That the federal government, in order to remain competitive in the North American market, explore the cost and feasibility of tax incentives, such as the accelerated capital cost allowance or other support programs to improve the affordability of commercial natural gas vehicles and the use of natural gas as transportation fuel to reduce air pollutants and support economic growth. There should also be a focus on ensuring that communities across Canada have access to sustainable energy in the form of affordable natural gas. 35. That the federal government continue to engage provinces and territories, the Federation of Canadian Municipalities and other stakeholders on the implementation of the new Building Canada Plan with a goal of building strong rural and urban communities. 36. That the federal government continue to promote public-private partnerships, or P3s, for public infrastructure where they can produce better value for taxpayers’ dollars. Consideration should be given to expanding the eligibility of P3 Canada to rural or less densely populated areas. 37. That the federal government continue with and strengthen its efforts to combat contraband tobacco by working to reduce contraband sales. 38. That the federal government set aside proceeds from the upcoming 700mhz spectrum auction for strategic reinvestment in the deployment of broadband infrastructure in Canada’s rural and remote regions. 39. That the federal government unveil a national conservation plan to further increase protected areas, thereby ensuring that Canada’s rich natural heritage is protected. 40. That the federal government amend Classes 43.1 and 43.2 of the Income Tax Act to specify that capital cost allowances for those classes apply to expenditures on tangible stand-alone energy storage assets. 41. That the federal government consider reviewing the mandate of Farm Credit Canada. |