FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

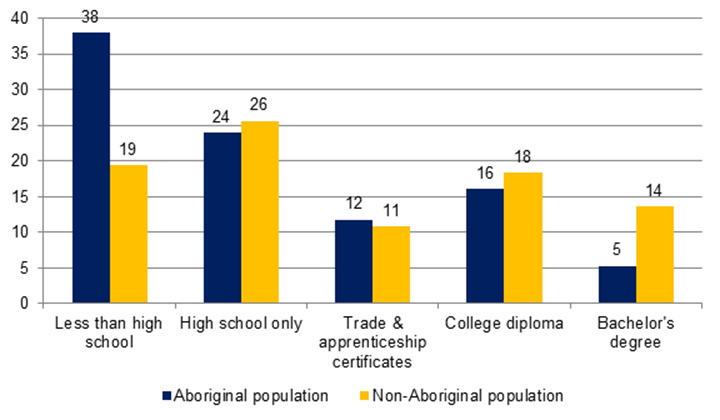

CHAPTER THREE: HELPING VULNERABLE CANADIANSIn Canada, there is a long history of helping individuals who experience social and/or economic challenges to reach their full potential in their lives, families, workplaces and communities. For example, Aboriginal people, beneficiaries of charities, children, youth and students, disabled persons, those with low income, seniors and women receive assistance from a variety of sources. In this context, the Committee invited selected witnesses to speak about the federal actions that should be taken to address the challenges faced by vulnerable Canadians. A. Background1. Aboriginal peopleAccording to the 2011 National Household Survey (NHS), there were 1,400,685 Aboriginal people in Canada at the time of the survey, representing 4.3% of the total Canadian population. Of the total Aboriginal population, 60.8% were First Nations, 32.3% were Métis, 4.2% were Inuit and 1.9% reported other Aboriginal identities. Overall, Canada’s Aboriginal population is younger and is growing faster than the non-Aboriginal population. The median age for Aboriginal people in 2011 was 27 years, 13 years lower than for non-Aboriginal Canadians. In that year, Aboriginal children aged 14 and younger made up 28% of the total Aboriginal population and 7% of all children in Canada. The Aboriginal population is increasingly urban, with a sizeable presence in Canada’s western provinces. As of 2012, 66% of registered Indians on-reserve lived in rural, special access or remote zones; 34% lived in urban zones. The NHS also found that less than one half of First Nations children lived with both parents at the time of the survey. NHS data show that, in Canada, educational attainment is lower for the Aboriginal population than for the non-Aboriginal population. As shown in Figure 4, the proportion of Aboriginal people without a high school diploma was 19 percentage points higher than for non-Aboriginal people at the time of the survey; the differences between the two populations were much lower in relation to three categories: a high school diploma, a trade and apprenticeship certificate, and a college diploma. Figure 4 — Educational Attainment, by Aboriginal and Non-Aboriginal Population, Canada, 2011 (%)

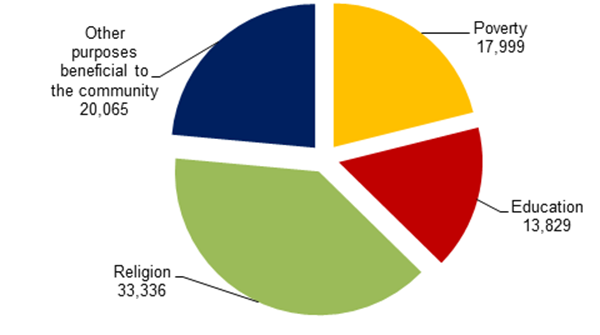

Source: Figure prepared using information obtained from: Statistics Canada, 2011 National Household Survey. The federal government exercises exclusive legislative authority over “Indians and Lands reserved for the Indians” by virtue of subsection 91(24) of the Constitution Act, 1867. This authority is exercised primarily in relation to the on-reserve registered (status) Indian population and, to a lesser extent, Inuit residing in their traditional homelands. Parliament approves appropriations for the Department of Aboriginal Affairs and Northern Development to support the provision of basic provincial-type services directed primarily to on-reserve First Nations communities. Education, health, housing, social assistance, and capital facilities and maintenance — such as schools and water treatment plants — comprise the basic core services for which funding is provided. The status of the Métis and the non-registered Indian population under subsection 91(24) remains yet to be clarified legally. The federal government maintains that it does not have exclusive responsibility for these groups, and that its financial responsibilities for these groups are therefore limited. 2. Beneficiaries of charitiesCharities play an important role in helping vulnerable Canadians, with a number of Canadians relying — to at least some extent — on charities for services previously provided by the various levels of government. Registered charities can be organizations, public foundations or private foundations, and their purposes include poverty reduction, education and religion, as shown in Figure 5. Figure 5 — Number of Registered Charities, by Type, Canada, 2009

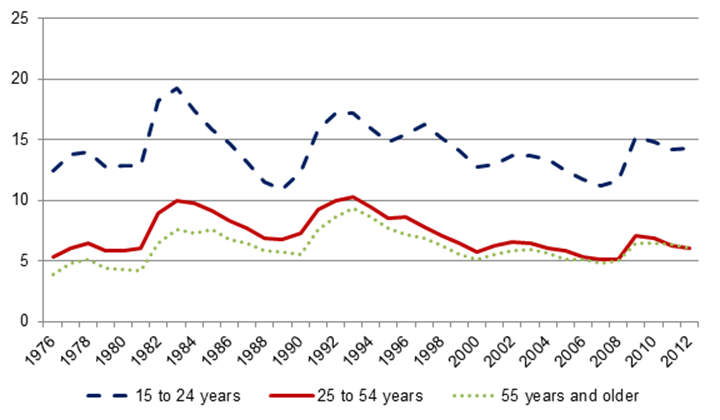

Source: Figure prepared using information obtained from: Canada Revenue Agency, Facts and Figures on the work of the Charities Directorate in 2009-2010, September 2010. The federal government supports charities in a variety of ways, including indirectly through tax incentives for corporations and individuals to make donations to registered charities and certain other organizations. In particular, donations may qualify for the Charitable Donations Tax Deduction, if made by a corporation, or for the non-refundable Charitable Donations Tax Credit, if made by an individual. Starting in the 2013 taxation year and extending until the 2017 taxation year inclusively, the First-Time Donor’s Super Credit will be available to individuals who have not claimed the Charitable Donations Tax Credit in any of the five preceding taxation years. 3. Children, youth and studentsAlthough Canada’s population is aging, children, youth and students represent a significant proportion of the population. According to Statistics Canada, the population aged 0 to 24 years represented 10.3 million individuals, or about 29.4% of the total population, in 2012. These individuals, who are the nation’s future, face a number of challenges, including child poverty, youth unemployment and student indebtedness. The federal tax system has several measures directed to families with children, including the Canada Child Tax Benefit (CCTB), the National Child Benefit Supplement (NCBS) for low-income families receiving the CCTB, the Universal Child Care Benefit, the child care expenses deduction, the amount for children born in 1995 or later, the children's fitness amount, and the Children's Arts Tax Credit. As well, Children’s Special Allowances are paid to federal and provincial agencies and institutions that care for children. The federal government provides a number of employment-related supports to youth aged 15 to 24; as shown in Figure 6, in 2012, this group had an unemployment rate that was more than double the rate for adults older than 25 years of age. Federal supports include a job bank and the Youth Employment Strategy; the latter measure helps young people to obtain the information, as well as the skills, work experiences and abilities, needed to make a successful transition into the labour market. Figure 6 — Unemployment Rate, by Age Group, Canada, 1976–2012 (%)

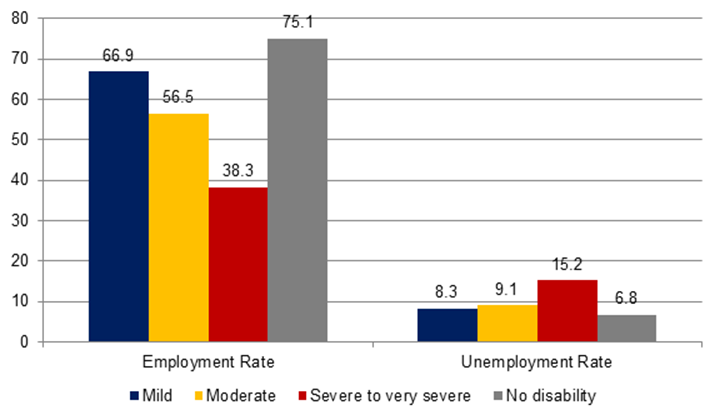

Source: Figure prepared using information obtained from: Statistics Canada, Table 282-0002, “Labour force survey estimates (LFS), by sex and detailed age group” accessed 8 November 2013. Students also receive federal support. For example, the Canada Student Loans Program (CSLP) is available to students qualifying for provincial student loans, and these loans may be supplemented by a variety of grants, including: for students from middle-income families, for students from low-income families, for students with dependents, and for part-time students with and without dependents. Federal tax support also occurs, such as through the scholarship exemption, the tuition tax credit, and the education and textbook tax credits. Finally, federal employment-related supports for post-secondary students include the Federal Student Work Experience Program, which is a work experience program that tries to match students to temporary jobs in federal departments and agencies, and the Summer Work Experience Program, which provides subsidies to employers for the creation of career-related jobs for students having difficulties finding summer jobs. 4. Disabled personsPeople with disabilities may face a number of barriers to their full participation in society, including in educational endeavours and in the labour market. According to The Government of Canada’s Annual Report on Disability Issues that was released in 2010, disabled persons may be limited in the amount of work that they can do in the workplace, or they may require workplace modifications or flexible working arrangements. As well, they may face discrimination and social exclusion. As shown in Figure 7, adults with disabilities — including those with mild disabilities — had lower employment rates than people without disabilities in 2006. Moreover, at that time, the unemployment rates for those with a disability were higher than the rate for people without a disability, and the unemployment rate rose with the severity of disability. Figure 7 — Employment and Unemployment Rates, by Severity of Disability, Canada, 2006 (%)

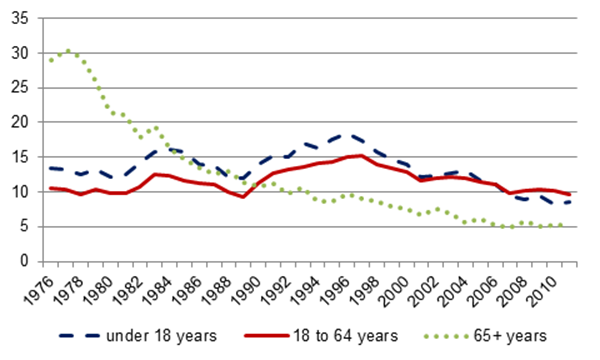

Source: Figure prepared using information obtained from: Statistics Canada, 2006 Participation and Activity Limitation Survey. The year 2006 is the latest year for which data are available. With access to disability supports essentially falling under the jurisdiction of the provinces/territories as part of their responsibilities in relation to health care, education and community services, the federal government provides financial assistance through the CHT and the Canada Social Transfer (CST). As well, the federal government is directly responsible for disability supports for First Nations and Inuit people, as well as for veterans and members of the Canadian Forces. Federal tax measures are also available for persons with disabilities and/or for their families and informal caregivers. These measures include registered disability savings plans, the non-refundable disability tax credit, the deduction for medical expenses, the caregiver amount, the family caregiver amount, the infirm dependant deduction, the refundable medical expense supplement, the disability supports deduction, and the Child Disability Benefit. In addition, the federal government provides assistance through Canada Disability Savings Grants and Bonds, and through funding to a number of programs aimed at increasing the employment of people with disabilities; these programs include Labour Market Agreements for Persons with Disabilities, the Opportunities Fund for Persons with Disabilities, the Enabling Accessibility Fund and the Entrepreneurs with Disabilities Program. Students with disabilities may be eligible for grants of two types: for students with permanent disabilities, and for services and equipment for persons with a permanent disability. 5. Those with low incomeCanadians who have low income may experience a range of difficulties. For example, children living in low-income families may find it more difficult to learn because of inadequate nutrition, adults may face housing challenges, and seniors with insufficient income in retirement may be unable to afford adequate health care. As shown in Figure 8, the percentages of children and working-age adults living in low-income families have been declining since the late 1990s, reaching 8.5% and 9.7% respectively in 2011. Since 1976, the percentage of seniors living in low-income families has been decreasing steadily, and has been the lowest of all three age groups since 1990; in 2011, the rate was 5.2%. Figure 8 — Percentage of the Population Living in Low-Income Families, by Age Group, Canada, 1976–2011 (%)

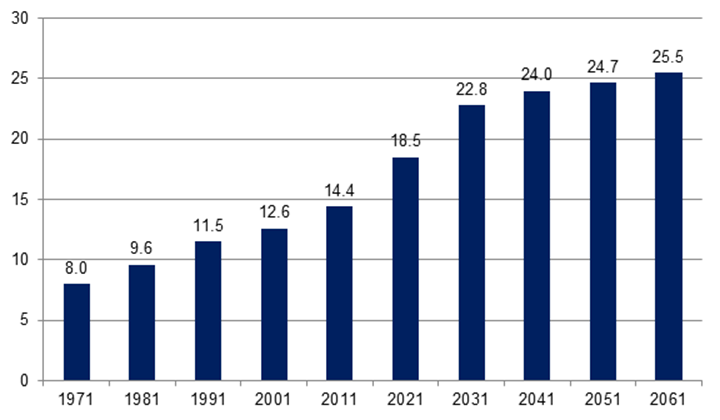

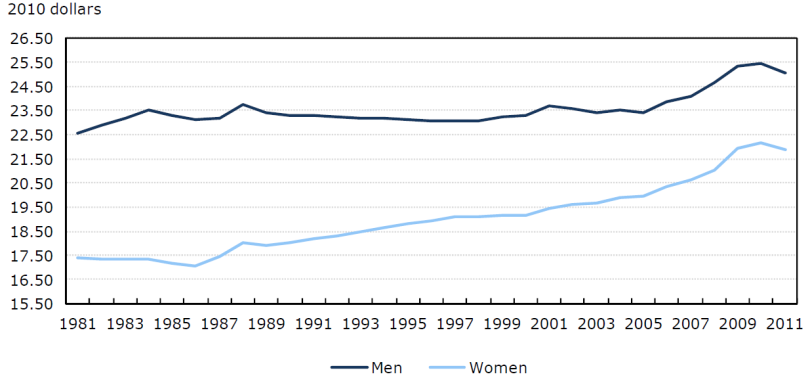

Note: The measure of low income is the low income cut-off, or LICO, which varies by family and community size. The LICO represents the estimated income threshold below which a family spends 20 percentage points more of its income on food, clothing and shelter than the average family. Source: Figure prepared using information obtained from: Statistics Canada, Table 202-0802, “Persons in low income families,” accessed 18 October 2013. The federal government supports those living in low-income families through a variety of tax and direct support measures. For example, in addition to the CCTB and the NCBS mentioned earlier, individuals with low and modest incomes may be eligible for the refundable Goods and Services Tax/Harmonized Sales Tax credit, and working Canadians with low income may be eligible for the refundable Working Income Tax Benefit (WITB). As noted below, the government supports low-income seniors through the Guaranteed Income Supplement (GIS). 6. SeniorsThe Canadian population has been aging for a number of decades and, in 2011, the proportion of seniors in the population reached 14.4%. According to projections by Employment and Social Development Canada and as shown in Figure 9, this proportion will reach 25.5% in 2061, mainly as a consequence of low fertility rates, an increase in life expectancy, and the aging of the baby boom generation. Figure 9 — Population 65 Years of Age and Older, Canada, 1971–2061 (%)

Note: 1971–2011 data are historical; 2012–2061 data are projections. Source: Figure prepared using information obtained from: Employment and Social Development Canada, Indicators of Well-Being — Aging Population, accessed 8 November 2013. This demographic shift may lead to fiscal challenges for Canada. Unless the rate of productivity growth increases relatively substantially in the future, the aging of the population is expected to result in slower real GDP growth over the coming decades and, consequently, in a slower rate of growth in the tax base available to the government. At the same time, an aging population may require greater spending on health care and income support for seniors. The Canada Pension Plan provides retirement and various other types of benefits. For example, the CPP retirement pension is a monthly payment available to CPP contributors as early as 60 years of age, the disability benefit is paid monthly to qualified CPP contributors and their dependent child(ren), survivor benefits are paid to a deceased contributor’s estate, surviving spouse or common-law partner and dependent child(ren), and the death benefit provides a one-time payment to, or on behalf of, the estate of a deceased contributor. The federal government supports seniors through a number of programs and tax measures. For example, direct support is provided through Old Age Security. Moreover, retirees who have low income, and certain low-income spouses or partners, may be eligible to receive the GIS and the Allowance respectively. Finally, an Allowance for the Survivor is also available to certain low-income seniors. Federal tax measures are available as incentives for people to save for retirement. For example, contributions to RRSPs and registered pension plans are tax-deductible. As well, tax measures are available once individuals reach the age of retirement, including pension income splitting, the pension income amount and the age amount. 7. WomenWomen’s economic circumstances are influenced by a wide range of factors, including employment status, age, level of education, geographic location, and family status and responsibilities, among others. Certain groups of women, including those who are Aboriginal, immigrants, seniors and/or disabled, may be more vulnerable to economic insecurity than the female population as a whole. The difference between the average real hourly wages of men and women who are employed full-time has narrowed significantly since the early 1980s, as shown in Figure 10. According to Statistics Canada, from 1981 to 2011, average real hourly wages for men grew by 11%, while those for women increased by 26%. This narrowing is thought to reflect the growing propensity of women to obtain higher education, remain in their jobs longer and work in high-paying occupations; job tenure, occupation and union status have also been contributing factors. Figure 10 — Average Real Hourly Wages of Men and Women Employed Full-Time, Canada, 1981–2011 (2010 dollars)

Source: Figure prepared using information obtained from: Statistics Canada, The Evolution of Canadian Wages over the Last Three Decades, 2013, p. 14. Federally, Status of Women Canada (SWC) is responsible for promoting equality for women and their full participation in the economic, social and democratic life of Canada. In achieving that goal, SWC offers strategic policy advice and gender-based analysis support, administers the Women’s Program, and promotes commemorative dates relating to women in Canada. B. Changes Proposed by Witnesses Invited to Address “Helping Vulnerable Canadians”In speaking to the Committee about helping vulnerable Canadians, the witnesses invited to address this topic commented on Aboriginal people, beneficiaries of charities, children, youth and students, disabled persons, those with low income, seniors and women. 1. Aboriginal peopleAccording to the Whispering Pines Clinton Indian Band, as the Indian Act’s prohibition on holding legal title to real property situated on a reserve has greatly impaired opportunities for development on reserves, the federal government should follow through on its commitment to introduce legislation in relation to First Nations ownership of real property situated on a reserve. In focusing on the importance of education and First Nations-led initiatives, the Assembly of First Nations advocated predictable and stable funding for such initiatives, and urged the development — in collaboration with First Nations — of a new statutory funding formula to replace the 2% funding cap; in its view, the formula should take into account various factors, including inflation, demographic changes and socio-economic disparities. 2. Beneficiaries of charitiesImagine Canada explained that charities have difficulties accessing federal resources to help them deal with certain difficulties; it urged the government to work toward eliminating obstacles in order to ensure that charities can access federal business support resources. In addition, it requested that a date for implementation of a “stretch tax credit” for charitable giving be announced. 3. Children, youth and studentsAccording to ParticipACTION, annual federal funding of $5 million would support the continuation of the organization’s activities aimed at promoting sports and physical activity for children and youth, including those with a disability and those living in urban, rural and Aboriginal communities. Kathleen A. Lahey, who is with Queen’s University and appeared as an individual, suggested that the government could redirect resources that are currently devoted to various child care programs and other initiatives in order to fund a national child care program as a way to accelerate and improve child development while providing opportunities for parents to return to the labour market. The Canadian Alliance of Student Associations asked that the CSLP be changed to: increase the weekly loan limit; add an exemption in relation to personally held financial assets; raise the exemption for RRSPs to the average annual RRSP contribution made by Canadians; and exempt the value of a student’s automobile and all income earned while studying in determining the amount of a loan. The Fédération Étudiante Universitaire du Québec suggested that the amount that can be claimed under the tuition and textbook tax credits should be reduced, with the resulting federal fiscal amount invested in the CST. 4. Disabled personsIn order to allow people with print disabilities to access materials in an alternative format through public libraries and to improve their educational opportunities, the Canadian National Institute for the Blind proposed that the federal government renew its commitment to the national digital hub initiative by providing $9.63 million over the next three years to facilitate the implementation of the initiative in public libraries across Canada, assist the initiative in improving service delivery, and enable an increase in the quantity of materials in alternative formats that the initiative provides. It also suggested that the government could redirect part of the $11 million in funding to cover mailing costs under the Literature for the Blind program to help accelerate the transition to digital distribution under the initiative. Special Olympics Canada requested additional funding over a four-year period to allow it to assist more athletes, develop a strategy to reduce barriers to participation in sport, organize larger national games, improve volunteer recruiting efforts, and undertake research and promotion activities. 5. Those with low incomeThe Canadian Nurses Association identified affordable and adequate housing as a key determinant in health outcomes, and requested renewal of the $2.7 billion in federal funding currently directed to social housing. In an effort to improve access to care for patients, especially those in financial difficulty, seniors and disabled, it proposed that nurse practitioners be authorized to sign claim forms for federally administered programs, and that the Food and Drugs Act be amended to allow nurse practitioners to distribute samples of drugs to patients. Finally, the Canadian Nurses Association highlighted the need for the government to enter into a new agreement with the provinces in respect of the CHT, and to maintain the annual growth rate in the amount of the CHT at 6%. Ms. Lahey suggested that many non-refundable tax credits should be made refundable or changed into grants, as more low-income individuals would then be able to claim them. 6. SeniorsWith the aging of the population and the significant increase in expected health care costs, the Canadian Medical Association called on the federal government to collaborate with other levels of government in the development of a national strategy for health care for seniors. According to it, such a strategy should integrate home care, long-term care and palliative care; investments to address shortages in long-term and home care would also be required under this strategy. Furthermore, the Canadian Medical Association requested funding of $25 million over five years for the implementation of a national Alzheimer strategy. The Canadian Nurses Association also commented on health care for seniors, proposing the creation of a 10-year commission that would develop a strategy with three main goals: promote the health and well-being of seniors; increase support for chronic disease prevention and management efforts; and increase capacity for certain issues, such as dementia and end-of-life care. It also highlighted the need to create a health innovation fund that would implement the commission’s recommendations and invest in health infrastructure. 7. WomenMs. Lahey proposed the elimination of all tax incentives that provide benefits to individuals with a dependent spouse or partner, as she believes that such measures encourage women to leave the labour force. Although she advised against the adoption of income splitting for two-parent families, Ms. Lahey said that — if implemented — the measure should be made refundable and phased out as income reaches a certain threshold. She also highlighted the need to ensure equal employment rights and equal access to Employment Insurance (EI) benefits for men and women. C. Changes Proposed by Witnesses Invited to Address Issues Other Than “Helping Vulnerable Canadians”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. Fiscal Sustainability and Economic Growth WitnessesThe Investment Industry Association of Canada and Financial Executives International Canada focused on seniors through their proposals about pensions and retirement. The Investment Industry Association of Canada suggested that group RRSPs should be treated in the same manner as defined benefit and defined contribution pension plans with respect to Canada Pension Plan (CPP) contributions and EI premiums; with implementation of this proposal, employers would have a incentive to offer such plans, as they would not be required to pay these contributions and premiums in respect of the amounts contributed by them to group RRSPs. Financial Executives International Canada urged the federal government to develop a national framework for retirement planning and retirement income; in its view, the framework could include expanding the CPP to allow additional voluntary contributions by employees. 2. Prosperous and Secure Rural and Urban Communities WitnessesDavid Hulchanski, who is with the University of Toronto and appeared as an individual, spoke about low-income Canadians and income polarization, and advised against three specific changes: a doubling of the TFSA contribution limit; the introduction of income splitting; and an expansion of the Temporary Foreign Worker Program in large urban centres. To assist low-income Canadians, he proposed: enhancing the CPP, the EI program and the WITB; introducing a national care agenda, including for child care and elder care; creating a national anti-poverty strategy in collaboration with provinces and territories; and strengthening labour laws. 3. Government Efficiency WitnessesIn order to ensure adequate amounts of income for Canadians in their retirement years, the Canadian Union of Public Employees advocated an increase in CPP contribution and benefit rates. 4. Employment Opportunities for Canadians WitnessesLike the Canadian Union of Public Employees, the Canadian Labour Congress suggested a phased-in, fully funded increase in CPP retirement benefits. In speaking about the indebtedness of Canadian households, the Institut de recherche et d'informations socio-économiques stated that the decline in EI coverage has contributed to increased credit card debt by consumers. D. The Committee’s RecommendationsThe Committee recommends: 17. That the federal government reaffirm its commitment, as it seeks to return to budgetary balance, not to reduce transfers to persons, including those for seniors, children and the unemployed, or transfers to other levels of government in support of health care and social services, equalization and the gas tax transfer to municipalities. 18. That the federal government continue to identify ways to increase the labour market and economic participation of vulnerable Canadians, including youth, Aboriginal Canadians, and persons with a disability. Specifically, the government should actively explore proven programs to help these Canadians fill the skilled job shortages and address our shared priority of improving First Nations educational outcomes. 19. That the federal government move forward with a First Nations property ownership act in order to provide Aboriginal Canadians with the same property rights as other Canadians. 20. That the federal government continue to work with the provinces to implement Pooled Registered Pension Plans. 21. That the federal government explore the feasibility and cost of exempting additional in-study income from the Canada Student Loans Program’s assessment of borrowers’ assets. 22. That the federal government continue to improve health research for the health care sector and health professions to further improve health care delivery for patients and reduce costs through improved efficiency. For example, consideration should be given to the development of pan-Canadian health indicators and the promotion of best practices, such as the innovative work that is being done at the Sunnybrook Health Sciences Centre. 23. That the federal government continue to explore innovative ideas for greater charitable giving by Canadians, such as a stretch tax credit, building upon positive initiatives like the First-Time Donor’s Super Credit. 24. That as Canada is one of four Group of Seven countries without a national dementia and Alzheimer’s strategy, the federal government move expeditiously on the creation and implementation of such a strategy. 25. That the federal government heed the call of numerous Canadian charities and allow these charities to use computers in their fundraising lotteries, a measure which would save them millions of dollars while costing the taxpayer nothing. |