RNNR Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

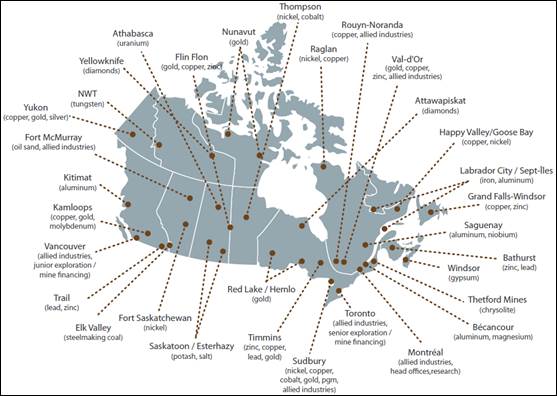

THE FUTURE OF CANADA’S MINING SECTOR: SUSTAINABLE GROWTH BEYOND THE GLOBAL DOWNTURNINTRODUCTIONThe mining industry is a major generator of wealth and employment for Canadians. In 2015, it accounted for about 3.2% ($60.3 billion) of the national gross domestic product (GDP), with ripple economic benefits in other sectors of the economy – from the supplies and equipment industry to the financial and insurance sectors. According to a representative from Natural Resources Canada (NRCan), “it is said that for every $1 billion of output in the minerals and metal sector, the direct demand for goods and services in Canada increases by $615 million.”[1] Furthermore, mining is one of Canada’s highest-wage employers and proportionally the largest private sector employer of Indigenous peoples.[2] With nearly 380,000 employees nationwide, the sector has approximately 10,000 Indigenous workers, and accounts for 20% to 25% of the GDP of the northern territories.[3] Mining wages averaged $36 an hour in 2013, which is about 60% higher than Canada’s all-industry average.[4] At the international level, the mining industry has played a central role in establishing Canada’s position as a resource-based economy.[5] In 2015, the sector accounted for 19% of all Canadian exports, with commodities like uranium and potash representing as much as 30% and 22% of the global supply respectively.[6] There were about 1,700 exploration and mining companies headquartered in Canada in 2014, with operations in 105 countries and global mining assets of almost $260 billion.[7] Finally, almost 60% of international mining deals take place on Bay Street, making Toronto, in the words of one witness, the “mining financial capital of the world.” [8] Over the past few years, the global mining industry has been experiencing a cyclical downturn, with many commodity prices dropping below their average or desired value.[9] In view of the consequent impacts on mining in Canada (and as part of its broader study entitled The Future of Canada’s Oil and Gas, Mining and Nuclear Sectors: Innovation, Sustainable Solutions and Economic Opportunities), the Standing Committee on Natural Resources (the Committee) sought to investigate the overall state of the Canadian industry with a long-term view of recovery and growth beyond the current downturn. Between 6 June and 15 November 2016, the Committee held 12 meetings, hearing from a wide range of mining experts from industry, government, Indigenous peoples, academia and civil society. The Committee is pleased to present its report, which concludes its study on the mining sector and presents recommendations to the Government of Canada. BUILDING A FOUNDATION FOR SUSTAINABLE GROWTH BEYOND THE GLOBAL DOWNTURNCanada’s mining sector has been experiencing a cyclical downturn, with many commodity prices dropping in value – for example, iron values dropped by 35%, copper by 25% and gold by 11% since 2011.[10] According to Carl Weatherell of the Canada Mining Innovation Council (CMIC), “in 2015, the global mining industry experienced record impairments of $53 billion, far outstripping similar losses in the oil and gas industry for the same time period.”[11] The Committee heard that the exploration sector has been the hardest hit, with investment declining from a high of $2.8 billion in 2011, at the peak of the super cycle, to an estimated $683 million in 2016.[12] In addition, the number of exploration companies has declined since 2012, and 431 project operators are expected to have merged, become dormant, or ceased to exist by 2016.[13] There was general consensus among the witnesses that the current downturn is cyclical rather than structural, and that some recovery is already underway. According to Marian Campbell Jarvis of NRCan, the challenge facing Canada’s minerals and metals sector is twofold: “the first is the economic competitiveness of Canadian operations and maintaining an attractive investment climate, and the second is one of social acceptance, environmental performance, community involvement, and a sense of shared benefit and risk.”[14] The Committee heard that the Canadian mining sector already benefits from a number of competitive advantages, namely Canada’s resource wealth, taxation policy and position as a global centre for mining finance and innovation. Maximizing on these advantages to ensure a stable investment climate is particularly important given the long-term horizon of most mining exploration and development projects,[15] and considering the potentially devastating consequences of mine closures on employees and the local economy.[16] The sustainability of Canadian mineral exploration is of special concern for the mining industry. The Committee heard that the exploration business is becoming riskier and more costly, especially for junior companies that account for approximately 70% of Canadian discoveries and create almost 30% more value per dollar expended compared to major mining companies.[17] The likelihood of an exploration project leading to a discovery that will become an operating mine is one in a thousand, or less;[18] hence, the vast majority of Canadian mining operations never move beyond the exploration stage[19] and are confronted with rising operational costs.[20] Furthermore, considering that many mineral reserves have been declining over the past three decades (e.g., zinc, by 86%, and nickel, by 63%), and that higher-grade ores are becoming scarcer, mining companies have to dig deeper, operate more remotely or mine lower grades in order to stay in business.[21] Ugo Lapointe of MiningWatch Canada explained that mining lower grade ore consumes more energy and water resources, generates more waste, and is thus more likely to have negative impacts on the environment and encounter social and political resistance.[22] The Committee heard that infrastructure development and innovation are central to the long-term competitiveness of the mining sector. In many remote and northern regions, the development of mineral deposits is contingent on the availability of basic infrastructure and services, such as railways, roads and electric power.[23] Furthermore, innovation and technological upgrades can address some of the industry’s economic and environmental challenges – for example, by improving the productivity, energy efficiency and cost-effectiveness of mining operations; facilitating the development of niche commodities for new and emerging markets; and strengthening waste management and environmental reclamation practices. According to NRCan, “energy, water, and waste are the areas of greatest challenge and opportunity to increase competitiveness and to reduce environmental impacts and improve performance.” [24] With regards to social acceptance, the Committee heard that sustainable resource development requires social licence in order to remain sustainable.[25] Meaningful engagement with affected Indigenous communities is especially critical, given the Crown’s constitutional duty to consult and, where appropriate, accommodate Indigenous peoples on resource development projects.[26] The Committee also heard that industry needs to remain proactive about corporate social responsibility (CSR) practices by protecting its employees, local communities and the environment. [27] Finally, the Committee heard that the industry needs a skilled and sustainable labour force, and would benefit from efforts to facilitate mining education, training and recruitment, especially among unrepresented groups such as women and Indigenous people.[28] With a view to sustaining the long-term economic growth and sustainability of the Canadian mining industry, the following sections expand on four main themes based on evidence from the witnesses: 1) maximizing on Canada’s competitive advantages; 2) fostering innovation in mining technologies and practices; 3) enabling meaningful engagement with Indigenous peoples; and 4) developing a skilled labour force through education and training. MAXIMIZING ON CANADA’S COMPETITIVE ADVANTAGESThe following sections discuss some of the advantages and challenges of operating in Canada for the mining industry in four areas: a) geography and resource development infrastructure (including mining clusters); b) Canada’s investment climate; c) Environmental Impact Assessments (EIAs); and d) carbon pricing. A. Geography and Resource Development InfrastructureCanada is endowed with rich mineral resources in terms of quantity, quality and variety. Canadian mineral deposits include gold, potash, copper, nickel, lead, zinc, diamonds, coal, chromite and uranium, among others, in addition to niche commodities – such as lithium, graphite, cobalt, indium, molybdenum, tungsten and the rare earth elements – that could be “leveraged to establish new supply chains”[29] for the advanced and clean technology sectors. According to Pamela Schwann of the Saskatchewan Mining Association, Canada’s potash and uranium deposits are the “world’s highest grade,” giving Canada a “clear geological advantage” along with the status of being the world’s top producer of these commodities.[30] In addition, Christopher Zahovskis of Northcliff Resources Ltd. told the Committee that the sizeable Sisson deposit in New Brunswick could become the largest operational tungsten mine in the world when it starts production.[31] A few witnesses also spoke of rich chromite deposits in Northern Ontario’s Ring of Fire region, with an estimated value of $60 billion and enough ore to sustain more than a century of production.[32] While some mining centres have the advantage of being connected to export ports at tidewater or marine transportation corridors in the Great Lakes region,[33] much of Canada’s mineral deposits are located in remote regions of the country where the lack of infrastructure like roads, transmission lines and high-speed telecommunications increases the cost of developing and operating mines. [34] For example, the Committee heard that remote exploration projects located 50-to-500 kilometres from a supply route can cost 227% to 300% of the cost of non-remote projects.[35] As a result, according to Joe Campbell of the NWT & Nunavut Chamber of Mines, many known deposits in Northern Canada remain uneconomic because of their remoteness and inaccessibility.[36] Some witnesses also argued that the lack of infrastructure connecting mineral deposits to markets and population centres is a barrier to attracting investment in Canadian mineral exploration. For example, the Committee heard that billions of dollars are required to build the infrastructure needed for mineral development in Ontario’s Ring of Fire region, including transmission lines, power grids, fibre optics, railways and roads.[37] According to Frank Smeenk of KWG Resources Inc., an estimated $3 billion investment is needed for transportation assets alone before any mines can begin operating.[38] Iain Angus of the Northwestern Ontario Municipal Association pointed out that addressing the infrastructure deficit in the north will likely lower the cost of mining activities and advance the development of remote Indigenous communities. Finally, some witnesses called for additional support for Canada’s mining clusters in order to advance innovation and resource development in the sector. As shown in Figure 1, mining clusters are regional networks of interconnected businesses and institutions that specialize in different mining-related fields,[39] and that have the potential to facilitate innovation and accelerate the commercialization and adoption of new technologies.[40] John Mason of the Thunder Bay Community Economic Development Commission argued that aligning the local service and supply sector with specific mineral development opportunities is a way of advancing the development of clusters around mine and mineral development.[41] Furthermore, Vik Pakalnis of MIRARCO Mining Innovation suggested that the recent federal allocation of $800 million for the government’s “cluster networks strategy” should be seen as an opportunity to revisit the strategic orientation of Canada’s mining clusters – for example, by consolidating and focusing research and development activities in research clusters.[42] Figure 1: Canadian Mining Clusters

Source: Mining Association of Canada, Fact & Figures 2015, p.18 B. Investment ClimateGiven that 60% of all international mining deals are made at the Toronto Stock Exchange on Bay Street, a number of witnesses identified Toronto as a centre for Canadian and global mining finance activities.[43] On the other hand, the Committee learned that mining investment has dropped significantly in recent years, especially in the exploration sector. Australia surpassed Canada as the world’s top destination for mineral exploration investment for the first time in 2015,[44] as investment in the Canadian exploration sector declined from a high of $2.8 billion in 2011 to $823 million in 2015, and an estimated $683 million in 2016.[45] While the Mining Association of Canada (MAC) has identified up to $145 billion in potential new investment in Canada’s mining sector, some companies have already had to delay their mine development projects due to insufficient access to financial capital.[46] Many witnesses highlighted the Mineral Exploration Tax Credit (METC) and flow-through shares as critical financial tools for catalysing investment in Canada’s mining exploration sector, especially junior companies.[47] According to Andrew Cheatle of the Prospectors and Developers Association of Canada (PDAC), flow-through shares accounted for more than two-thirds of all exploration-focused financing in Canadian exchanges over the past decades. Almost 90% of PDAC’s membership reported that if the METC were not renewed, it would have “a negative to severely negative impact on their ability to attract investors.”[48] Similarly, speaking of the ongoing review of flow-through tax incentives by Finance Canada, Gavin Dirom of the Association for Mineral Exploration British Columbia stated the following: Removing these important tax incentives at a time when the industry is still recovering from [the downturn in mineral commodity prices], could have a crippling effect on the recovery of the industry. These incentives support the discoveries of new deposits, and advance the development of mining projects and the creation of socio-economic opportunities across the country. They support and benefit remote and aboriginal communities where natural resource development is the only source of jobs and economic opportunity, infrastructure and skills development, and community capacity building.[49] A number of witnesses recommended that the government renew the METC and continue supporting flow-through financing.[50] For example, Ms. Schwann thinks renewing the METC for a period longer than a year would benefit exploration companies, while Mr. Mason recommended that the METC and flow-through financing be renewed for at least three years, or even made permanent.[51] Witnesses also recommended the creation of new funds to support the development of infrastructure and mineral resources.[52] Pierre Gratton of MAC thinks the Alaskan infrastructure bank is a model that could be emulated in Canada; it “provides long-term, low-interest financing for major infrastructure projects that allow economic development that might otherwise not take place […helping] finance projects that banks won’t touch.”[53] Alternatively, Gregory Bowes of Northern Graphite Corporation called for the creation of a national resource bank managed by the private sector and supported by public funds that would “invest directly, debt and equity, in resource projects in Canada.” Such bank, according to Mr. Bowes, could be modelled after Quebecois organizations – such as Caisse de dépôt, Ressources Québec, and Sodémex – that invest directly in junior resource companies.[54] C. Environmental Impact AssessmentThe Committee heard different views on how the Canadian Environmental Impact Assessment (EIA) process affects the competitiveness of the mining industry. Some witnesses, such as Ms. Schwann and Dale Austin of Cameco Corp., praised Canada’s EIA process and regulatory regime for being strong, robust and science-based.[55] Furthermore, Susanna Cluff-Clyburne of the Canadian Chamber of Commerce stated that “Canada’s legal and regulatory stability is a competitive advantage to our businesses and attractive to prospective foreign investors.”[56] Ross Beaty of Pan American Silver Corporation also commented on the industry’s general environmental performance for having “an outstanding reputation globally for best-practice environmental standards.”[57] In addition to these views, several witnesses also saw room for improvement in Canada’s EIA processes, for example:

In discussing ways to improve Canada’s EIA processes, some witnesses called for more balance in weighing the needs of economic development and industry with environmental, social and Indigenous concerns,[63] while others emphasized the importance of bound timelines as a means of improving the predictability of the regulatory process.[64] Mr. Gratton thinks the CEAA should “still have the rigour of timelines, but […] include some flexibility to work with provincial governments.”[65] He advised that timelines consider the regulatory processes enforced by all levels of government.[66] Similarly, Mr. Bowes stated that Canada’s EIA processes need to be “simplified” and “streamlined” with greater substitution between equivalent federal and provincial EIA processes, where appropriate.[67] Finally, Mr. Beaty argued that “applying an economic value to natural capital in assessing the impact of mining will help quantify the loss of natural lands and the mitigation needs.”[68] D. Carbon pricingFor an industry known to be “emissions-intensive and trade exposed” (EITE), mining emits more greenhouse gases (GHG) than the industrial average, while selling globally-traded commodities at prices set by international markets.[69] In view of the carbon pricing system recently announced by the federal government, the cost of carbon-emitting fuels – such as gasoline, diesel, natural gas, and coal – is expected to rise. For mining firms that have no choice but to use fossil fuels in their operations, a carbon tax will incur a direct increase to their operational expenses. The Committee heard varying opinions with regards to the potential impacts of a carbon price on the mining sector. Some witnesses saw carbon pricing as an incentive to advance innovation and energy efficiency in the sector.[70] For example, Jean Robitaille of CMIC stated that carbon pricing would “force the industry to develop new technologies and new ways of operating to reduce the use of vast quantities of fossil fuels.”[71] In addition, Mr. Beaty stated that a carbon tax is “the best and most transparent way of applying a price on pollution and encouraging innovation to reduce emissions,” and is likely to lead to the development of “a really strong, innovative clean tech industry,” with economic benefits in other sectors of the economy.[72] According to these witnesses, even though carbon pricing may be costly in the short term, it should encourage innovations that will lead to cost savings and improved productivity over the long-term. On the other hand, some witnesses expressed concern that carbon pricing would make certain operations unprofitable (or less profitable), thereby affecting the economic feasibility of some projects.[73] Mr. McDougall told the Committee that the new tax would raise the operational costs of the placer mining industry considerably, given that industry’s heavy reliance on diesel-powered equipment.[74] Similarly, Mr. Mason and Mr. Angus were both concerned that new mine developments in their region may not proceed if new input costs are imposed on the industry, particularly in a low commodity price environment.[75] To account for the EITE and cyclical characteristics of the mining business, some witnesses recommended that the government reduce the cost burden of carbon pricing for the mining sector.[76] For example, Mr. Beaty recommended that carbon pricing systems include offsets for certain internationally-traded products to protect the competitiveness of Canadian exporters against suppliers in countries with no carbon tax.[77] Furthermore, Mr. Bowes suggested that commodity industries should be allowed to “build up credits in good years that could be used in bad years […] to help to smooth out [their business] cycles.”[78] With regards to the revenue collected by governments through carbon pricing, Mr. McDougall told the Committee that the funds should be returned to the companies, either directly through income tax rebates or “as an incentive in some other form to try to reduce [the industry’s] use of fossil fuels […].”[79]John Mullally of Goldcorp suggested that the $8 billion in carbon price revenues expected to be raised by the Government of Ontario by 2020 could be used to build infrastructure in northern Ontario.[80] Finally, some witnesses discussed alternatives to carbon pricing with the same objective of reducing the sector’s greenhouse gas emissions. Sarah Fedorchuk of Mosaic told the Committee that her company “strongly supports additional efforts to reduce emissions through offsets, cogeneration, carbon capture and storage, and energy efficiency.”[81] Moreover, Mr. McDougall told the Committee that low-interest loans for efficiency upgrades and renewable electricity production, accelerated capital cost allowances on new equipment purchases, pilot projects to field test new technologies, and educational programs are options that the Klondike Placer Miners’ Association would like to see explored.[82] FOSTERING INNOVATION IN MINING TECHNOLOGY AND PRACTICESBased on evidence from the witnesses, the following sections discuss the challenges and opportunities facing Canadian mining innovation in three areas: a) the industry’s overall capacity to develop and commercialize mining innovations; b) the productivity and cost effectiveness of mining operations, including energy efficiency and ways to improve exploration practices and develop niche commodities for emerging markets; and c) waste management and environmental reclamation. A. Collaborative Innovation: from Research to CommercializationIn a cyclical industry with high capital costs and long investment horizons, mining companies are cautious to adopt unproven technologies and processes.[83] In discussing barriers to supporting mining innovation, some witnesses expressed the need for funding mechanisms that support the full innovation cycle, from the research to the commercialization stage.[84] According to Mr. Weatherell, “the existing funding mechanisms to support research, development, and innovation – over 7,000 – are generally focused on research in academia, restricted to select regions of Canada, and are generally incompatible with the requirements of mining-related innovation projects.”[85] Furthermore, Douglas Morrison of the Centre for Excellence in Mining Innovation (CEMI) argued that innovation funding is disproportionately allocated to research compared to commercialization. He stated the following: The fact is that we have 30 years of research in the Sudbury basin on our deep mines, and very little of that has actually moved off into industry to be commercialized. It's because we don't have the mechanisms. It's not just finishing up with the research report, and then somehow it magically becomes a product. It doesn't. You go from a bench scale, […] to pilot scale, to operational scale, to full-scale field trial, then to commercialization of that field-trial result. The money that you have to spend to make those things happen, especially in a heavy industry like mining, is getting bigger and bigger all the time. One of the issues for us is the funding ratios for government funds versus industry funds. Right now it's dollar to dollar. You can see that the cost of innovation is very much larger when you move up through building physical machines and plants to do things more efficiently. That's much more expensive than large-scale trials and academic studies, yet the ratio we have to work with is still 1:1, exactly the same as for research.[86] Similarly, Richard Adamson of the Carbon Management Canada (CMC) Research Institutes used his organization as an example to make the point that certain innovations do not benefit enough from the current funding system. He stated that CMC, which addresses barriers to advancing climate-related technologies from the research to the commercialization stage, “is itself an innovation; as such, it does not fit easily into the traditional funding models available to universities [and] for-profit technology developers.”[87] The Committee also heard that research and innovation efforts across the mining sector are diffuse and would benefit from further collaboration. Ms. Campbell Jarvis cited research from the Canadian Chamber of Commerce estimating that there are 4,000 R&D programs and 40 different mining innovation research organizations across Canada that are “not necessarily connected.” She argued that the greatest potential for mining innovation “will not come from developing technology alone but from a broader industry-level systems model and process approach that builds platforms and integrates technology, data, and information – the so-called Internet of things […].” [88] One major industry-wide innovation is the Canada Mining Innovation Council (CMIC) – an umbrella organization that was created with the endorsement of the federal, provincial, and territorial ministers of energy and mines.[89] It employs a collaborative open innovation model to address industry-defined challenges, with members from academia, government, research laboratories, Fortune 500 companies, start-ups and small and medium-sized enterprises (SMEs), and Indigenous-operated businesses. According to Mr. Weatherell: CMIC created an innovation strategy for the industry called Towards Zero Waste Mining. Towards Zero Waste Mining defines the future of the industry in 10-plus years by focusing on the grand challenges common to the industry related to energy, environment, and productivity. […] With Towards Zero Waste Mining and CMIC, we're proposing a new model for innovation. This is how we're doing industry-led innovation that reduces the risk we've already identified.[90] Mr. Robitaille added that a roadmap is being drafted to align all companies to a common goal. Industry is involved in the management board and various technical committees “to ensure that the project is really geared to the needs that may have an impact and bring the Canadian mining industry to another level.”[91] B. Productive Mining: from Exploration to Value-Added ProductsThe Committee heard of a wide range of innovations, technologies and initiatives that aim to improve mining operations from the exploration stage to the development of value-added products for strategic and emerging markets. The following are some of the areas highlighted by the witnesses:

The Committee heard that many mining companies are interested in switching from equipment that runs on fossil fuels to electric systems powered by alternative, renewable or lower-emission energy sources.[103] Currently, fossil fuels, particularly diesel, are the primary fuel for mining operations, and many alternative technologies fall short of technical and/or economic feasibility. According to Mr. Pakalnis, part of the challenge is the transition cost of technology upgrades. He stated the following: We have to move from diesel underground to all electric. There are a number of companies that are already starting to supply different types of scooptrams and a variety of different vehicles. […] but we have a transition issue. We have thousands of pieces of equipment that cost a fortune. One scooptram underground costs you a million bucks, so you're not going to just discard that, especially when the mining industry is in tough shape right now because of the commodity prices. You have to develop a transition plan. Eventually, new mines will probably go all electric, but in the meantime we have to get to cleaner diesel filters and that sort of thing.[104] Mr. Campbell added that mining requires baseload energy supply (i.e., continuous power, 24 hours a day, 7 days a week), which limits the applicability of some renewable options.[105] For example, he explained that in the absence of grid power in remote mines, even electric equipment would need to be powered by diesel: [...] if I have electric equipment underground and I need to power my mine with a diesel generator, it doesn't really make much difference: I'm still burning that diesel fuel. All of the other green solutions that are currently available to us, in terms of wind and solar, are not ones that can effectively run a mine in the north. When you have a mine 300 kilometres away from anything else, your first concern is to make sure you don't kill anybody. We need a power source that we can rely on 24/7. Right now the only thing the industry has is diesel. Yes, we'd love to have electric power, but we need a grid to get to those mines to do that.[106] On the other hand, Mr. Beaty told the Committee that, while renewable sources are typically intermittent forms of energy not ideally suited as a baseload power supply, “[they] can be adjunct, especially in places where mines rely on diesel power, which is typically imported from far away.” He stated the following: [Diesel] is expensive power. You can decrease the cost of that using the new reality of renewable energy, which is that it's competitive with almost every other form of electricity generation. Costs are coming down quickly in those businesses, and this is just good business. Almost every mine that I know of is looking at putting in renewable energy as an adjunct to their existing forms of energy generation, electricity generation. It's just good business to do it. It decreases your costs.[107] Other alternative energy sources include nuclear power, which is non-emitting and costs “five times less than diesel,” according to Mr. Pakalnis.[108] He highlighted the potential role of small modular reactors (SMRs) to power mining operations: […] I was talking with Bruce Power about a research project on small modular nuclear batteries, so to speak, 20 to 30 megawatts, where you can put them in a small mining operation. Then you can mine it out, and you can put it somewhere else. In other words, you would not have all the transmission lines that have to be built. If we develop that particular source of energy, we'd be able to meet those greenhouse gas targets, [and] increase our production as well.[109] One of the main challenges associated with electrifying mining operations is related to the technical limitations of market-available battery storage technologies. As Mr. Mullally explained, lifting heavy material using batteries or electric equipment is still problematic using market-available technologies, particularly in terms of the battery’s life and charging cycle. While Goldcorp is on the verge of adopting near commercialized battery-operated equipment, Mr. Mullally thinks that emerging electric equipment still short of commercialization represents a “huge opportunity for Goldcorp, the industry, and for government to see significant improvements in mining's performance with respect to energy, clean technologies, and health and safety.” According to Brian St. Louis of Avalon Advanced Materials Inc., the production of battery-grade lithium hydroxide from lithium minerals represents an emerging business that requires innovative new processing technology. Lithium production and refining is different from traditional commodities in terms of investment risk and opportunity. He explained: The risks and challenges are more similar to a new manufacturing venture in that the developer is essentially bringing a new refined chemical product to market and needs to invest in downstream processing infrastructure and to develop relationships with customers. The upside for Canada in leveraging its natural resource wealth in critical materials is to build out the full supply chain for energy storage and electric vehicles rather than just being an exporter of the unrefined raw materials.[110] Mr. Bowes further highlighted the economic potential of battery storage technologies, stating that the international lithium ion battery industry is already worth $20 billion, and growing by more than 20% each year.[111] While this growth is mainly for use in smaller devices like cell phones, laptops and power tools, Mr. Bowes suggested that a much larger market for battery storage is emerging for use in electric vehicles and power grids, which is further increasing the global demand for commodities like lithium and graphite (another key component in lithium ion batteries).[112] Mr. St. Louis reiterated this view, stating that “lithium ion battery technology has evolved and continues to evolve to become the energy storage solution for electric vehicles and other emerging applications such as home and grid energy storage as the world transitions to a low-carbon economy.”[113] C. Environmental ReclamationDifferent mine sites have varying potential for environmental reclamation. As Brent Sleep of the University of Toronto explained, in Canada and globally, the sites that are easy to clean up (e.g., ones with contaminants near the ground's surface in permeable grounds) have already been cleaned up using a wide range of available technologies. At the other end of the spectrum, he added, there are sites that are more difficult to clean up due to challenges that remediation scientists still struggle to address – for example, sites with contaminants hidden deep in fractured rock, including polychlorinated biphenyls (PCBs) or heavy metals that are difficult to remove.[114] The witnesses discussed a wide range of innovations that aim to improve the industry’s waste management and environmental reclamation practices, including ones with potential to generate new revenue streams for mining companies. For example:

As discussed in previous sections, the Committee heard that many of the mining industry’s common environmental concerns can be addressed through sector-wide strategies, such as CMIC’s Towards Zero Waste Mining.[120] ENABLING MEANINGFUL ENGAGEMENT WITH INDIGENOUS PEOPLESThe Crown, at both the federal and provincial level, has a constitutional duty to consult and, where appropriate, accommodate Indigenous peoples on resource development projects.[121] As the Honourable Bob Rae of Olthuis Kleer Townsend explained, “the Supreme Court has made it clear that the provincial government is as much the Crown as the federal government with respect to resource development. At the same time, the federal government has key jurisdiction […under the Constitution], to take responsibility for issues affecting aboriginal people.”[122] The Committee heard that developing positive relationships between mining companies and local Indigenous communities can have mutual benefits for both parties. From the industry’s perspective, it is good business practice for mining companies to obtain “social license” in the communities where they intend to operate.[123] According to Michael Fox of PDAC, “the industry recognizes that it is critical to develop and maintain robust, open, and trusting relationships with aboriginal communities affected by, or with an interest in, mineral exploration and mining activities.”[124] Moreover, mining can contribute to socioeconomic development in Indigenous communities, especially in remote and northern regions, where resource development can bring new employment and business opportunities, as well as legacy infrastructure for the benefit of generations to come.[125] As Mr. Campbell explained: Over the past 25 years, with the discovery of diamonds in the Northwest Territories, the mining industry has made even greater strides in aboriginal communities, creating thousands of person-years of employment, supporting a wave of new aboriginal businesses, and producing a flow of millions in taxes and royalties, not only to public governments but now to aboriginal governments too. Mining has significantly catalyzed the creation of a middle class in the aboriginal communities in the north.[126] Impact benefit agreements (IBAs) are one way for companies and Indigenous communities to align their interests through benefit sharing. Nearly 500 IBAs have been signed between the mining industry and Indigenous peoples in Canada since 1974, with over 350 signed in the past decade.[127] As Mr. Fox explained, each IBA is unique: The content of agreements varies depending on a number of factors, particularly with the type and stage of a project, as well as the potential impacts of a project on communities. Company-community agreements contain provisions related to employment, preferential contracting and joint ventures, capacity funding, environmental measures and monitoring, traditional land use and knowledge provisions, training programs, shares and warrant opportunities, infrastructure opportunities, financial provisions, confidentiality clauses, and dispute resolutions and implementation mechanisms.[128] While IBAs are voluntary, they have become a virtual requirement for companies operating in or around Indigenous territory. According to Jason Batise of the Wabun Tribal Council, they provide companies with social license to operate and are “mandatory” for any mining company that intends to develop new mines or extract new minerals in Wabun territory. The Wabun Tribal Council also requires exploration companies operating in its territory to sign exploration agreements, addressing financial compensation, business opportunities, employment and training, elders’ knowledge, environmental considerations, and future IBA negotiations should a mine be developed.[129] Other effective mechanisms to engage Indigenous communities include co-management boards, as well as committees and working groups that address different aspects of resource development.[130] In light of the aforementioned legal and voluntary efforts to enhance relations between industry and Indigenous peoples, the Committee heard that there is room for improvement in the current consultation and engagement process. Many witnesses expressed that navigating the responsibilities, requirements, and relationships implicated by the Crown’s duty to consult can be challenging and uncertain in practice.[131] For example, Ms. Cluff-Clyburne stated the following: Governments can delegate the procedural aspects of their duty directly to businesses, usually by mandating consultation with indigenous peoples as part of the regulatory process. The lack of a clear framework for if, when, and how this delegation can occur and for the roles of the Crown, business, and Indigenous peoples often causes confusion, and this can lead to projects being delayed and even being cancelled.[132] Furthermore, there is concern that many Indigenous communities in Canada have insufficient capacity to engage meaningfully in resource development issues, which can undermine the industry’s ability to attain social acceptance, as well as the Crown’s duty to consult.[133] As Mr. Fox explained, there are two types of capacity when it comes to Indigenous communities and resource development: one is the capacity to understand the project and its impact on their communities; the other is the capacity to participate in the regulatory and environmental assessment process.[134] He listed the following barriers to realizing multi-stakeholder benefits from mining projects: Awareness gaps between companies and communities; skill gaps and capacity issues in communities; Crown-Aboriginal legacy issues; socio-economic conditions; health, education, and social issues; land tenure uncertainties; jurisdictional issues and unsettled land claims; government resource revenue sharing; resource benefit sharing; and, the duty-to-consult challenges across Canada.[135] Now that the Government of Canada has signaled that it would support the UN Declaration on the Rights of Indigenous People (UNDRIP) – including the principle of free, prior and informed consent (FPIC) – witnesses stated that more clarity is needed on what is expected of mining companies in terms of Indigenous consultation.[136] In the words of Mr. Mullally, Canada needs “a principled framework that aligns interests for industry, First Nations, and government, and that potentially get people to a better understanding, a consensus, over what projects work and don’t work.”[137] Sean Willy of Des Nedhe Development explained that Indigenous people want to be treated as partners and are generally supportive of environmentally sound resource development. He stated: Our communities want to ensure that their views and inputs are incorporated throughout the development of mineral resources, especially when it comes to environmental planning, monitoring, and into decommissioning. The bottom line is that Indigenous communities will support mining development, but not at the expense of a poor environmental stewardship plan.[138] Moreover, witnesses said that companies must communicate early, often, and transparently with Indigenous communities.[139] The Committee heard that good industry-community relations require meaningful engagement,[140] and that companies should be open to modifying their development plans in order to address Indigenous concerns adequately.[141] In reference to the growing legal framework for Indigenous participation in resource development decisions, both in Canada and internationally, Mr. Rae told the Committee that “[we are] living in a world in which the question of how to successfully engage First Nations is the key to future resource development.”[142] DEVELOPING A SKILLED LABOUR FORCEThe Committee heard that developing a skilled labour force is a prerequisite for a competitive mining industry. According to Richard Paquin of Unifor, the skilled trades across Canada will be 80,000 workers short of demand within the next five years.[143] On the other hand, certain groups, namely women and Indigenous people have long been underrepresented in the mining sector.[144] Indigenous people may have more difficulty acquiring mining jobs because of barriers to attaining educational and training opportunities. For example, Peter Hollings of Lakehead University explained that many Indigenous youth have difficulty getting through high school; their main challenge is “not getting through university, it’s getting to university.” [145] Indeed, according to Mr. Sleep, of the first year intake of 22 students in the University of Toronto’s mining engineering program, not one is an Indigenous person.[146] Similarly, Mr. Pakalnis – who told the Committee of his school’s pride to have graduated Canada’s only Indigenous Ph.D. mining engineer last year – thinks there should be far more Indigenous students in post-secondary mining programs across Canada.[147] In light of these challenges, witnesses described two strategies for increasing the number of Indigenous people working in mining: 1) targeting Indigenous students at all levels from early childhood through to post-secondary to develop the knowledge and skills that will be in demand by the sector in the future, and 2) training local Indigenous populations to develop the skills needed in the sector today.[148] Glenn Nolan of Noront Resource Ltd. argued that addressing these elements would: [Lay] a foundation for building awareness of the industry and building trust within the community. It showcases the importance of continuing education for students, not just for mining jobs but for the opportunities advanced education allows. […] Any time you put people to work, you're creating a legacy, you're building skills, you're building knowledge, and you're building experience they can take elsewhere, if that's the opportunity and that's their desire in the future. […] In regard to sustainability, while the ore resource might be diminished or taken away, what you have is a group of trained individuals and companies that can then provide opportunities elsewhere, or go elsewhere for the same kind of work, or deliver the same kind of service. Some witnesses called for the federal government to increase funding for on-reserve schooling by matching the provincial funding and removing the 2% per year cap on Indigenous education funding.[149] Other witnesses called for post-secondary recruitment programs and incentives that aim to increase the intake of Indigenous students to mining programs.[150] Finally, some witnesses recommended targeted programs that expose Indigenous students to mining careers from an early age – from kindergarten through to secondary school.[151] The Committee also heard of existing opportunities for Indigenous adults to continue their education and develop qualifications for potential employment in the mining sector. The Aboriginal Skills and Employment Training Strategy and the Skills and Partnership Fund are examples of such programs, administered by Employment and Social Development Canada.[152] Furthermore, some IBAs contain provisions that require companies to provide scholarships to Indigenous students for post-secondary education.[153] The Committee also heard about educational partnerships that address the specific needs of the industry and Indigenous communities, such as the partnership between Noront Resources Ltd., the Matawa First Nations Employment and Training Services, and Confederation College in Thunder Bay that provides professional development training and advice to members of Matawa communities with interest in mining careers.[154] RECOMMENDATIONSBased on the evidence presented in the previous sections, the Committee recommends the following: 1. The Committee recommends that the Government of Canada continue to encourage investment in mining exploration activities:

2. The Committee recommends that the Government of Canada work in collaboration with industry, Indigenous governments and communities, and provincial/territorial governments to develop the infrastructure needed to enable and/or facilitate exploration and development activities in northern and remote regions with mineral resource potential. 3. The Committee recommends that the Government of Canada work in collaboration with industry, Indigenous governments and communities, and provincial/territorial governments to provide more clarity with regards to land access and tenure in northern regions with high mineral potential:

4. The Committee recommends that the Government of Canada work with provincial, territorial and Indigenous governments to streamline and simplify Canada’s regulatory and environmental assessment (EA) process. At the same time, the government must ensure that Canada’s regulatory process continue to minimize the environmental impacts of mining projects as much as possible, based on scientific evidence and, following robust stakeholder consultations, reflecting the interests of local and Indigenous communities. 5. The Committee recommends that the Government of Canada work with the provinces and territories to create a pan-Canadian framework on pricing carbon pollution to ensure that industry is provided with certainty, stability and clarity, while driving innovation in the mining sector. 6. The Committee recommends that the Government of Canada provide further support for innovation, clean technology and clusters in the mining sector by continuing to invest in R&D and innovation initiatives in the sector, especially the work of industry-led organizations such as the Canada Mining Innovation Council (CMIC) and the Centre of Excellence in Mining Innovation (CEMI). 7. The Committee recommends that the Government of Canada work in collaboration with industry, Indigenous governments and communities, and provincial/territorial governments to create a framework for a clear and consistent process and protocol for Indigenous consultation and participation. 8. The Committee recommends that the Government of Canada address the socioeconomic barriers that hinder the ability of Indigenous peoples to participate meaningfully in resource development decisions:

9. The Committee recommends that the Government of Canada work in collaboration with industry, Indigenous governments and communities, and provincial/territorial governments to improve mining education and skills training opportunities, especially for women and Indigenous peoples. 10. Finally, the Committee recommends that the Government of Canada work with industry, Indigenous governments and communities, provincial/territorial governments, as well as international governments and organizations to promote and improve responsible mining practices in Canada and abroad by ensuring that enough financial securities are available to conduct environmental reclamation effectively regardless of the profitability of mining projects and in cases of unexpected spills or accidents. [1] Standing Committee on Natural Resources (RNNR), Evidence, 1st Session, 42nd Parliament, 6 June 2016 (Marian Campbell Jarvis, Assistant Deputy Minister, Minerals and Metals Sector, Department of Natural Resources). [2] Mining Association of Canada, Facts & Figures of the Canadian Mining Industry 2015. [3] RNNR, Evidence, 1st Session, 42nd Parliament, 22 September 2016 (Andrew Cheatle, Executive Director, Prospectors and Developers Association of Canada). [4] RNNR, Evidence, 1st Session, 42nd Parliament, 18 October 2016 (Richard Paquin, Mining Director, Unifor). [5] RNNR, Evidence, 1st Session, 42nd Parliament, 3 November 2016 (Peter Hollings, Director, Centre of Excellence for Sustainable Mining and Exploration, Lakehead University). [6] RNNR, Evidence, 1st Session, 42nd Parliament, 27 September 2016 (Pamela Schwann, President, Saskatchewan Mining Association). [8] RNNR, Evidence, 1st Session, 42nd Parliament, 25 October 2016 (Vic Pakalnis, President and Chief Executive Officer, Mirarco Mining Innovation). [10] Ibid. [11] RNNR, Evidence, 1st Session, 42nd Parliament, 18 October 2016 (Carl Weatherell, Executive Director and Chief Executive Officer, Canada Mining Innovation Council). [13] Ibid. [14] Ibid. [15] RNNR, Evidence, 1st Session, 42nd Parliament, 29 September 2016 (Dale Austin, Manager, Government Relations, Cameco Corporation). [16] RNNR, Evidence, 1st Session, 42nd Parliament, 1 November 2016 (Trent Mell, President and Head of Mining, PearTree Financial Services). [22] RNNR, Evidence, 1st Session, 42nd Parliament, 1 November 2016 (Ugo Lapointe, Canadian Program Coordinator, MiningWatch Canada). [23] RNNR, Evidence, 1st Session, 42nd Parliament, 22 September 2016 (Joe Campbell, Director, Northwest Territories and Nunavut Chamber of Mines); Evidence (Cheatle, PDAC). [25] RNNR, Evidence, 1st Session, 42nd Parliament, 1 November 2016 (Jason Batise, Executive Director, Wabun Tribal Council); RNNR, Evidence, 1st Session, 42nd Parliament, 22 September 2016 (Pierre Gratton, President and Chief Executive Officer, Mining Association of Canada). [26] RNNR, Evidence, 1st Session, 42nd Parliament, 27 October 2016 (Hon. Bob Rae, Partner, Olthuis Kleer Townsend). [27] RNNR, Evidence, 1st Session, 42nd Parliament, 1 November 2016 (Ken Neumann, National Director for Canada, United Steelworkers). [28] Ibid. [29] RNNR, Evidence, 1st Session, 42nd Parliament, 4 October 2016 (Brian St. Louis, Manager, Governement affairs, Avalon Advanced Materials Inc.). [31] RNNR, Evidence, 1st Session, 42nd Parliament, 22 September 2016 (Christopher Zahovskis, President and Chief Executive Officer, Northcliff Resources Ltd.). [32] RNNR, Evidence (Pakalnis, Mirarco Mining Innovation); RNNR, Evidence, 1st Session, 42nd Parliament, 27 October 2016 (Frank Smeenk, President and Chief Executive Officer, KWG Resources Inc.); RNNR, Evidence, 1st Session, 42nd Parliament, 20 October 2016 (Iain Angus, Vice-president, Northwestern Ontario Municipal Association). [33] RNNR, Evidence, 1st Session, 42nd Parliament, 20 October 2016 (Gavin Dirom, President and Chief Executive Officer, Association for Mineral Exploration British Columbia; and John Mason, Project Manager, Mining Services, Thunder Bay Community Economic Development Commission); Evidence (Angus, Northwestern Ontario Municipal Association). [39] RNNR, Evidence, 1st Session, 42nd Parliament, 27 September 2016 (John Mullally, Director of Government Relations and Energy, Goldcorp Inc.); Evidence (Cheatle, PDAC); Evidence (Weatherell, CMIC); Evidence (Pakalnis, Mirarco Mining Innovation); Evidence (Mason, Thunder Bay Community Economic Development Commission). [40] RNNR, Evidence (Mullally, Goldcorp); Evidence (Mason, Thunder Bay Community Economic Development Commission); Evidence (Pakalnis, Mirarco Mining Innovation). [43] RNNR, Evidence (Pakalnis, Mirarco Mining Innovation); Evidence (Mullally, Goldcorp); Evidence (Cheatle, PDAC). [46] RNNR, Evidence (Gratton, Mining Association of Canada); Evidence (St. Louis, Avalon Advanced Materials). [47] RNNR, Evidence (St. Louis, Avalon Advanced Materials); Evidence (Schwann, Saskatchewan Mining Association); Evidence (Cheatle, PDAC); Evidence (Dirom, Association for Mineral Exploration British Columbia). [50] RNNR, Evidence, 1st Session, 42nd Parliament, 27 October 2016 (Ryan McEachern, Managing Director, Canadian Association of Mining Equipment and Services for Export); Evidence (Mason, Thunder Bay Community Economic Development Commission RNNR, Evidence (Dirom, Association for Mineral Exploration British Columbia); Evidence (St. Louis, Avalon Advanced Materials); Evidence (Schwann, Saskatchewan Mining Association); Evidence (Cheatle, PDAC). [51] RNNR, Evidence (Schwann, Saskatchewan Mining Association); Evidence (Mason, Thunder Bay Community Economic Development Commission). [52] RNNR, Evidence (McEachern, Canadian Association of Mining Equipment and Services for Export); Evidence (Gratton, Mining Association of Canada); RNNR, Evidence, 1st Session, 42nd Parliament, 29 September 2016 (Gregory Bowes, Chief Executive Officer, Northern Graphite Corporation). [55] RNNR, Evidence (Schwann, Saskatchewan Mining Association); Evidence (Austin, Cameco Corporation). [56] RNNR, Evidence, 1st Session, 42nd Parliament, 22 September 2016 (Susanna Cluff-Clyburne, Director, Parliamentary Affairs, Canadian Chamber of Commerce). [57] RNNR, Evidence, 1st Session, 42nd Parliament, 29 September 2016 (Ross Beaty, Chairman, Pan American Silver Corporation). [60] Ibid. [61] RNNR, Evidence, 1st Session, 42nd Parliament, 25 October 2016 (Mike McDougall, President, Klondike Placer Miners' Association). [63] RNNR, Evidence (Bowes, Northern Graphite Corporation); Evidence (Mason, Thunder Bay Community Economic Development Commission). [64] RNNR, Evidence (Austin, Cameco Corporation); Evidence (Bowes, Northern Graphite Corporation); Evidence (McDougall, Klondike Placer Miners' Association); Evidence (McEachern, Canadian Association of Mining Equipment and Services for Export); Evidence (Zahovskis, Northcliff Resources); Evidence (Gratton, Mining Association of Canada). [66] Ibid. [70] RNNR, Evidence (Beaty, Pan American Silver); RNNR, Evidence, 1st Session, 42nd Parliament, 18 October 2016 (Jean Robitaille, Chair, Canada Mining Innovation Council); Evidence (Austin, Cameco Corporation). [73] RNNR, Evidence (Robitaille, CMIC); Evidence (Angus, Northwestern Ontario Municipal Association); Evidence (Mason, Thunder Bay Community Economic Development Commission); Evidence (McDougall, Klondike Placer Miners' Association). [75] RNNR, Evidence (Angus, Northwestern Ontario Municipal Association); Evidence (Mason, Thunder Bay Community Economic Development Commission). [76] RNNR, Evidence (Beaty, Pan American Silver); Evidence (Bowes, Northern Graphite Corporation); Evidence (Dirom, Association for Mineral Exploration British Columbia); Evidence (McDougall, Klondike Placer Miners' Association). [77] Ibid. [81] RNNR, Evidence, 1st Session, 42nd Parliament, 4 October 2016 (Sarah Fedorchuk, Senior Director, Public Affairs, Mosaic). [84] RNNR, Evidence (Pakalnis, Mirarco Mining Innovation); Evidence (Weatherell, CMIC); RNNR, Evidence, 1st Session, 42nd Parliament, 3 November 2016 (Douglas Morrison, President and Chief Executive Officer, Centre for Excellence in Mining Innovation). [87] RNNR, Evidence, 1st Session, 42nd Parliament, 1 November 2016 (Richard Adamson, President, CMC Research Institutes). [90] Ibid. [92] RNNR, Evidence, 1st Session, 42nd Parliament, 25 October 2016 (Harold Gibson, Professor and Metal Earth Director, Mineral Exploration Research Centre, Laurentian University of Sudbury). [95] RNNR, Evidence, 1st Session, 42nd Parliament, 18 October 2016 (Brent Sleep, Professor, Department of Civil Engineering, University of Toronto). [96] RNNR, Evidence, 1st Session, 42nd Parliament, 3 November 2016 (Ginny Flood, Vice-President, Government Relations, Suncor Energy Inc.). [98] RNNR, Evidence, 1st Session, 42nd Parliament, 4 October 2016 (Magdi Habib, Director General, CanmetMINING, Minerals and Metals Sector, Department of Natural Resources). [109] Ibid. [112] Ibid. [116] Ibid. [118] RNNR, Evidence, 1st Session, 42nd Parliament, 3 November 2016 (Roussos Dimitrakopoulos, Professor, Mining and Materials Engineering Department, McGill University). [121] RNNR, Evidence (Rae, Olthuis Kleer Townsend); RNNR, Evidence, 1st Session, 42nd Parliament, 27 October 2016 (Sheilagh Murphy, Assistant Deputy Minister, Lands and Economic Development, Department of Indian Affairs and Northern Development). [123] RNNR, Evidence (Batise, Wabun Tribal Council); Evidence (Gratton, Mining Association of Canada). [124] RNNR, Evidence, 1st Session, 42nd Parliament, 3 November 2016 (Michael Fox, Co-Chair, Aboriginal Affairs Committee, Prospectors and Developers Association of Canada). [126] Ibid. [127] RNNR, Evidence (Fox, PDAC); Evidence (Murphy, Department of Indian Affairs and Northern Development); Evidence (Gratton, Mining Association of Canada). [130] RNNR, Evidence, 1st Session, 42nd Parliament, 27 October 2016 (Stephen Van Dine, Assistant Deputy Minister, Northern Affairs Organization, Department of Indian Affairs and Northern Development); Evidence (Willy, Des Nedhe Development); Evidence (Schwann, Saskatchewan Mining Association); Evidence (Zahovskis, Northcliff Resources). [131] RNNR, Evidence (St. Louis, Avalon Advanced Materials); Evidence (Zahovskis, Northcliff Resources); Evidence (Rae, Olthuis Kleer Townsend); Evidence (Mullally, Goldcorp); Evidence (Fox, PDAC); Evidence (Murphy, Department of Indian Affairs and Northern Development); Evidence (Cluff-Clyburne, Canadian Chamber of Commerce). [134] Ibid. [135] Ibid. [136] RNNR, Evidence (St. Louis, Avalon Advanced Materials); Evidence (Rae, Olthuis Kleer Townsend); Evidence (Mullally, Goldcorp); Evidence (Schwann, Saskatchewan Mining Association). [139] RNNR, Evidence (Fox, PDAC); Evidence (Mason, Thunder Bay Community Economic Development Commission); Evidence (Batise, Wabun Tribal Council); Evidence (St. Louis, Avalon Advanced Materials); Evidence (Hollings, Lakehead University). [140] RNNR, Evidence (Batise, Wabun Tribal Council); Evidence (Fox, PDAC); Evidence (Willy, Des Nedhe Development); RNNR, Evidence, 1st Session, 42nd Parliament, 3 November 2016 (Glenn Nolan, Vice-president of Government Affairs, Noront Resources Ltd.); Evidence (Rae, Olthuis Kleer Townsend); RNNR, Evidence (Mullally, Goldcorp). [148] RNNR, Evidence (Nolan, Noront Resources); Evidence (Batise, Wabun Tribal Council); Evidence (Pakalnis, Mirarco Mining Innovation); Evidence (Gibson, Laurentian University of Sudbury). [150] RNNR, Evidence (Batise, Wabun Tribal Council); Evidence (Willy, Des Nedhe Development); Evidence (Pakalnis, Mirarco Mining Innovation); Evidence (Gibson, Laurentian University of Sudbury). |