FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

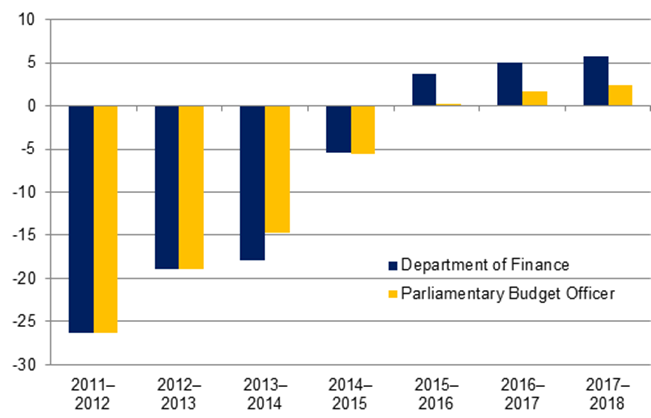

CHAPTER TWO: FOCUSING ON FISCAL SUSTAINABILITY AND ECONOMIC GROWTHCanada is a member of the Group of Seven countries, is a trading nation and — in terms of gross domestic product (GDP) — has one of the world’s largest economies. From that perspective, the fiscal and economic situations of countries worldwide — particularly of countries with which Canada has a significant trade and/or investment relationship — are important for the country’s prosperity, the quality of life of residents and the success of businesses. While the recovery from the global financial and economic crisis continues, many advanced countries still face challenges as efforts are under way to reduce levels of government spending and debt while simultaneously attempting to stimulate economic growth. In addition to the effects of these international challenges on Canada, the country is also expected to experience a range of domestic challenges. In this context, the Committee invited specific witnesses to share their views about the federal actions that should be taken to ensure Canada’s federal fiscal sustainability and economic growth. A. Background1. Federal Fiscal Situation and ProjectionsAccording to the Annual Financial Report of the Government of Canada for 2012–2013, the federal budgetary deficit in that year was $18.9 billion, lower than the budgetary deficit of $26.3 billion in 2011–2012. Moreover, in 2012–2013, the federal debt was $602.4 billion and the federal debt-to-GDP ratio was 33.1%, higher and lower respectively than the figures of $583.6 billion and 33.2% in 2011–2012. Figure 1 shows projections by the Department of Finance and the Office of the Parliamentary Budget Officer (PBO) of federal budgetary balance for the 2011–2012 to 2017–2018 period. Figure 1 — Federal Budgetary Balance, 2011–2012 to 2017–2018 ($ billions)

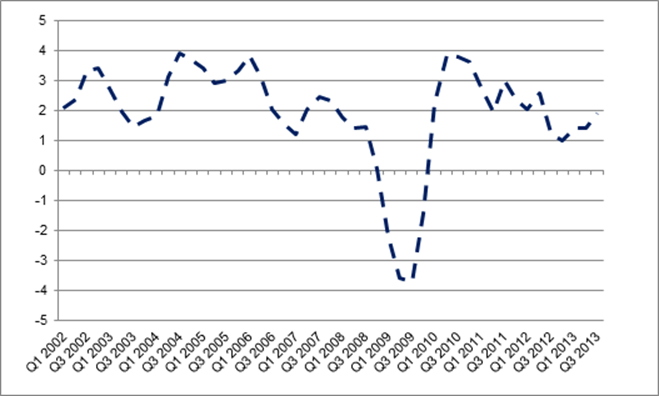

Notes: Data for the 2013–2014 to 2017–2018 period are projections. Sources: Figure prepared using information obtained from: Department of Finance, Jobs, Growth and Long-Term Prosperity — Economic Action Plan 2013, 21 March 2013, p. 287; Department of Finance, Update of Economic and Fiscal Projections, 12 November 2013; and Office of the Parliamentary Budget Officer, Economic and Fiscal Outlook Update, 28 October 2013, p. 7. At the 5–6 September 2013 Summit of the Group of Twenty nations in St. Petersburg, Russia, Canada reiterated its commitment to return to balanced federal budgets by 2015–2016, and forecasted that federal net debt as a proportion of GDP will increase from 33.5% in 2012–2013 to 33.8% in 2013–2014 before falling to 28.1% in 2017–2018. As well, Canada made a commitment to achieve a federal net debt-to-GDP ratio of 25.0% by 2021, and stated that it “would consider delaying the planned attainment of this goal, beyond 2021, only if a significant, unforeseen and adverse economic shock were to occur.” In the long term, the aging of Canada’s population is expected to have significant implications for the sustainability of government finances. Both the Department of Finance and the PBO have agreed that a slower expected rate of economic growth will reduce the growth rate of government revenue in the future, while increased expenditures in relation to programs that mostly benefit the elderly will create fiscal pressures as the baby boom generation reaches retirement age. Similarly, both the Department of Finance and the PBO have projected that, as the aging of the population will put downward pressure on labour input growth, labour productivity growth is expected to account for a proportionally larger contribution to future economic growth than has been the case in the past. 2. Past, Present and Projected Economic GrowthAccording to Statistics Canada, real GDP growth in each of the first and second quarters of 2013 was 1.4% higher than in those quarters in 2012. As shown in Figure 2, the Canadian economy grew comparatively more in 2010 and 2011 than it had since the beginning of the global financial crisis; the real GDP growth rates in the third and fourth quarters of 2012, and in the first and second quarters of 2013, were the lowest since 2009. Figure 2 — Year-Over-Year Real Gross Domestic Product Growth, Canada, First Quarter 2002 — Third Quarter 2013 (%) Note: The gross domestic product (GDP) data were calculated by Statistics Canada using 2007 constant prices. Source: Figure prepared using seasonally adjusted information obtained from: Statistics Canada, Table 380-0064, “Gross domestic product, expenditure-based,” CANSIM (database), accessed 3 December 2013. In recent years, aggregate household spending has exceeded aggregate household saving, which has led to increased household indebtedness. Similarly, due to increased spending following the global financial crisis, the federal government has increased its debt. The Senior Deputy Governor of the Bank of Canada has argued that households have reached the limit of their spending capacity, and further increases in their debt and/or reductions in their accumulated savings may be unsustainable, particularly as interest rates are expected to rise in the future and debt repayment becomes more costly. As well, according to him, in light of the federal government’s intention to balance its budget by 2015–2016, households and governments will contribute less to economic growth in the future than they have in the recent past. According to the International Monetary Fund (IMF), in order for economic growth to increase significantly in Canada in the future, businesses and/or net exports must contribute to growth; businesses — in aggregate — must spend more than they save and/or the value of exports must exceed the value of imports. Recently, the Governor of the Bank of Canada suggested that improved confidence in global markets and among domestic businesses will lead to increased growth in business investment and exports. The Bank of Canada, the IMF, selected financial institutions, the Organisation for Economic Co‑operation and Development (OECD) and the Department of Finance, which relies on a survey of private‑sector forecasters when determining its forecast, have estimated that annual economic growth in Canada will be between 1.4% and 1.9% in 2013 and between 2.0% and 2.9% in 2014, as shown in Table 1. Table 1 — Actual and Projected Annual Real Gross Domestic Product Growth, Canada, by Organization, 2011–2014 (%)

Notes: The numbers in brackets are previous projections. Sources: Table prepared using information obtained from: House of Commons, Standing Committee on Finance, Minutes of Proceedings, 2nd Session, 41st Parliament, 29 October 2013, 1305; Bank of Canada, Monetary Policy Report, 23 October 2013, p. 20; Department of Finance, June 2013: Department of Finance Private Sector Survey, June 2013; BMO, Canadian Economic Outlook, 11 October 2013; CIBC, “Looking Outside the Beltway,” Economic Insights, 8 October 2013, p. 12; Royal Bank of Canada, Economic and Financial Market Outlook, June 2013, p. 7; TD Economics, Quarterly Economic Forecast, 25 September 2013, p. 5; Desjardins, Economic & Financial Outlook, 10 October 2013, p. 9; International Monetary Fund, World Economic Outlook: Hopes, Realities, Risks, April 2013, p. 2; and Organisation for Economic Co-operation and Development, OECD Economic Outlook, May 2013, p. 207. 3. Small BusinessesA firm’s size can be measured in a number of ways, including by its sales, revenue, assets or number of employees; the last of these is among the most widely used measures. According to Statistics Canada, a small business employs fewer than 100 people, while a medium-sized business employs between 100 and 499 individuals; a large business employs 500 or more people. In 2012, 1.08 million Canadian businesses, representing 98% of all businesses, were small. Collectively, these small businesses employed approximately 70% of the private-sector labour force and accounted for about 41% of the value of Canada’s exports in that year. According to other data sources, a business is “small” if it employs fewer than 50 people. Using this definition, Table 2 shows the contribution made by small businesses to each province’s and the nation’s GDP over time. Table 2 – Contribution to Gross Domestic Product by Small Businesses, Canada and by Province, 2002–2011 (%)

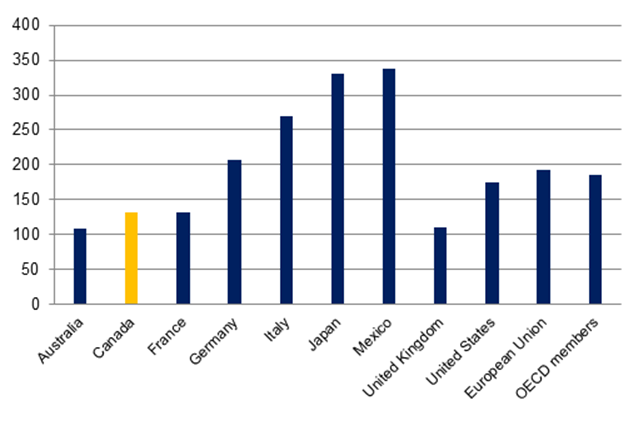

Note: Small businesses comprise businesses with fewer than 50 employees, plus those operated by the self-employed with no paid employees. Source: Table prepared using information obtained from: Industry Canada, Key Small Business Statistics, August 2013. With the small business deduction, the federal government supports small businesses through a preferential tax rate applied on the first $500,000 of qualifying business income earned by a Canadian-controlled private corporation with taxable capital employed in Canada of less than $15 million. As well, the government supports business owners, including those who are small, when they are dealing with credit and debit card companies; in particular, this support occurs through the voluntary Code of Conduct for the Credit and Debit Card Industry. 4. Tax ComplianceLike a number of other countries, Canada wants a tax system that is fair for taxpayers and that protects the revenue base. To ensure that the tax system meets these goals, taxpayers must comply with tax laws; that is, they must experience some measure of compliance burden. Legislative amendments that have not yet been enacted into law, when added to the complexity of the tax system, may increase the cost and time associated with tax compliance. Figure 3 shows the number of hours, in 2012, required by businesses in various countries to prepare tax returns and pay taxes. Figure 3 – Number of Hours Per Year to Prepare and Pay Business Taxes, Selected Countries, 2012

Notes: “Taxes” include corporate income taxes, value-added or sales taxes and labour taxes, including payroll taxes and social security contributions. Preparation time includes the time required to collect all of the information needed to calculate the tax payable and to calculate the amount payable. “OECD” is Organisation for Economic Co-operation and Development. Source: Figure prepared using information obtained from: The World Bank, Time to prepare and pay taxes (hours). To assist taxpayers in complying with tax legislation, the Canada Revenue Agency provides written, non-binding income tax and technical interpretations of specific provisions of tax laws, publishes information guides that describe each type of tax form, and helps eligible taxpayers prepare their income tax returns. Taxpayers can also request an advance income tax ruling for a technical interpretation that relates to a specific transaction that is being considered. B. Changes Proposed by Witnesses Invited to Address “Focusing on Fiscal Sustainability and Economic Growth”The witnesses invited by the Committee to speak about the topic of focusing on fiscal sustainability and economic growth highlighted the fiscal situation of the federal government, a variety of trade agreement and trade-related investment issues, financing for small and medium-sized businesses, and tax simplification. 1. Federal Fiscal SituationFinancial Executives International Canada encouraged the federal government to balance its budget without raising corporate or personal income taxes, and argued that — if additional tax revenue is needed — the Goods and Services Tax (GST) rate should be increased. Similarly, the Canadian Council of Chief Executives supported the goal of achieving a balanced budget by 2015. According to the Canadian Centre for Policy Alternatives, given that the federal net debt-to-GDP ratio is about one third the size of that of households, it is less important for the government to balance its budget than for the government to focus on inflation-adjusted wage increases for middle-wage earners, improved support for low-income Canadians and more job creation for youth. In commenting on income splitting as a way to assist households in reducing their debt, it stated that this approach would be relatively expensive and would be inconsistent with the federal objective of achieving a balanced budget by 2015. Regarding the implementation of federal balanced budget legislation, Luc Godbout — who is with the University of Sherbrooke and appeared as an individual — indicated that such legislation should require the government to have an average budget surplus of 1% of GDP over the business cycle, set aside an annual budget reserve of $5 billion and outline a plan for allocating unanticipated surpluses. Arguing that this type of legislation could provide a strong signal that the government has a specific fiscal target, the University of Ottawa’s Kevin Page advocated a study of the experiences of countries with balanced budget legislation. He also stated that such legislation may only be appropriate in the context of a high level of debt relative to GDP, a situation that does not currently exist in Canada. Mr. Page also urged the government — like governments in other OECD countries — to prepare annual fiscal sustainability reports that would include data from all municipal, provincial and territorial governments. Moreover, he suggested that the government should publish five-year spending plans for each department and agency, outlining spending reductions and corresponding changes to service levels; these changes may have implications that will lead to future spending pressures on governments. Emphasizing that Canada’s economic growth and the federal budget are linked, the Conference Board of Canada — in projecting a real GDP growth rate for the 20 years following 2015 of 2% and in noting that the average annual real GDP growth rate was between 3% and 3.5% over the past 25 years — suggested that the government should consider the lower expected growth rate when making budgetary decisions. It also proposed that the government explore ways in which tax policy could be reformed in order to increase potential economic growth. Finally, Mr. Page argued that federal spending on health care will be proportionately lower than such provincial spending in the future, as changes to the Canada Health Transfer (CHT) agreement will increase the federal contribution by 6% annually until 2017, while costs are expected to rise by more than that percentage each year; he proposed a national dialogue on health care policy and financing that, in his view, should involve all stakeholders and consider options for reforming federal transfers to the provinces. 2. International Trade, Investments to Increase Trade and Internal TradeThe Canadian Council of Chief Executives shared its view about the international trade priorities that should be pursued by the federal government, urging a concentration on Asia through the Trans-Pacific Partnership (TPP) negotiations, on South Korea, India and Japan through bilateral negotiations, and on China through further trade co-operation; the Conference Board of Canada agreed with a focus on the TPP negotiations. Moreover, the Canadian Council of Chief Executives proposed additional funding for Canada’s trade negotiating teams, the Trade Commissioner Service, and Export Development Canada. According to the Canadian Council of Chief Executives, the government should support a change in purpose and methodology in relation to the World Trade Organization, as well as the Council’s suggestion — which it plans to make at the December 2013 Bali Ministerial meeting — in relation to an agreement to reduce customs and border procedures for exporters. It also urged the government to explore the possibility of joining the Pacific Alliance and, regarding the North American Free Trade Agreement, advocated actions in three areas: regulatory harmonization, facilitation of business travel, and expanded energy infrastructure and opportunities for renewable energy within the continent. The Canadian Council of Chief Executives and the Association québécoise de l’industrie touristique said that the government should consider ways in which to expedite the visa process for certain Mexican travellers while respecting security considerations. Regarding other actions that could be taken in an effort to increase international trade, the Conference Board of Canada suggested that the government should consider upgrades to the Port of Halifax. With a view to facilitating the construction of an oil refinery and marine terminal in Kitimat, British Columbia from which China has agreed to purchase all refined fuel that is produced there, Kitimat Clean Ltd. requested a federal loan or a loan guarantee for each of two purposes: $100 million to finance one half of the expense of a feasibility study and $8 billion to finance one third of the construction cost of the facility. Internal trade was addressed by the Canadian Council of Chief Executives and the Certified General Accountants of Canada, which encouraged provincial, territorial and federal governments to remove internal trade barriers in Canada in order to ensure that trade within the country is not more constrained than is international trade. 3. Financing for Small and Medium-Sized BusinessesIn the context that small and medium-sized businesses are important contributors to Canada’s growth, the Investment Industry Association of Canada stated that, to assist small businesses that are facing difficulties accessing sufficient start-up capital, the federal government should consider three options for lowering the capital gains tax applied on the shares of a small business: defer the capital gains tax if the vendor, within six months of selling a share in respect of which there are capital gains, purchases a share of a small business listed on a stock exchange; reduce the effective capital gains tax rate for the shares of small Canadian companies that are either initial or secondary public offerings; and/or lower the effective capital gains tax rate for the traded shares of small Canadian companies listed on a stock exchange. In its view, the government should also study the potential benefits of a small business financing incentive program, which could have two elements: tax relief of up to 30% of the value of small business common shares for the purchaser and a tax exemption for capital gains in relation to those shares if they are held for three years. In arguing that “workers’ capital funds” are essential to Canada’s economic development and to helping meet the venture capital needs of small and medium-sized businesses, the Conféderation des syndicats nationaux urged the government to reconsider the proposed phase out of the Labour Sponsored Venture Capital Corporations Tax Credit that was announced in the 2013 federal budget. A similar suggestion was made by the Information Technology Association of Canada. 4. Tax SimplificationFinancial Executives International Canada encouraged the federal government to simplify the Income Tax Act (ITA) by: allowing a company to elect to include capital losses in its eligible capital expenditure pool; permitting companies to claim input tax credits in a related company; and requiring that a mandatory settlement process be included in the field of audit and objection stages for both income tax and GST payments. The Chartered Professional Accountants of Canada urged simplification in two stages: a review of the tax system followed by the appointment of an expert panel to identify options for simplification of the ITA; and the creation of a tax simplification office, based on the office that exists in the United Kingdom. Finally, the Certified General Accountants Association of Canada advocated a study on two issues: how to begin to take action on simplifying the tax system; and the development of a mechanism that would ensure that technical tax amendments are addressed in a timely manner. C. Changes Proposed by Witnesses Invited to Address Issues Other Than “Focusing on Fiscal Sustainability and Economic Growth”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. Prosperous and Secure Rural and Urban Communities WitnessesThe Calgary Chamber of Commerce suggested that the federal government should adopt a “bandwidth approach” — spending increases linked to the population growth and inflation rates — to managing its spending. In indicating that small retailers incur high processing fees for credit card transactions and do not have a sales volume that enables them to negotiate lower transaction fees, the Canadian Convenience Stores Association called for a review of fees associated with credit card transactions and a ruling by the government on appropriate fees for the processing of credit card transactions. 2. Government Efficiency WitnessesThe Canadian Federation of Independent Business argued that public sector pension plans are unsustainable and unfair, and made a variety of proposals: parliamentarians and new federal public service employees should be members of defined contribution pension plans; the normal age of retirement for all federal public service employees should be increased to 65 years; and the bridge benefit that federal public service employees receive because of the integration of their pension plan should be eliminated. Like the Canadian Convenience Stores Association, the Retail Council of Canada spoke about credit card transaction fees, advocating a reduction in such fees paid by merchants. The Canadian Federation of Independent Business proposed a reduction in the small business corporate income tax rate to 9% in order to maintain the historical difference between the corporate income tax rate for medium and large businesses on one hand and that for small businesses on the other hand. The Canadian Taxpayers Federation suggested that the federal government should honour its commitment to balance the federal budget by 2014 as a means of increasing confidence in the Canadian economy. It also proposed that federal public service wages and pension benefits be better aligned with those in the private sector. In speaking about ways in which the government could reduce expenditures and increase revenue, Canadians for Tax Fairness argued that the government should close unfair and ineffective tax loopholes. Moreover, it called for capital gains to be taxed at the same rate as employment income, particularly in the case of the stock option deduction. Canadians for Tax Fairness also proposed a number of other changes in relation to the ITA: reduce the complexity of the personal income tax system; “toughen” the rules on tax havens; eliminate tax credits that do not achieve their objectives; reduce the maximum amount that can be contributed to a registered retirement savings plan (RRSP) or a Tax-Free Savings Account (TFSA); and eliminate the business entertainment tax deduction. In order to make Canadian retailers more internationally competitive and reduce cross-border shopping, the Retail Council of Canada argued for further tariff reductions in relation to consumer goods that are no longer manufactured in Canada. 3. Employment Opportunities for Canadians WitnessesUnifor commented on the extent to which federal government spending should be used to stimulate the economy, and asserted that — following the attainment of a federal balanced budget — such spending as a percentage of GDP should not be decreased. The United Steelworkers said that government spending should be tied to GDP, and proposed that the government maintain federal program services. As well, Unifor proposed that the government negotiate a generous and stable revenue-sharing arrangement for health care and other social programs in the next renegotiation of federal-provincial fiscal transfer agreements. The Regroupement des jeunes chambres de commerce du Québec supported the elimination of the budget deficit and the creation of a debt repayment plan. Like the Canadian Convenience Stores Association and the Retail Council of Canada, the Canadian Restaurant and Foodservices Association was concerned with transactions fees paid by small businesses. It supported making the voluntary code of conduct for Canada’s credit and debit card industry mandatory in order to bring merchant fees charged by credit card companies in line with those currently being charged in the European Union; it indicated that, at this time, it is satisfied with Canada’s debit card regime. The Canadian Restaurant and Foodservices Association also stated that, following the Competition Tribunal’s decision to dismiss the case of Commissioner of Competition v. Visa Canada Corporation and MasterCard International Incorporated, the government should implement legislation that would determine how merchant fees should be imposed. Regarding tax incentives to encourage business succession, the Regroupement des jeunes chambres de commerce du Québec highlighted the Home Buyers’ Plan and suggested the creation of a similar program for the purchase of small or medium-sized Canadian businesses. Like the Conféderation des syndicats nationaux, the Regroupement des jeunes chambres de commerce du Quebec highlighted that “workers’ capital funds” benefit the economy, and requested that the Labour Sponsored Venture Capital Corporations Tax Credit be maintained. Northam Brands Ltd. noted that excise tax is imposed on domestically produced apple cider if the cider contains imported flavourings; it requested a temporary tax exemption for such ciders to facilitate the development of a domestic supply of apple concentrate. Regarding assistance for advanced manufacturing, Canadian Manufacturers & Exporters requested the expansion of existing federal sector-specific programs to include all sectors and regions in Canada. It also suggested the creation of a $150 million capital investment fund to aid in the development, expansion or upgrading of production facilities. In noting that the United States is becoming more energy self-sufficient, the Canadian Association of Petroleum Producers argued that the government should promote Canada as a reliable, innovative and well-regulated supplier of energy. Regarding capital investment in new machinery, such as diesel-powered mobile construction equipment, the Canadian Construction Association asked that the capital cost allowance (CCA) rate for Class 38 be increased to 25% on a straight-line basis to match the rate that the United States applies on similar equipment. More generally, Canadian Manufacturers & Exporters urged the government to review CCA rates for all classes of assets with a view to harmonization with the rates in the United States for similar assets. It also called for the temporary accelerated CCA rate for machinery and equipment to be made permanent. In speaking about international and domestic investment in the Canadian upstream petroleum sector, the Canadian Association of Petroleum Producers argued for competitive tax and regulatory systems in Canada, including the recognition of liquefied natural gas facilities as manufacturing and processing for tax purposes. It also supported better and more timely implementation of regulations under the Canadian Environmental Assessment Act, the Species at Risk Act, the Fisheries Act and the Oceans Act. In relation to increased Canadian exports, Unifor suggested that the government should develop strategies to expand investment, innovation, production and exports in strategic sectors; these strategies could be similar to those in countries such as Germany, Israel and Korea. D. The Committee’s RecommendationsThe Committee recommends: 1. That the federal government, acknowledging the current fiscal situation, restrict new spending commitments in the upcoming budget and continue to reject new costly and irresponsible spending. 2. That the federal government remain focused on its plan to return to balanced budgets in 2015. 3. That the federal government introduce balanced budget legislation that will allow the government to meet the commitment to a balanced budget while simultaneously restraining spending. 4. That the federal government reaffirm its already strong commitment to keep taxes low and to not impose new taxes on Canadians, especially any form of a carbon tax that would harm key sectors of the economy while passing the costs on to Canadian families. At the same time, the government should continue to ensure a competitive tax system to promote job creation and attract new investments, including through a continued commitment to small businesses and ensuring competitive personal income tax rates. 5. That the federal government continue to review public sector compensation and benefits to ensure their ongoing financial sustainability, and to align them more closely and make them more competitive with other public- and private-sector employers. 6. That the federal government and the Bank of Canada continue to support the current inflation-targeting framework. 7. That the federal government explore ways to simplify the Income Tax Act to reduce the complexity and inefficiency of its administration. Additionally, the government should ensure the timely assessment of income tax returns and explore the possibility of permitting consolidated reporting. These actions should be taken to ease the burden on Canadian taxpayers. 8. That the federal government undertake a comprehensive review of the tax system and ensure its fairness, as well as its neutrality, by continuing to close tax loopholes that allow select taxpayers to avoid paying their fair share of tax. As well, the government should examine additional ways to better equip the Canada Revenue Agency to combat tax evasion while working collaboratively with law enforcement agencies to prosecute tax evaders. 9. That the federal government remain vigilant in examining ways to improve Canada’s international tax competitiveness, including through the continued implementation of the recommendations of the Advisory Panel on Canada's System of International Taxation. 10. That the federal government continue to build upon the positive work that the Venture Capital Plan is doing to enhance Canada’s venture capital system. 11. That the federal government continue to pursue its aggressive trade agenda, including through continued pursuit of free trade agreements like the Canada–European Union Comprehensive Economic and Trade Agreement and the conclusion of tax treaties with foreign governments, to help eliminate barriers for Canadian goods and services in new export markets. 12. That the federal government continue to encourage provinces and territories to eliminate internal barriers to trade and mobility within Canada. 13. That the federal government continually review all relevant legislation and regulations to ensure the safety and security of the financial sector, thereby maintaining Canada’s standing as having the soundest banking system in the world. At the same time, the government should continue to explore ways to better protect consumers of financial sector products and services. 14. That the federal government further enhance the neutrality of the tax system by eliminating unnecessary fossil fuel subsidies, in line with Canada’s commitment to the Group of Twenty nations. 15. That the federal government investigate the cost and feasibility of expanding the accelerated capital cost allowance to encourage the construction of domestic infrastructure in relation to downstream activities in the oil and gas sector, such as transportation, refining and upgrading, and projects like the Kitimat Clean Refinery. As well, the government should encourage and support the development of infrastructure in relation to liquefied natural gas exports. 16. That the federal government work with the private sector to help Canadian businesses strengthen and grow, create jobs and improve exports. |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||