PACP Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

REPORT 2, DISPOSING OF GOVERNMENT SURPLUS GOODS AND EQUIPMENT, OF THE 2018 SPRING REPORTS OF THE AUDITOR GENERAL OF CANADA

Introduction

According to the Office of the Auditor General of Canada (OAG), federal organizations can dispose of “surplus assets by either transferring them to other departments or agencies, or selling, donating, recycling, or scrapping them.”[1] Such disposal of movable assets are governed by the following:

- the Financial Administration Act;

- the Surplus Crown Assets Act—which authorizes Public Services and Procurement Canada (PSPC) to be responsible for the disposal of all surplus assets unless another department or agency has been authorized to do so;[2] and

- the Treasury Board of Canada Secretariat (TBS) Policy on Management of Materiel—which states that “materiel be managed by departments in a sustainable and financially responsible manner that supports the cost-effective and efficient delivery of government programs.”[3]

The OAG further notes that the Treasury Board policy “requires that deputy heads of federal organizations ensure that surplus movable assets are disposed of quickly and effectively, in a manner that obtains the highest net value for the Crown. Assets must be disposed of in compliance with the Treasury Board Directive on Disposal of Surplus Materiel. If the expected cost of selling an asset is more than the expected selling price, then the sale would have no net value. In such a case, the directive indicates that the organization must consider other disposal methods, such as donating, transferring, or recycling.”[4]

Additionally, PSPC provides comprehensive advice regarding the disposal of surplus assets for the federal government through GCSurplus. Working under a cost-recovery model, this organization “helps the government dispose of its surplus movable assets, such as working electronics, office equipment, vehicles, ships, and planes. GCSurplus provides online marketplaces for sales by auction (GCSurplus.ca); interdepartmental transfers (GCTransfer); and sales of controlled assets (GCMil), such as military equipment and ammunition, to preapproved and qualified bidders.”[5]

In the spring of 2018, the OAG released a performance audit whose objective was to determine “whether selected federal organizations disposed of surplus goods and equipment at the appropriate time in a manner that maximized benefits. These benefits include selling assets for the best possible return, reusing or refurbishing assets that were still in good condition, donating assets to organizations that could benefit from them, and disposing of assets in an environmentally sustainable way.”[6] The federal organizations selected for study were the Canada Revenue Agency (CRA), PSPC, the Royal Canadian Mounted Police (RCMP), and Shared Services Canada (SSC), based on their size and level of GCSurplus usage.[7]

On 5 November 2018, the House of Commons Standing Committee on Public Accounts (the Committee) held a hearing on this audit.[8] In attendance from the OAG were Jerome Berthelette, Assistant Auditor General of Canada, and Martin Dompierre, Principal; from PSPC were Marie Lemay, Deputy Minister, and Nicholas Trudel, Director General, Specialized Services Sector; from CRA, Bob Hamilton, Commissioner of Revenue and Chief Executive Officer, and Kami Ramcharan, Assistant Commissioner and Chief Financial Officer; from the RCMP, Dennis Watters, Chief Financial and Administrative officer; and, from SSC, Ron Parker, President, and Stéphane Cousineau, Senior Assistant Deputy Minister, Corporate Services.[9]

Findings and Recommendations

A. Surplus Assets: Selling vs. Other Disposal Options

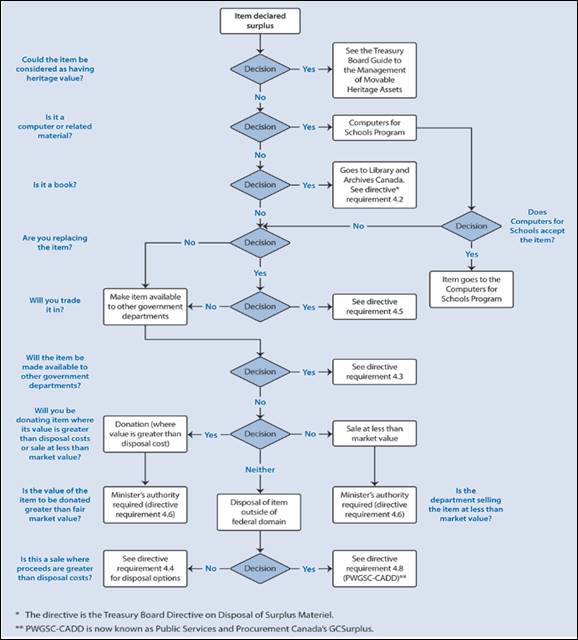

For federal assets declared as surplus, a materiel management officer follows a process, based on Treasury Board requirements, when disposing of them; for example, “if the expected cost of selling an item is more than the expected selling price, then the item should be transferred, donated, or scrapped.”[10] Figure 1 shows a flow chart of this logic model process.

Federal organizations transfer assets by posting a request on GCTransfer; a similar action takes place for sales through GCSurplus.[11] They can spend the proceeds of such a sale on anything but transfer payments (including government-to-government transfer payments), and must do so “in the fiscal year in which they are recorded or the next fiscal year.”[12]

Overall, the OAG found that “federal organizations preferred to sell surplus assets rather than to transfer them and that the organizations generally received less from the sale of assets than the value estimated as the assets’ remaining future benefit to the government.”[13] Furthermore, they “rarely used GCTransfer and donations to help the Government of Canada get the full benefits” from surplus assets.[14]

Figure 1—Material Management Officer Logic Model Pertaining to the Disposal of Federal Surplus Assets

Source: Office of the Auditor General of Canada, Report 2–Disposing of Government Surplus Goods and Equipment, of the 2018 Spring Reports of the Auditor General of Canada, Exhibit 2.1. For more detailed information, refer to the Treasury Board Directive on Disposal of Surplus Material.

Additionally, the OAG found that in 2001, CRA—which has its own policies and procedures regarding surplus assets[15]—had an internal website for transferring assets. In July 2014, “the Agency introduced a moratorium that limited the purchasing of new furniture and required managers to reuse and refurbish furniture internally before making any purchases. This produced savings of more than $4.5 million over three years.”[16]

The OAG noted the significance of this finding as “the Government of Canada as a whole is required to use its assets to their fullest. Assets that are surplus to one program, office, or department or agency could still be useful to another. The cost of transferring or refurbishing assets can be less than the cost of purchasing new assets or selling old assets.”[17] Moreover, the CRA approach “showed that the Agency was reusing assets and refurbishing furniture to extend their use. This success shows that it is possible to reuse assets internally to generate cost savings. If more federal organizations adopted a similar approach, the Government of Canada could increase cost savings and the benefit to Canadian taxpayers.”[18]

Lastly, “donations or transfers can extend the use of assets and provide benefits to non‑profit organizations and other levels of government in Canada. For example, the federal government’s Computers for Schools program refurbishes donated computers and distributes them to schools, libraries, Indigenous communities, and other non-profit organizations.”[19] During the hearing, Jerome Berthelette, Assistant Auditor General of Canada, explained that the OAG found that the federal organizations studied during this audit “chose to sell surplus assets rather than extend their use by transferring them to other federal organizations. Efforts to transfer assets through GCTransfer accounted for just over 4% of total requests to sell or transfer assets during [the] audit period.”[20]

Additionally, the OAG found that 84% of all federal organizations rarely or never donated assets. Officials in selected federal organizations stated that internal processes for donating surplus assets were cumbersome.[21]

Regarding the value of assets, the OAG explained that the “net book value of an asset represents the estimated remaining future benefit of that asset. This value is calculated by taking the original cost of the asset and subtracting an estimate of the asset’s use. According to the Public Accounts of Canada 2015–2016 and departmental financial information,” the federal government estimated the net book value of vehicles, machinery, and equipment disposed was $67 million, for which it received $42 million in proceeds from their disposal.[22] For 2016–2017, it received $50 million for $82 million in net book value.[23] These results suggest that “federal organizations disposed of assets that still had benefits and could have been used by other federal organizations.”[24]

Finally, the OAG “found that during the period covered by the audit, approximately one quarter of sales lots (items sold individually or grouped together) sold for less than $100 each. It is unclear in these instances whether selling was the best disposal method,” and suggests federal organizations consider other options for such assets.[25]

Therefore, the OAG recommended that PSPC, the RCMP, and SSC should review their asset life-cycle processes, including procurement, to facilitate and encourage the transfer and reuse of assets.[26]

In response to this recommendation, all of the affected federal organizations agreed, and provided the following in their action plans:

- PSPC—the Department will review its asset life cycle processes to ensure that the disposal of valuable assets meets the criteria identified in the OAG audit in the most cost-effective manner, including the “consideration of the transfer, reuse and donation of assets, with the proper documentation supporting the decision making,” by 31 March 2019.[27]

- RCMP—The RCMP will review the asset life cycle processes in consultation with materiel managers across the organization to facilitate and encourage the transfer and reuse of assets, including a focus on disposal methods that obtain the highest net value per the Treasury Board policy, by 31 March 2019.[28]

- SSC—the Department completed a study to define the full life cycle of materiel management, including the development of a target operating model; an SSC Disposal Request form, Disposal Training Guide for Cost Centres, and a Transfer Agreement was created and approved.[29]

In response to questions regarding the role that PSPC—as a support organization—plays with respect to encouraging transferring assets instead of disposing them, Nicholas Trudel (Director General, Specialized Services Sector, PSPC) provided the following:

We promote transfers first, before sales. The transfer percentage is low because one department has to need a surplus asset from another department. Most departments make full use of their assets before disposing of them, so they are very used. Often, to reduce their costs and to have more modern equipment, departments consider purchasing new equipment, not reusing an asset that is at the end of its useful life.[30]

He further acknowledged that since there are commissions from the sale of surplus assets, it may create a disincentive for departments to transfer or donate assets.[31]

Therefore, to encourage all federal organizations to more comprehensively examine their asset life-cycle management processes, the Committee recommends:

Recommendation 1—on encouraging asset transfer and reuse

That, by 30 June 2019, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada provide the House of Commons Standing Committee on Public Accounts with a report outlining their revised asset life-cycle processes, including procurement, to facilitate and encourage the transfer and reuse of assets.

The OAG also recommended that CRA, PSPC, the RCMP, and SSC should review internal processes to facilitate the donation of surplus assets.[32]

In response to this recommendation, the affected federal organizations provided the following in their action plans:

- CRA—the Agency agrees to review internal processes to facilitate the donation of surplus assets by September 2019.[33]

- PSPC—the Department will review internal processes (in collaboration with GCSurplus and TBS) to determine a suitable and cost-effective manner to donate surplus assets while still ensuring the best value for the Crown by 30 June 2019.[34]

- RCMP—The RCMP will review internal processes to facilitate the donation of surplus assets; furthermore, it will “open a dialogue on this subject with [TBS] through ongoing committee work to identify potential changes to policy requirements that would facilitate the donation of surplus assets,” by 31 March 2019.[35]

- SSC—the Department has an approved standard for materiel transfer, loan, and donation that outlines the process and parameters that cost centre managers must follow for information technology (IT) materiel and equipment. As well, stemming from the 2018 review, a Donation Agreement was created and approved.[36]

At the hearing, all the affected organizations reiterated their agreement with this recommendation. For example, Ron Parker (President, SSC) provided the following:

In response, we put in place an approved standard for materiel transfer and donation. It outlines the process and parameters that cost centre managers must follow for surplus materiel and equipment. In response to the recommendation, we will also continue to monitor and assess the standard and look for opportunities for improvement.[37]

Nicholas Trudel explained some of the challenges regarding donating federal surplus assets:

[We'll] start to look at what it costs us to make a donation: Is this marginal to our business and not really a big deal, or is this much more of a burden and we need to think about it differently?[38]

Thus, the Committee recommends:

Recommendation 2—On donations of surplus assets

That, by 30 September 2019, the Canada Revenue Agency, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada provide the House of Commons Standing Committee on Public Accounts with a report outlining their revised internal processes to facilitate the donation of surplus assets.

B. Keeping Detailed Records to Support Disposal Decisions

DATA ISSUE

Due to insufficient documentation, the OAG was unable to determine whether the federal organizations it studied had disposed of surplus goods and equipment at the appropriate times, and thus, was “unable to assess whether surplus assets were losing value while waiting to be disposed of.”

Source : Office of the Auditor General of Canada, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.52.

According to the OAG, federal entities must keep auditable records to justify surplus assets disposal decisions; however, they found that PSPC, the RCMP and SSC had not adequately done so.[39] Specifically, of the transactions examined at these organizations, 65% did not have costing analyses to justify their chosen disposal methods.[40] In contrast, 100% of the CRA files examined included a costing analysis.[41]

The OAG also found that “documentation that tracked disposal decisions was more complete for federal organizations that consistently used standardized forms and templates.”[42]

Consequently, the OAG recommended that PSPC, the RCMP, and SSC “should keep sufficient documentation to justify the disposal methods that they selected” and “should consider standardizing their forms to ensure consistency, and consider all factors when making disposal decisions, such as disposal cost, asset value, and environmental impact.”[43]

In response to this recommendation, the affected federal organizations provided the following in their action plans:

- PSPC—the Department will implement a standardized process to document disposal decisions including considering the remaining value of the asset.[44]

- RCMP—the RCMP has already identified areas of improvement relating to the disposal process and its documentation; consequently, a new form is in development to be finalized by 31 March 2019. Also, the feasibility of an electronic application is also being assessed; if deemed feasible, it could be implemented in the 2019–20 fiscal year.[45]

- SSC—the Department completed a review of existing processes, practices and tools such as forms for both non-IT and IT assets to help incorporate standardized industry practices and delivery models; additionally, a disposal training guide for cost centres and an SSC Disposal Request Form were created and approved.[46]

At the hearing, all the affected federal organizations agreed with this recommendation. For example, Dennis Watters (Chief Financial and Administrative Officer, RCMP) committed to the following:

We'll develop a disposal form for the RCMP that allows for the documentation of disposal decisions while strengthening the approval process. We'll implement an electronic approval system that aligns with the delegated financial signing authorities and allows for performance measuring and reporting.[47]

Notwithstanding the above, the Committee recommends:

Recommendation 3—on proper documentation for disposal actions

That, by 30 June 2019, Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada provide the House of Commons Standing Committee on Public Accounts with a report outlining their revised policies regarding keeping sufficient documentation to justify the disposal methods that they selected, standardizing their forms to ensure consistency, and considering all factors when making disposal decisions, such as disposal cost, asset value, and environmental impact.

C. Effectiveness of GCSurplus

The OAG found that GCSurplus was effective at selling surplus assets and depended entirely on sales commissions to operate; however, this dependence created a disincentive to promote other disposal methods (e.g., transfers or donations).[48] Furthermore, as GCSurplus could not carry money over from year to year, it was difficult for it “to invest in multi-year projects, such as modernizing its online presence with real‑time bidding, planning for warehouse relocations, or improving the functionality of GCTransfer.”[49]

Lastly, the OAG found that during the audit period, “GCSurplus processed over 3,000 sales requests that sold for less than $20 each. The Treasury Board directive indicates that if the expected cost of selling an asset is more than the expected selling price, then other methods of disposal must be considered, such as donating, transferring, or recycling.”[50] As such, the OAG concluded it was “unlikely that the proceeds exceeded the cost of conducting such sales.”[51]

Thus, the OAG recommended that PSPC “should assess whether it can expand the services it offers to all federal organizations and it should encourage the donation and reuse of assets across government.”[52] In its action plan, CRA also suggested that “a broader, integrated horizontal approach across government would facilitate an efficient, fair, and transparent donation process for both the donor departments and the receiving organizations.”[53]

In PSPC’s Detailed Action Plan, the Department stated the following:

As the common provider of GCSurplus, PSPC will conduct an analysis of assets by class to determine whether they can be transferred for donation or reuse. The Department will engage with the materiel management community to increase awareness of the GCTransfer tool. Regarding donations, the Department will engage with the TBS as the policy owner to understand how GCSurplus in its unique situation might broker donation transactions [to be completed by 31 December 2019].[54]

Additionally, the Department explained that by 31 March 2019, it will complete a proof of concept for donations—in full compliance with TBS policy—followed by a more comprehensive pilot, by 31 March 2020.[55] On this point, Nicholas Trudel elaborated as follows:

We've started to work with the RCMP on a first proof of concept on how we would donate. We started with a set of 400 first aid kits that could no longer be used because of partial expiry. We issued call letters, transparently, to charitable organizations, to try to find out who was interested.

The purpose of that was for us to figure out how we might do this—figure out the policies, the incentives, and how we should set up a program. In that first stage, which we anticipate finishing by the end of this fiscal year, by March, we hope to have a better idea of how this program might work.

Then we'll go to a pilot phase. We'll try to look at how we implement it at an institutional level. Just because it works on a handful of transactions doesn't mean that it will be a good program design.[56]

Consequently, the Committee recommends:

Recommendation 4—on a centralized approach to donating assets

That, by 30 June 2019, Public Services and Procurement Canada provide the House of Commons Standing Committee on Public Accounts with a report outlining its revised policies regarding the development and implementation of a new service for federal organizations to better encourage the donation and reuse of assets across government.

Additional Commentary

The Committee was pleased to learn about CRA’s approach and success pertaining to its management of surplus goods and assets and expects other federal organizations to try to follow their practices in this regard.

Conclusion

The Committee concludes that the federal organizations selected by the OAG for this audit “did not always dispose of surplus goods and equipment in a manner that maximized benefits. The incentives to sell surplus assets outweighed other methods, such as reusing, refurbishing, and donating. There are more opportunities inside and outside the Government of Canada to reuse assets and maximize their use. The Canada Revenue Agency is one example of how to increase the reuse and refurbishment of assets within one federal organization.”[57]

In contrast, the Committee was concerned upon learning that the OAG was “unable to conclude on whether the selected federal organizations disposed of surplus goods and equipment at the appropriate time because organizations did not maintain sufficient documentation.”[58]

To address these concerns, the Committee has made four recommendations to help ensure that federal organizations improve their management of surplus assets.

Summary of Recommended Actions and Associated Deadlines

Table 1—Summary of Recommended Actions and Associated Deadlines

Recommendation |

Recommended Action |

Deadline |

Recommendation 1 |

Public Services and Procurement Canada, the Royal Canadian Mounted Police, and Shared Services Canada should provide the House of Commons Standing Committee on Public Accounts with a report outlining their revised asset life-cycle processes, including procurement, to facilitate and encourage the transfer and reuse of assets. |

30 June 2019 |

Recommendation 2 |

CRA, PSPC, the RCMP, and SSC should provide the Committee with a report outlining their revised internal processes to facilitate the donation of surplus assets. |

30 September 2019 |

Recommendation 3 |

PSPC, the RCMP, and SSC, should provide the Committee with a report outlining their revised policies regarding keeping sufficient documentation to justify the disposal methods that they selected, standardizing their forms to ensure consistency, and considering all factors when making disposal decisions, such as disposal cost, asset value, and environmental impact. |

30 June 2019 |

Recommendation 4 |

PSPC should provide the Committee with a report outlining its revised policies regarding the development and implementation of a new service for federal organizations to better encourage the donation and reuse of assets across government. |

30 June 2019 |

[1] Office of the Auditor General of Canada (OAG), Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.1.

[2] Ibid., para. 2.3.

[3] Treasury Board of Canada Secretariat (TBS), Policy on Management of Materiel, Section 5.1.

[4] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.5.

[5] Ibid., paras. 2.7 and 2.8.

[6] Ibid., para. 2.10.

[7] Ibid., para. 2.11.

[8] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 5 November 2018, Meeting No. 117.

[9] Ibid.

[10] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.19.

[11] Ibid., para. 2.20.

[12] Ibid., para. 2.21.

[13] Ibid., para. 2.22.

[14] Ibid.

[15] Ibid., para. 2.6.

[16] Ibid., para. 2.23.

[17] Ibid., para. 2.25.

[18] Ibid., para. 2.26.

[19] Ibid., para. 2.27.

[20] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 5 November 2018, Meeting No. 117, 1530.

[21] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.39.

[22] Ibid., para. 2.30.

[23] Ibid.

[24] Ibid.

[25] Ibid., para. 2.32.

[26] Ibid., para. 2.40.

[27] Public Services and Procurement Canada, Detailed Action Plan, p. 1.

[28] Royal Canadian Mounted Police, Detailed Action Plan, p. 1.

[29] Shared Services Canada, Supplemental Detailed Action Plan, p. 1.

[30] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 5 November 2018, Meeting No. 117, 1600.

[31] Ibid., 1620.

[32] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.41.

[33] Canada Revenue Agency, Detailed Action Plan, p. 1.

[34] Public Services and Procurement Canada, Detailed Action Plan, p. 2.

[35] Royal Canadian Mounted Police, Detailed Action Plan, p. 2.

[36] Shared Services Canada, Supplemental Detailed Action Plan, p. 2.

[37] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 5 November 2018, Meeting No. 117, 1555.

[38] Ibid., 1620.

[39] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.49.

[40] Ibid.

[41] Ibid., para. 2.50.

[42] Ibid., para. 2.51.

[43] Ibid., para. 2.53.

[44] Public Services and Procurement Canada, Detailed Action Plan, p. 3.

[45] Royal Canadian Mounted Police, Detailed Action Plan, p. 3.

[46] Shared Services Canada, Supplemental Detailed Action Plan, p. 3.

[47] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 5 November 2018, Meeting No. 117, 1545.

[48] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.59.

[49] Ibid.

[50] Ibid., para. 2.60.

[51] Ibid.

[52] Ibid., para. 2.61.

[53] Canada Revenue Agency, Detailed Action Plan, p. 1.

[54] Public Services and Procurement Canada, Detailed Action Plan, pp. 4-5.

[55] Ibid.

[56] House of Commons Standing Committee on Public Accounts, Evidence, 1st Session, 42nd Parliament, 5 November 2018, Meeting No. 117, 1620.

[57] OAG, Disposing of Government Surplus Goods and Equipment, Report 2 of the 2018 Spring Reports of the Auditor General of Canada, para. 2.62.

[58] Ibid., para. 2.63.