FINA Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

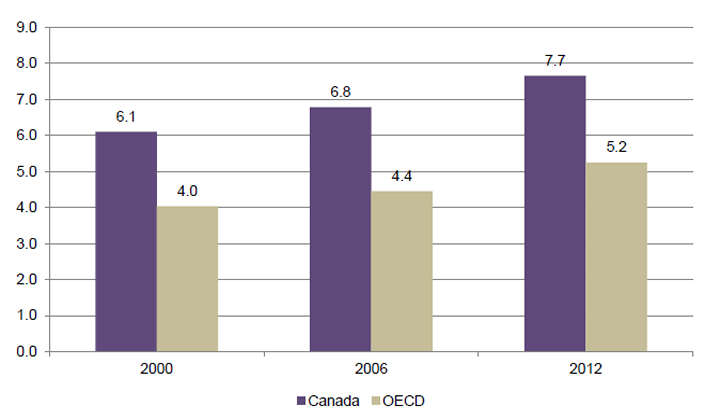

CHAPTER THREE: SUPPORTING FAMILIES AND HELPING VULNERABLE CANADIANS BY FOCUSING ON HEALTH, EDUCATION AND TRAININGA. Background1. HealthAccording to the Canadian Institute for Health Information, Canada consistently ranks near or above peer countries on a range of quality of health care indicators. Relative to an average of 21 member countries of the Organisation for Economic Co-operation and Development (OECD), from 2010 to 2012, Canada performed better in terms of avoidable hospital admissions, as well as cancer screening and survival; that said, the Canadian incidence of trauma related to child delivery and in-hospital fatalities due to stroke tended to be relatively higher. As shown in Figure 3, public-sector health spending by all governments in Canada represented 7.7% of gross domestic product (GDP) – or $13.9 billion – in 2012, up from 6.1% in 2000. As a share of GDP, this spending was consistently higher in Canada than was the case for the average of OECD countries from 2000 to 2012, with the gap between Canada and the OECD average growing by about 0.4 percentage points over the period. Figure 3 – Public-Sector Health Spending by All Governments as a Percentage of Gross Domestic Product, Canada and the Average for OECD Countries, 2000, 2006 and 2012 (%)

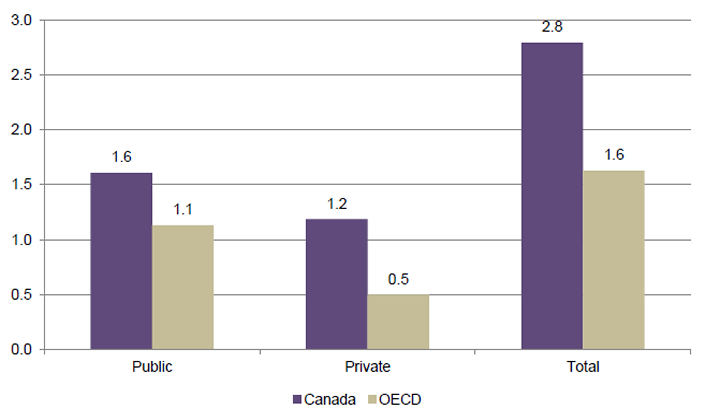

The OECD average is based on the latest data available in each country. The latest data for Australia, New Zealand, Portugal and Spain is 2011, and for the Netherlands is 2002. Source: Figure prepared using information from: Organisation for Economic Co-operation and Development, OECD Health Statistics 2014. Although Canada’s provincial/territorial governments have primary jurisdiction over health care, the federal government provides indirect support in this area through transfer payments to provincial/territorial governments – including the Canada Health Transfer – and through a range of tax measures for individuals – including the Disability Tax Credit, the non-refundable tax credit for medical expenses, the refundable medical expense supplement, the caregiver tax credit, the tax credit for infirm dependants aged 18 or older, the family caregiver tax credit, the spouse or common-law partner amount, and the amount for children under 18 years of age. As well, the federal government provides direct support for health research, surveillance and the development of health information technology. It also funds grants and contributions to individuals and organizations to facilitate their participation in a variety of activities, such as health promotion, health protection, disease prevention and health research. Finally, the federal government delivers health care to specific groups of people within its jurisdiction, most notably to First Nations people on reserve, Inuit people, members of the Canadian Armed Forces and their families, and inmates of federal penitentiaries. 2. Education and TrainingAccording to the OECD’s Education at a Glance 2014, Canada has one of the most highly educated populations in the world. In 2012, 53% of adults aged 25 to 64 had attained a tertiary level of education, compared to the OECD average of 32%. However, over the 2000 to 2012 period, growth in those attaining a tertiary level of education in Canada did not keep pace with the average of OECD countries; the 2.4% average annual growth rate for Canadian adults was lower than the OECD average of 3.2%. For all forms of post-secondary education, which is tertiary education plus vocational training and apprenticeship programs, Statistics Canada reported that, as of 2011, almost two-thirds of Canadian adults held post-secondary education qualifications. Figure 4 shows that, in 2011, spending on tertiary education in Canada was higher than the OECD average. As well, the private share of funding at the tertiary level, at 42.5% in that year, was above the OECD average of 30.6%. Canada is among the countries with the highest tuition fees, although governments in Canada provide students with financial assistance. According to the OECD, educational support provided by governments to households and other private entities – i.e., charitable organizations, private businesses and business associations – represented 0.38% of GDP in Canada in 2010, compared to the OECD average of 0.31%; 2010 is the latest year for which estimates are available. Figure 4 – Spending on Tertiary Education as a Percentage of Gross Domestic Product, by Source of Financing, Canada and the Average for OECD Countries, 2011 (%)

Source: Figure prepared using information from: Organisation for Economic Co-operation and Development, Education at a Glance 2014: OECD Indicators, Table B2.3, “Expenditure on educational institutions as a percentage of GDP, by source of fund and level of education (2011).” Although Canada’s provincial/territorial governments have primary jurisdiction over post-secondary education and training, the federal government provides indirect support in this area through the Canada Social Transfer to provinces/territories, and through tax measures for individuals – including the education amount, a non-refundable tax credit for eligible tuition fees, the textbook amount, a non-refundable tax credit for interest paid on student loans, a deduction for tools for tradespersons and apprentice mechanics, and a tax exemption for scholarships. The federal government also supports students, mainly through the Canada Student Loans Program, and provides grants to apprentices – including through the Apprenticeship Incentive Grant and the Apprenticeship Completion Grant – and to students from low- and middle-income families, students with dependants, part-time students and students with a permanent disability. Other grants include the Canada Education Savings Grant, the Additional Canada Education Savings Grant and the Canada Learning Bond, which are linked to a registered education savings plan. B. Changes Proposed by Witnesses Invited to Address “Supporting Families and Helping Vulnerable Canadians by Focusing on Health, Education and Training”In speaking to the Committee about supporting families and helping vulnerable Canadians by focusing on health, education and training, witnesses commented on a range of issues. In relation to health, they focused on caregiving, a number of specific disorders, management and accountability, the health needs of Aboriginal people, and other health-related issues. Regarding education and training, they mentioned financial and other support for students and educational institutions, the education and training needs of Aboriginal people, and supporting education for people with a visual disability through alternative format materials. 1. Healtha. CaregivingCanadian Doctors for Medicare and the Canadian Medical Association suggested that the government invest in a national strategy for seniors through which integrated care services would be provided for home care, hospitals, hospices and long-term care facilities. In its brief, the Canadian Medical Association proposed that the $2.3 billion in annual savings that would occur through improvements to the integration of services across health care sectors be reallocated to continuing care infrastructure; this funding would leverage provincial/territorial investments in the construction, renovation and retrofitting of assisted living units, other innovative residential models and long-term care facilities. To support the health care needs of low-income families, Neurological Health Charities Canada and the Canadian Medical Association encouraged the government to introduce refundability for the caregiver tax credits. As well, the Neurological Health Charities Canada’s brief outlined its support in relation to enhancing the Compassionate Care Benefit provided through the Employment Insurance program. In particular, the brief advocated an increase in the benefit period, broader eligibility criteria, elimination of the mandatory waiting period, and extended eligibility to include caregivers who support those with a chronic or episodic medical condition. The Canadian Foundation for Healthcare Improvement’s brief requested funding of $10 million annually for five years to continue its work on facilitating innovation in all health care sectors – including hospitals, long-term care facilities and health regions – and the integration of caregiving across these sectors. b. Neurological, Cardiovascular, Eating and Mental Health DisordersIn its brief, the Alzheimer Society of Canada asked for funding of $150 million over five years to allow it to collaborate with the Heart and Stroke Foundation of Canada in the creation of a national dementia plan; the plan would facilitate early diagnosis and access to treatment and support, accelerate dementia research, and promote equal access to health care and services across Canada. The Neurological Health Charities Canada’s brief requested funding of about $65.8 million to enable partnerships with the government for two purposes: to address key knowledge gaps identified in the National Population Health Study of Neurological Conditions; and to enhance the Canadian Longitudinal Study on Aging to enable new diagnostic measures, better data analysis and the development of a multi-generational research study. With a view to fostering innovation, promoting accelerated discovery, and improving efficiency in the application of new cures and disease-modifying treatments, the Heart and Stroke Foundation of Canada, the Sunnybrook Health Sciences Centre and the Alzheimer Society of Canada’s brief advocated annual funding of $30 million for enhanced collaboration among researchers and health specialists. The National Initiative for Eating Disorders noted that, to reduce the incidence of eating disorders, family doctors need training on appropriate screening methods, and mental health nurses and health care counsellors need to provide guidance to youth within high schools. As well, in its brief, the National Initiative for Eating Disorders requested funding of $3 million over five years to develop a data collection framework for eating disorders, and to eventually create an action plan to address gaps in information in autism, neurological conditions and mental health in Canada. In its brief, Partners for Mental Health requested funding of $100 million over five years for a proposed national youth suicide prevention fund to facilitate collaboration among governments, the private sector, and volunteer and youth groups; matching funding of $100 million would be raised from other governments and/or the private or philanthropic sectors. c. Management and AccountabilityThe Canadian Medical Association’s brief proposed continued funding for the Canada Health Infoway to develop health information technology, and additional funding of $500 million for projects to improve the management of patient health care through the enhancement of electronic medical records. To address the long-term care needs of Canadians, the Canadian Medical Association proposed that federal transfers to the provinces/territories have enhanced accountability mechanisms to enable more direct monitoring of the manner in which this funding is used. In its view, such mechanisms are an alternative to enhanced transfer funding. Canadian Doctors for Medicare urged the government to develop two main initiatives: an accountability framework for the provinces/territories to regulate the extent to which clinics comply with the Canada Health Act in terms of user fees and extra billing; and a new health accord that would improve accountability and ensure standardization of health care across jurisdictions, and that would support the provincial-territorial initiative to develop a national pharmacare program. d. Health Needs of Aboriginal PeopleThe Assembly of First Nations urged the government to consider renewing its funding beyond 2014-2015 for a number of programs that support First Nations health, including the Health Services Integration Fund, the Aboriginal Health Human Resources Initiative, the Aboriginal Diabetes Initiative, maternal and child health, the Children's Oral Health Initiative, and the National Aboriginal Youth Suicide Prevention Strategy. More generally, it proposed the creation of new funding mechanisms that would replace contribution agreements with a fiscal mechanism that recognizes First Nations titles and rights, including a renegotiation of the 2% escalator established in 1996-1997 for federal financing to First Nations. According to the Assembly of First Nation’s brief, the government should develop a long-term strategy that provides increased funding for Health Canada’s Non-Insured Health Benefits program, and Aboriginal Affairs and Northern Development Canada’s Family Violence Prevention program, and restored funding for the Aboriginal Healing Foundation. To improve child protection and development, the Assembly of First Nation’s brief urged the government to take a variety of actions: enhance funding for the First Nations Child and Family Services program by adding $108 million to the program’s base funding and increasing that support by 3% annually; change Aboriginal Affairs and Northern Development Canada’s policy so that support is provided to First Nations agencies operating in reserve communities with fewer than 1,000 children; and enhance existing federal support for First Nations reserve communities in which more than 6% of children are in care. YWCA Canada encouraged the creation of a national action plan in relation to violence against women; the plan would set national standards for prevention, support services, legal services, and access to justice and social policies. In relation to Aboriginal women, and with the support of the Assembly of First Nations, it also asked the government to initiate a national inquiry and action plan on missing and murdered indigenous women. In relation to its partnership with Aboriginal organizations and communities to improve health for those with cardiovascular disease, the Heart and Stroke Foundation of Canada requested funding of $50 million to support locally based programs delivered within Aboriginal communities that aim to improve health for Aboriginal people. e. Other Health-related IssuesIn its brief, the Canadian Medical Association advocated an increase in incentives for tax-sheltered savings vehicles to help Canadians deal with rising out-of-pocket costs for health care; specific mention was made of Tax-Free Savings Accounts. As well, the brief proposed funding of $5 million annually to expand the New Horizons for Seniors Program to include initiatives that promote healthy aging activities for seniors. Hope Air requested an amendment to the Air Travellers Security Charge Act to ensure that the Air Travellers Security Charge is not levied on flights provided without charge by a registered charity to low-income Canadians travelling to required medical appointments. As well, it proposed that the charge also not apply to non-air ambulance flights purchased from an air carrier using charitable funds donated to Hope Air. The Centre for Drug Research and Development’s brief suggested that, in order to assist Canadian families with appropriate treatments and to help the Centre’s ongoing sustainability as a large-scale national endeavour, funding of $153 million is needed to support the Centre’s next five years of operation. 2. Education and Traininga. Financial and Other Support for Students and Educational InstitutionsIn its brief, the Canadian Alliance of Student Associations proposed a variety of changes to the Canada Student Loans Program, including: an increase in the loan limit; and, when assessing eligibility, an exemption for all income earned while studying and elimination of the parental contributions policy or, short of this change, inclusion of the real contributions that parents make to their child’s education. As well, the Canadian Alliance of Student Associations’ brief requested a 9.4% increase in the Canada Student Grants program’s funding to account for inflation since 2009, and an extension of the program to graduate students who have significant financial need. With a focus on reducing student debt, the Canadian Federation of Students’ brief suggested that the government eliminate current federal tax expenditures on education-related tax credits and support through the registered education savings plans, with the amount of such expenditures used to increase non-repayable grants to students through the Canada Student Grants program. To facilitate the transition from school to work for youth, Mitacs and the Association of Universities and Colleges of Canada urged an increase in funding for Mitacs research internships, particularly the Mitacs-Accelerate program. In an effort to increase accountability, and thereby facilitate long-term objectives regarding educational quality and affordability, the Canadian Federation of Students requested the implementation of a federal post-secondary education act that would be established in cooperation with the provinces; modeled on the Canada Health Act, it should include a dedicated transfer payment for post-secondary education. b. Education and Training Needs of Aboriginal PeopleDue to the potential increase in federal revenue resulting from the education and employment of Aboriginal people, Indspire and the Association of Universities and Colleges of Canada’s brief proposed that the 2013 federal budget’s commitment of $10 million over two years for the Building Brighter Futures: Bursaries and Scholarship Awards program be increased to meet the estimated need of $40 million annually, with 50% of this amount raised through Indspire’s efforts to attract private donations. To enhance access to – and success in – higher education for Aboriginal students, the Association of Universities and Colleges of Canada requested direct financial support for those students, as well as support for educational institutions – working with local communities – to ensure both increased access to education and training and successful transitions to work. Moreover, the Association of Universities and Colleges of Canada’s brief urged increased support for Aboriginal Affairs and Northern Development Canada’s Postsecondary Partnerships Program and the creation of 500 graduate scholarships for Aboriginal students. Similarly, the Canadian Federation of Students requested removal of the funding cap on increases to the Post-Secondary Student Support Program in order to reduce financial barriers and assist with the learning needs of Aboriginal people. The Assembly of First Nations indicated that it wants to work with the government to develop a new financial framework for education that provides predictable and sustainable transfer payments to First Nations schools. In its view, the framework should include implementation of the additional $1.9 billion in funding that was mentioned in the 2014 federal budget and renegotiation of the 2% escalator for federal funding that was established in 1996-1997. As well, the Assembly of First Nation’s brief urged new funding of $500 million annually for five years to support First Nations training and employment, and renewal of the Aboriginal Skills Employment and Training Strategy for an additional five years, including increased resources for essential skills and literacy training and for child care for young parents entering the workforce. c. Supporting Education for People with a Visual Disability through Alternative Format MaterialThe Canadian National Institute for the Blind requested funding of $3.25 million annually for the next three years to cover the cost of producing alternative format print materials, as this service is not eligible for public funding. It also proposed that existing annual funding for the Literature for the Blind program be reallocated to digital delivery of print material, which would allow Canadians who have difficulty reading standard print material to download accessible reading materials. C. Changes Proposed by Witnesses Invited to Address Topics Other Than “Supporting Families and Helping Vulnerable Canadians by Focusing on Health, Education and Training”The Committee’s witnesses were invited to speak about a particular topic. When they appeared, they often made comments about one of the other five topics selected by the Committee, as indicated below. 1. “Balancing the Federal Budget to Ensure Fiscal Sustainability and Economic Growth” WitnessesThe National Association of Federal Retirees and the Veterans Ombudsman proposed that the government address deficiencies in the New Veterans Charter. In particular, the Veterans Ombudsman urged implementation of the recommendations in the June 2014 report by the House of Commons Standing Committee on Veterans Affairs, entitled The New Veterans Charter: Moving Forward. In addition, the Veterans Ombudsman encouraged the government to consider measures that would help healthy veterans transition from military to civilian life, such as training programs – developed in collaboration with post-secondary education institutions – that would direct veterans to occupations in which there is a shortage of labour. Lastly, the Veterans Ombudsman proposed an increase in the amount of the Permanent Impairment Allowance and measures to make the allowance more accessible. To support research on the health of military personnel, veterans and their families, the National Association of Federal Retirees advocated funding of $1 million annually for five years for the Canadian Institute for Military and Veteran Health Research. With a focus on improving the income security of future retirees, the Canadian Union of Public Employees and the National Association of Federal Retirees proposed an expansion of the Canada Pension Plan. The Canadian Union of Public Employees also supported an increase in the amount of the Guaranteed Income Supplement, and cancellation of the change in the age of eligibility for this benefit and for the Old Age Security pension. The Canadian Union of Public Employees urged the government to negotiate a 10-year agreement with respect to the Canada Health Transfer; in its view, the agreement should include an annual escalator of at least 6%. It also advocated the creation of a national prescription medicine plan, a national community residential and home care program, and additional funding for community health care centres and clinics. Similarly, with a view to ensuring that Canadians have continuous access to medically necessary drugs, the National Association of Federal Retirees supported the development of a national home care strategy and a national pharmaceuticals strategy. The Canadian Union of Public Employees requested that the government, in collaboration with the provinces/territories and other stakeholders, develop a national early childhood education and care program. The Conference Board of Canada encouraged the government to invest in education and training as a means of supporting economic growth. The University of Ottawa’s Kevin Page supported improvements in the performance reporting of universities that are receiving funds from the Canada Social Transfer. In order to ensure that apprenticeship is perceived as a viable option for post-secondary education and to encourage more people to pursue trades as a career path, the Canadian Council of Chief Executives proposed that apprentices be awarded diplomas, rather than certificates or other types of degrees. 2. “Increasing the Competitiveness of Canadian Businesses Through Research, Development, Innovation and Commercialization” WitnessesIn its brief, Canada’s Research-Based Pharmaceutical Companies urged the government to implement the recommendations in the 2011 report by the Standing Senate Committee on Social Affairs, Science and Technology, entitled Canada’s Clinical Trial Infrastructure: A Prescription for Improved Access to New Medicines. In commenting that it has adequate resources to continue its activities until 2017, the Mental Health Commission of Canada called for funding that would allow it to pursue its activities until 2025. The Information Technology Association of Canada supported continuing investments in the Canada Health Infoway. Polytechnics Canada advocated the creation of a tax credit for employers that participate in Employment and Social Development Canada’s Red Seal Program and whose apprentices successfully complete the program and obtain a certification. 3. “Ensuring Prosperous and Secure Communities, Including Through Support for Infrastructure” WitnessesThe Canadian Life and Health Insurance Association proposed the creation of a 15% non-refundable tax credit for premiums paid for long-term care insurance. 4. “Improving Canada’s Taxation and Regulatory Regimes” WitnessesArthur Cockfield – who is with Queen’s University and appeared as an individual – requested that tax credits for low-income individuals be both simplified and harmonized with provincial income support programs. Regarding administration of the Universal Child Care Benefit and the Goods and Services Tax/Harmonized Sales Tax credit, Mike Moffat – who is with Western University and appeared as an individual – suggested that these measures be merged so that Canadians receive a single cheque. The Institute of Marriage and Family Canada advocated an increase in the amount of the Universal Child Care Benefit and the Canada Child Tax Benefit, and opposed the creation of a federally subsidized national day care program that could lead to the loss of government-provided benefits. Regarding the Canada Child Tax Benefit, Frances Woolley – who is with Carleton University and appeared as an individual – highlighted the penalty for single parents receiving this benefit, and advocated rules for eligibility and a benefit amount that would be similar to the Working Income Tax Benefit. 5. “Maximizing the Number and Types of Jobs for Canadians” WitnessesThe Quebec Employers’ Council urged the government to undertake reviews in two areas: its recent decision to link increases in the amount of the Canada Health Transfer to the rate of growth in the country’s gross domestic product; and the Canada Health Act. According to its brief, a review of the Canada Health Act should assess the feasibility of giving the provinces/territories more financial resources and flexibility to comply with the Act’s regulatory requirements, as well as its accessibility and universality provisions. Moreover, the Quebec Employers’ Council suggested that the government combat tobacco smuggling more effectively, and increase innovation in the tobacco manufacturing sector to reduce smoking-related health risks. |