FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

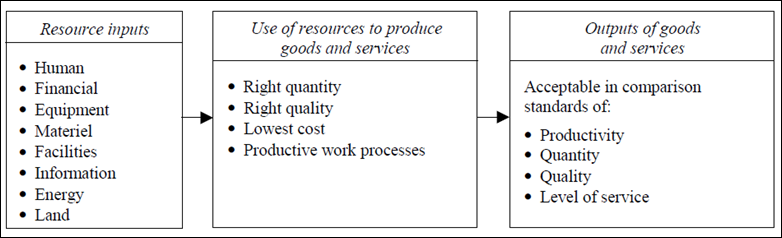

CHAPTER SIX: IMPROVING GOVERNMENT EFFICIENCYIn part as a result of program and tax spending that occurred during the global financial and economic crisis, governments in a number of developed countries are seeking ways to limit growth in — if not reduce — their expenditures while continuing to deliver the same or improved services to their residents. Improving the efficiency with which services are delivered is one means of meeting this challenge. Canada’s federal government has adopted various approaches designed to improve efficiency, such as conducting spending reviews and studying reforms that could reduce “red tape.” In this context, the Committee invited specific witnesses to share their views about the federal actions that should be taken to improve government efficiency. A. Background1. Responsibility for Efficiency within the Federal GovernmentThe Office of the Auditor General of Canada (OAG) defines the term “efficiency” as “how well an organization uses its resources to produce acceptable goods and services in comparison to a norm, target or standard.” Efficiency is improved, for example, when more goods and/or services of a given quality are produced with the same or fewer labour and/or other inputs. The main elements of efficiency are shown in Figure 19. Figure 19 – Main Elements of Efficiency

Source: Figure prepared using information obtained from: Office of the Auditor General of Canada, Auditing of Efficiency, October 1995, p. 4. According to the OAG, efficiency is one of three dimensions of the performance of the federal government. The other two dimensions are economy and effectiveness, both of which are linked to efficiency. “Economy” requires that inputs of appropriate quantity and quality be obtained at least cost. The economic acquisition of resources contributes to efficiency by minimizing the cost of inputs used. “Effectiveness” both overlaps with, and extends beyond, efficiency into the impacts of programs. Efficiency is closely linked to effectiveness because it is a factor in determining the least-cost method of achieving desired outcomes. In the federal government, responsibility for managing with due regard for efficiency is shared by central agencies — the Privy Council Office, the Treasury Board of Canada Secretariat and the Department of Finance — and departments. Central agencies are responsible for establishing and assessing government-wide opportunities to provide better services, while departments are responsible for delivering specific federal programs or services with due regard for efficiency. 2. Spending ReviewsAs part of the federal strategic review process launched in 2007, departments and agencies review all of their programs with a view to ensuring that programs and services are focused on their core mandates, streamlining internal operations and achieving better results for Canadians. Between 2007–2008 and 2010–2011, more than $2.8 billion in annual savings were generated by four strategic reviews. In the 2011 federal budget, the government launched a comprehensive review of departmental spending with the objective of achieving at least $4 billion in annual savings by 2014–2015. In the 2012 budget, the government announced that $5.2 billion in annual savings by 2014–2015 had been identified as part of the spending review announced a year earlier. 3. Red Tape Reduction Reports and Red Tape Reduction Action PlanThe federal government administers roughly 2,600 regulations. These regulations affect the daily lives of Canadians on matters ranging from the goods and services that they buy, to the government services that they receive, to the quality of the air that they breathe and the water that they drink. In January 2011, the Red Tape Reduction Commission was launched. Headed by the Minister of State for Small Business and Tourism, the Commission was asked to identify irritants to business stemming from federal regulatory requirements, and to provide recommendations to reduce systemic and specific compliance burdens. In September 2011, the Commission released its first report, entitled What Was Heard. The report analyzed the results of the consultations that the Commission had undertaken, and identified some potential reforms. The Commission then worked with independent experts to evaluate the viability of these potential reforms. In January 2012, the Commission released its second — and final — report, entitled Recommendations Report. The final report contains 90 recommendations directed at 18 federal departments and agencies. On October 2012, the government released the Red Tape Reduction Action Plan, which identifies six reforms, as outlined in Table 3. Table 3 — Reforms Proposed in the Red Tape Reduction Action Plan

Source: Table prepared using information obtained from: the Treasury Board of Canada Secretariat, “Red Tape Reduction Action Plan,” October 2012. B. Changes Proposed by Witnesses Invited to Address “Improving Government Efficiency”The witnesses invited by the Committee to speak about the topic of improving government efficiency focused on strengthening parliamentary oversight of government spending and two particular areas where “red tape” could be reduced. 1. Strengthened Parliamentary Oversight of SpendingAccording to the Canadian Taxpayers Federation, Cabinet receives detailed, long-term cost information in relation to proposed legislation; it suggested that the federal government should amend the Financial Administration Act to require that Parliament be provided with a detailed lifetime cost forecast when legislation is introduced. The Canadian Union of Public Employees argued that the government should be more transparent, and should provide parliamentarians and the Parliamentary Budget Officer with the information they need to hold the government to account for the results it achieves with taxpayers’ money. 2. Specific “Red Tape” Reduction OpportunitiesIn its brief provided to the Committee, the Cambri Development Group Inc. suggested that the federal government should reinstate the e-registration system for property transactions on First Nations land. In its view, this successful pilot project — which was cancelled — had resulted in a two-day approval period for transactions and a reduction in the paperwork required to complete the registration. According to the Canadian Union of Public Employees, the government could reduce red tape by eliminating the P3 Canada Fund and stop subsidizing the privatization of public services. C. Changes Proposed by Witnesses Invited to Address Issues Other Than “Improving Government Efficiency”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. Fiscal Sustainability and Economic Growth WitnessesThe Investment Industry Association of Canada urged the federal government to pursue the co-operative securities regulator that it is proposing; in its view, the result would be streamlined regulation and lower administrative costs for businesses. The Certified General Accountants Association of Canada and the Chartered Processional Accountants of Canada encouraged the government to require businesses to adopt standard business reporting for all government filings. 2. Rural and Urban Communities WitnessesThe Canadian Convenience Stores Association and Credit Union Central of Canada highlighted that over-regulation and red tape compliance are burdens for small retailers and co-operative financial institutions respectively. Credit Union Central of Canada provided two examples — complying with the requirements of Canada’s anti-money laundering regime and with the proposed anti-spam regulations — and suggested that federal government regulations should be implemented in a manner that is cost-effective for co-operative financial institutions. 3. Employment Opportunities for Canadians WitnessesThe Quebec Employers’ Council asked that new regulations in specific areas — the transportation sector, and consumer protection in the telecommunications and financial services sectors — adhere to the one-for-one principle so as to preserve the competitiveness of Canadian companies when they compete with foreign businesses that have not invested in existing infrastructure. D. The Committee’s RecommendationsThe Committee recommends: 42. That the federal government vigorously and continually review spending of taxpayers’ money to eliminate all waste and inefficiencies, including through the elimination of government programs that no longer serve their purpose or achieve their intended results. This review should include an ongoing review of corporate assets to obtain the most effective and efficient use of government resources, thereby ensuring value for taxpayers. 43. That the federal government continue to implement the recommendations of the Red Tape Reduction Commission, such as the “one-for-one” Rule, to reduce irritants to business that impede growth, competitiveness and innovation. Government efforts could include exploring the possibility of standardizing business reporting language, known as XBRL, to reduce compliance costs for taxpayers and enhance federal data collection. 44. That the federal government continue to work cooperatively with willing provinces and territories towards establishing a co-operative capital markets regulator in order to better protect Canadians and promote the integrity of Canada’s financial system. These efforts should build on the progress of the agreement with Ontario and British Columbia. |