RNNR Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

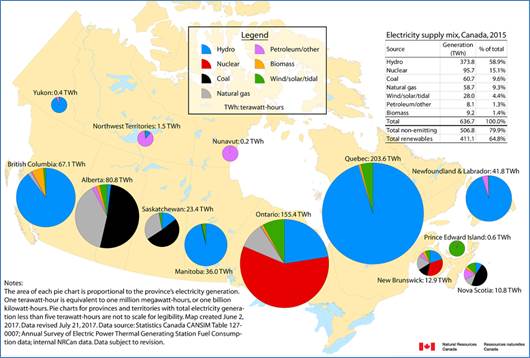

STRATEGIC ELECTRICITY INTERTIESINTRODUCTIONAffordable, reliable electricity is critical for the sustainability of the Canadian economy and way of life.[1] As shown in Figure 1, the electricity generation portfolio of each province and territory varies, both in terms of the volume of electricity generated and the fuel sources used. Canada, which has significant hydroelectric resources, has one of the highest proportions of electricity generated from renewable or non‑greenhouse gas (GHG) emitting sources in the world, with renewable sources and non‑GHG emitting sources accounting for 65% and 80% of Canada’s electricity generation respectively.[2] Several jurisdictions however, rely heavily on GHG‑intensive fuel sources like coal, diesel, and/or natural gas. Figure 1 – Canada's Electricity Supply Mix, 2015

Source: Natural Resources Canada, Submission, 20 September 2017. Witnesses described the current period as one of rapid innovation and transformation in the electricity sector, as electrical technology has become increasingly digital, distributed, and local.[3] The Committee heard that current investments in the sector, which have averaged $20 billion a year in Canada since 2012,[4] are transforming electricity operations and markets by offering more tools for managing and selling transmission, generation, storage, distribution, and demand. For example, Chris Benedetti of Sussex Strategy Group described how “new technologies, products, and services have been emerging at an incredible pace, challenging conventional notions of how we supply and we use electricity.”[5] Rapid declines in the prices of renewable energy and storage technologies have contributed to their increasing rate of adoption, in Canada and worldwide, at multiple scales.[6] Utility providers are digitalizing the electric system and giving grid operators a certain amount of control over distribution and end-use demand management.[7] Furthermore, the Committee heard that the Pan-Canadian Framework on Clean Growth and Climate Change describes electricity as “the cornerstone of a modern, clean growth economy.”[8] Several witnesses explained that, in addition to the broad trends discussed above, federal, provincial and territorial climate policy is driving reform in Canada’s electricity markets.[9] In particular, three government climate policy measures are leading to electric system reforms:[10]

In light of these changes, the Committee invited a wide range of experts from government, industry, academia and civil society to discuss strategic electricity interties. This report presents the Committee’s findings according to four themes: 1) Canada’s electricity transmission interties; 2) opportunities to strengthen Canada’s interties; 3) enhanced regional cooperation; and 4) recommendations to the Government of Canada. The Committee is pleased to present its report, which concludes its study on strategic electricity interties. CANADA’S ELECTRICITY TRANSMISSION INTERTIES

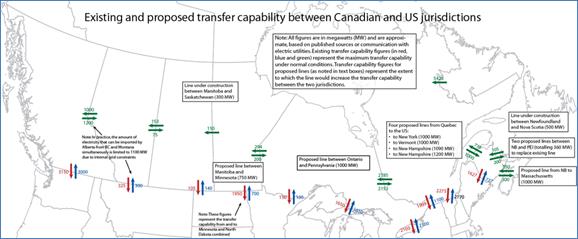

As Figure 2 demonstrates, Canada’s electricity transmission interties are stronger north-south than east-west, and there are currently six proposed interties to increase electricity trade with U.S. markets.[17] David Cormie of Manitoba Hydro explained that “large hydro utilities such as Manitoba Hydro, BC Hydro, Hydro-Québec, and – in the past – Ontario Hydro […], usually have large hydro surpluses to market, and have optimized the development of their systems in conjunction with investments in large interconnections to the United States.”[18] Several witnesses discussed how, in the past, east-west interties on a similar scale have not been economically viable, or provided enough benefits to utilities to justify.[19] Some provinces, like Quebec and Ontario can transfer very large volumes of electricity in both directions, while other jurisdictions, notably Saskatchewan and the three territories, have small or even no intertie capacity. Figure 2 – Existing and Proposed Transfer Capability between Canadian and U.S. Jurisdictions

Source: Natural Resources Canada, Submission, 20 September 2017. Canada is a net exporter of electricity to the United States.[20] Electricity exports to U.S. markets have generally increased in recent years, even as the price received for Canadian electricity has fallen because of low natural gas prices in the U.S.[21] Provinces have continuously augmented their export capacity to U.S. states on a bilateral basis,[22] while east-west interties also benefited exports by providing provinces with more ways to access U.S. markets.[23] Wayne Stensby of ATCO Group explained that from his company’s perspective, “interties that connect us east to west and allow the provinces to be more interconnected, and then through to the U.S. for export, provide additional opportunities.”[24] A. Assessing the Need for New Intertie InvestmentsTransmission interties are one tool among many used by electric system planners to manage the grid. Transmission interoperates with the other parts of the electric system, including generation, storage, distribution, and end-use demand management, meaning that the decision to develop interties (or any other electric asset) has consequential effects on the rest of the system.[25] Given the long-lived nature of electric infrastructure and the rapidly lowering cost of renewable and storage technologies, Patrick Bateman of the Canadian Solar Industries Association argued that governments should “take into account current and realistic future pricing” when making investment decisions in individual projects.[26] Dr. Handan Tezel, representing the Ontario Society of Professional Engineers, emphasized that any decisions on interties should be made with attention to the electricity market reforms taking place across North America, which “are evolving toward a design that includes separate markets for energy, capacity, ancillary services, transmission, and distribution.”[27] B. Potential Benefits of Increased IntertiesMany witnesses discussed the potential benefits of increased interties between provinces and with the United States. According to these witnesses, a primary benefit is that exporting surplus electricity creates economic development opportunities for the generating jurisdiction,[28] while providing cheaper electricity to the importing jurisdiction. In that regard, Derek Stenclik of General Electric stated that interties enable “lower-cost resources in one region to offset more expensive or less efficient generation in other regions.”[29] To illustrate this point, Mike MacDougall of Powerex explained that the B.C.-Alta. intertie enables his company to import inexpensive surplus electricity from Alberta at night, and then export electricity back to Alberta during times of peak demand in that province.[30] He explained that this is an advantageous economic solution for both provinces because British Columbia can profit off the price arbitrage between regions, while Alberta can import electricity when it needs it the most, at a price that is less expensive than what it would otherwise cost to run an Alberta generation plant for a few hours to satisfy peak demand.[31] Another important potential benefit of increased interties that witnesses highlighted to the Committee is that interties complement high penetrations of variable renewable electricity by enabling jurisdictions to trade surplus renewable generation with other markets when output is high, and to import electricity when output is low.[32] Renewable energy sources like hydroelectricity, wind, solar, and tidal are naturally variable on different time scales: for example, hydroelectricity capacity is reduced in winter; wind typically blows stronger at night and during the winter; solar can only produce during the day, and produces more on sunny days; and tidal capacity varies predictably according to the coming and going of the tides. Using interties to increase the breadth of the grid helps smooth out the supply from the natural variability of these renewable energy sources, reducing the need for backup generation capacity and lowering overall costs.[33] Interties are also beneficial for avoiding the curtailment, or spillage, of renewable electricity (see box),[34] and can enable the use of hydroelectric resources in British Columbia, Manitoba, Newfoundland & Labrador, and Quebec as energy storage reservoirs for neighbouring systems. Interties are also useful for enabling the import of clean electricity to displace fossil fuel-fired electricity.[35] For example, several witnesses, including Jerry Mossing of the Alberta Electric System Operator discussed how Alberta could import surplus clean electricity from British Columbia to displace its coal-fired electricity.[36] Tom Bechard of Powerex explained that in light of carbon competitiveness regulations in Alberta that will come into force in January 2018, which will “raise the price of coal generation there relative to other sources” there will be additional incentive for Alberta to import electricity from British Columbia. Mike Marsh of SaskPower and Mark Sidebottom of Nova Scotia Power, two other coal-dependent provinces, also discussed similar opportunities to displace coal electricity in their province by importing clean electricity from neighbouring provinces over interties. Interties can also be used to defer capital cost investments into additional generation capacity needed to satisfy peak demand.[37] Wayne Stensby of ATCO Group explained that “interties enable provinces and territories to share capacity and meet the wave of peak demand as it moves from the east to the west across our regions. Provinces and territories could avoid the use of more expensive peaking plants that are presently in place today or wouldn't need to be in place in the future.”[38] Furthermore, interties provide ancillary grid services that are valuable to grid operators. Such ancillary services are technical functions that are needed for an electric system to run reliably, including functions like providing voltage and frequency regulation, regulating flexible reserves to better manage the variable load of wind and solar resources, and building resilience into the grid so that the system can recover from outages more quickly.[39] According to some witnesses, including Dr. Handan Tezel, market reforms taking place at the present time, as noted above, are creating incentives to encourage investment in these areas.[40] Because other technologies like storage, distributed generation, smart grids, and smart appliances can also provide ancillary services, interties would compete with these technologies in ancillary service markets.[41]

C. Potential Challenges of Increased IntertiesWitnesses also raised several challenges of increasing transmission interties between provinces and with the United States, including:

OPPORTUNITIES TO STRENGTHEN CANADA’S INTERTIE CAPACITYThroughout the course of its study, the Committee heard about different opportunities to interconnect regions with interties. A summary of these opportunities, including witnesses’ remarks about the challenges and opportunities that give rise to them follows. A. Western CanadaThere are several opportunities to better interconnect the western provinces, which arise due to the phase out of coal-electricity in Alberta and Saskatchewan, and the resource mix of the western provinces.[54] One opportunity would be to strengthen the existing intertie between British Columbia and Alberta, which is currently operating under capacity,[55] but which could provide the flexible baseload capacity needed for Alberta to manage its transition off coal and integrate high volumes of variable renewable electricity.[56] As Alberta phases out coal, Niall O’Dea of NRCan stated, it “will require a combination of new wind and solar generation as well as dispatchable resources such as hydro, natural gas, or imports from neighbouring provinces. Natural gas is currently the lowest cost dispatchable option, but it is likely to become [costlier] as carbon pricing is phased in.”[57] The ability of British Columbia to quickly ramp up or down hydroelectric production, and import or export surplus renewable electricity to/from Alberta, could be of benefit to both provinces, and a strengthened British Columbia to Alberta intertie would also provide a hedge against the seasonal variability of wind and hydroelectricity, which have opposing profiles in terms of seasonal capacity.[58] According to Wayne Stensby of ATCO Group, both British Columbia and Alberta could take advantage of each other’s interties with the United States to facilitate the export of clean electricity to U.S. markets, which could help finance the market reforms underway in Alberta.[59] That said, witnesses warned the Committee that the challenge of negotiating the details associated with this opportunity would be complicated, particularly given British Columbia’s planning criterion of being self-sufficient in electricity supply and Alberta’s fully privatized electricity market.[60] A similar opportunity created by the coal phase out exists between Manitoba and Saskatchewan.[61] Like British Columbia and Alberta, Manitoba has a large hydroelectricity surplus and Saskatchewan relies on coal. Saskatchewan also has its own target to source 50% of its electricity supply from renewable energy by 2030.[62] Today, Saskatchewan’s existing interties with neighbouring provinces and states are not significant.[63] Saskatchewan has good hydroelectric potential in the north, according to Malcolm Metcalfe of Enbala Power Systems, but he said that from a cost-benefit perspective, Saskatchewan would be better off developing variable renewables in the south and building interties with Manitoba.[64] David Cormie of Manitoba Hydro stated that “significantly more intertie capacity between Manitoba and Saskatchewan is critical to the achievement of integrated operations [and connection to the U.S. grid] and to maximum emission reductions in Saskatchewan.”[65] Likewise, Mike Marsh of SaskPower supports “further research and study of interties between provinces, especially between Manitoba and Saskatchewan.”[66] Mr. Cormie noted however, that: the single biggest challenge between Manitoba and Saskatchewan is funding. Manitoba's electric sector is already 100% renewable. We already have a very large and adequate interconnected capability into the United States. For us to invest half a billion dollars or a billion dollars in more transmission lines to connect to Saskatchewan doesn't bring the province any more value than we already have. To the extent that the federal government is able to fund the Manitoba portion of that transmission line, it would make it a much more viable project for Saskatchewan.[67] Another opportunity raised by Wayne Stensby of ATCO Group is to connect Alberta, Saskatchewan, and Manitoba through a high-voltage direct current transmission line. Mr. Marsh also noted the possible opportunity of strengthening the Alberta-Saskatchewan intertie.[68] B. Northern and Remote Communities in CanadaNorthern and remote communities often rely on diesel generators to meet local electricity demand. As Lisa DeMarco of DeMarco Allan explained, many northern and remote communities face “energy poverty” and have reliability issues that can be up to 20 times worse than in southern Canada.[69] Chris Benedetti of Sussex Strategy Group explained how unreliable electricity in remote communities creates public health risks (water quality management and healthcare require stable energy supply, for example), calling the situation in some communities “a crisis of energy independence.”[70] Remote and northern communities are seeking alternatives to diesel that can provide affordable and reliable energy. The Committee heard that in some select regions, which must be determined on a case-by-case basis, interties that connect remote communities to the electric grid could be a solution. For example, Mr. Benedetti spoke about Wataynikaneyap Power, “an indigenous-led, indigenous-owned entity of 22 first nation communities in the northwestern part of Ontario to connect 17 indigenous communities that are currently dependent on diesel generation [to the Ontario power grid for the first time].”[71] Another opportunity noted by Wayne Stensby of ATCO Group is to build an intertie between Alberta and the Northwest Territories.[72] However, Mike Marsh of SaskPower noted that over long distances, the “economics [of interties] break down very, very fast.”[73] Other witnesses suggested that, as opposed to building new interties, there is potentially greater opportunity for remote and northern communities to use a combination of distributed renewable generation backed up by energy storage systems, connected through local microgrids.[74] As Louis Thériault, Vice‑President of the Conference Board of Canada explained, when it comes to solving these energy problems for the north, “it’s hard to find a homogenous, blanket solution,” but that “as part of the low-carbon transition, [wind power combined with energy storage is] definitely something that needs to be considered.”[75] C. Central CanadaQuebec and Ontario already have strong electricity interconnections, which permit Quebec to transfer electricity through Ontario for sale in U.S. markets and vice versa.[76] Electricity interties are also used to balance seasonal variability of generation capacity between the provinces, respond to emergencies, to improve reliability, and to control costs (such as by deferring investment in generation).[77] According to Jim Burpee, as electrification increases demand for electricity in Ontario and Quebec, the provinces will need to work together to determine where and how to make investments in the electricity system.[78] A unique suggestion raised by James Hinds, is to increase the capacity of interties between Manitoba and Ontario, which could satisfy some demand in western Ontario.[79] According to Mr. Hinds, the independent electric system operator for Ontario has been strengthening transmission networks in the Thunder Bay region, while Manitoba has been augmenting its hydroelectric capacity, providing an opportunity to expand the capacity of the small intertie that already exists between the provinces. D. Atlantic CanadaAtlantic Canadian provinces have several opportunities to build new and strengthen existing interties. Niall O’Dea of NRCan explained that “Nova Scotia and New Brunswick face a supply gap due to the coal phase-out, and they are constrained in that area by the limited current existing natural gas infrastructure for distribution. There is not the similar network we have elsewhere in Canada. Renewable resources such as wind and solar will be able to contribute in that space, but dispatchable capacities – so, again, firm capacity like hydro and nuclear – will be required to back up those variable resources.”[80] Mr. O’Dea identified “the reinforcement of the Nova Scotia-New Brunswick intertie or interconnection as an example of a project to advance in the near term.”[81] Mark Sidebottom of Nova Scotia Power told the Committee that “new and stronger interconnections will leverage large-scale hydro assets from both Quebec and Newfoundland and Labrador, creating long-term energy sustainability for all of eastern Canada, contributing to stability in electricity prices for customers here in Canada and in the U.S. and enabling significant carbon reduction.”[82] Mr. Sidebottom discussed how Nova Scotia’s electric grid, which is “very close to islanded now,” will quickly be limited in terms of the amount of variable renewables that can be added to it unless new flexible intertie capacity is added.[83] He discussed the many benefits of the collaborative relationship that exists today between Atlantic utility providers, telling the Committee that Nova Scotia and Newfoundland & Labrador have worked together on developing the Maritime Link intertie, and that the Nova Scotia and New Brunswick utilities are “actively engaged […] to dispatch electricity generation regionally and find efficiencies together.”[84] According to Tom Adams of Tom Adams Energy, the intertie between Prince Edward Island and New Brunswick is a prime example of the benefits of interties.[85] He explained that Prince Edward Island is “not self-sufficient in electricity supply. It's far more cost-effective for them to trade extensively with their neighbours and to obtain the bulk of their electricity supply from their neighbours. There's a situation where interties are just a critical resource.”[86] E. Canada-U.S. IntertiesAs noted above, provinces have made continuous investments to enlarge north-south intertie capacity with U.S. states.[87] Jim Burpee sees new opportunities for Canadian electricity exports if provinces work together, stating that “enhanced sales of clean electricity in the U.S. market is another developing opportunity for interprovincial partnerships.”[88] Mark Sidebottom of Nova Scotia Power and Keith Cronkhite of New Brunswick Power each described how their mutual investments and collaboration on interties has enabled increased U.S. exports, and both witnesses see future collaboration as being mutually beneficial.[89] The Committee heard that U.S. demand for low-emission electricity represents an economic opportunity for Canada to capitalize on its clean electricity and create additional value for exports, while supporting climate policy goals.[90] According to Niall O’Dea of NRCan, “there have also been some key decisions in the U.S., including in the U.S. northeast, to count Canadian hydroelectricity as contributing towards their renewable portfolio standards. This has been key because it allows them to count what is clean – Canadian clean energy – as clean when contributing to meeting their own emission reduction goals.”[91] A few witnesses noted that several North American independent system operators have developed systems that enable them to track the emissions attributes of electricity all in the goal of accounting for emissions savings tagged to specific imports and exports.[92] Chris Benedetti of Sussex Strategy Group told the Committee that he expects the Ontario independent system operator to adopt such a protocol “as a matter of course.”[93] Lisa DeMarco of DeMarco Allan explained that not only would it be permissible under international trade rules to distinguish a Canadian “clean electron” from a “plain old electron,” but that Canada could “leverage the emission-reducing effect of its clean electricity exports to [the U.S], and we should be negotiating that accounting and those provisions into any agreements with the U.S.”[94] North-south interties can pose some challenges for provinces. One raised by Mike MacDougall of Powerex is that north-south interties can displace interprovincial trade, leading to underused transmission capacity and lower returns on infrastructure investment. He provided the example of the Alberta and Montana grids, which were connected by an intertie in 2013, and explained that it “ended up not changing Alberta’s overall ability to bring electricity in, but just allocated capacity that was already there with B.C. over to Montana.”[95] Another challenge raised by a few witnesses is that renewable electricity in the United States is subsidized, which creates distortionary effects in the electric systems of neighbouring provinces.[96] However, it was noted that this challenge could also be an economic opportunity for provinces with large hydroelectric capacities, which could get paid by U.S. states to store power behind their dams when renewable generation exceeds demand.[97] ENHANCED REGIONAL COOPERATIONThe Committee heard that provinces and territories have often planned their electrical systems from a provincial perspective, as opposed to on a broader regional basis.[98] Some jurisdictions have energy policies that encourage this approach; British Columbia’s self-sufficiency criterion, for example, was raised by witnesses as being exceptional for prioritizing electricity self-reliance from other provinces, except on an emergency basis.[99] Witnesses described how in some cases, provinces have not made full use of east-west interties over concerns about the equitable allocation of benefits.[100] Witnesses noted that this dynamic has produced several areas where disharmony between provinces – of regulations, market structures, technologies, and politics – has created barriers to optimizing the potential capacity of interprovincial interties.[101] In Canada, decisions regarding electricity generation, transmission, and market regulation are areas of provincial and territorial jurisdiction. According to Niall O’Dea of NRCan, “ultimately, the provinces determine the pace and scale of the development of new electricity generation and transportation assets in Canada. That's why the collaboration with the provinces and territories is the key to success.”[102] To support a collaborative approach, the federal government has launched new initiatives to help it identify and invest in strategic transmission interties, including:

Different provinces have different regulatory and market structures for electricity. For example, several provinces’ electric utilities are vertically-integrated crown corporations with high degrees of central planning, while Alberta, notably, has a fully privatized electricity market.[107] Unlike the United States, Canada does not have a national regulator to integrate Canadian electricity markets and harmonize rules between jurisdictions to facilitate interprovincial trade.[108] As such, it falls to provincial system operators to harmonize provincial rules with how electricity networks operate in the United States. Lisa DeMarco of DeMarco Allan called this “problematic,” highlighting how regulatory differences between Canadian system operators and the Federal Energy Regulatory Commission prohibit maximal exports of Canadian electricity to U.S. markets.[109] Several witnesses discussed how modernizing and harmonizing regulations through federal, provincial and territorial government engagement could be constructive.[110] For example, Chris Benedetti of Sussex Strategy Group asked: “How can the federal government work with provincial system operators to help support the integration of markets and ease the flow of electricity across those markets, particularly if it's characteristic of the type of electricity that we believe is right: low-carbon electricity to meet our needs when we need them?”[111] The challenge of maximizing the benefits of interprovincial electricity trade is not just technical, explained several witnesses, but includes policy and regulatory issues between jurisdictions.[112] “Expanding the transmission capability under the current market framework without a new commercial arrangement is unlikely to achieve the economic and environmental benefits required to justify the necessary investments in the new transmission facilities, or to equitably distribute those benefits between the provinces,” argued Tom Bechard of Powerex.[113] Similarly, Wayne Stensby of ATCO Group called interjurisdictional regulatory cooperation “the crux of the question” of building interties, arguing that, “it's really where the work needs to be done to establish, number one, who would fund the interties and how they would get funded, and number two, how the electricity that's transferred across them is managed and marketed into these disparate marketing entities.”[114] Lisa DeMarco of DeMarco Allan recommended that the federal government consider whether a “provincially led, federally supported, industry staffed committee to work through in a co-operative federalist manner how to maximize clean energy exports” is warranted.[115] [1] The House of Commons Standing Committee on Natural Resources (RNNR), Evidence, 1st Session, 42nd Parliament, 18 October 2017 (Wayne Stensby, Managing Director, Electricity, ATCO Group). [2] RNNR, Evidence, 1st Session, 42nd Parliament, 20 September 2017 (Niall O'Dea, Director General, Electricity Resources Branch, Energy Sector, Natural Resources Canada). [3] RNNR, Evidence, 1st Session, 42nd Parliament, 2 October 2017 (Jim Burpee, as an individual); RNNR, Evidence, 1st Session, 42nd Parliament, 23 October 2017 (John Matthiesen, Vice-President, Power and New Energy, Advisian Americas, WorleyParsons); RNNR, Evidence, 1st Session, 42nd Parliament, 16 October 2017 (Lisa DeMarco, Senior Partner, DeMarco Allan); Evidence (Stensby, ATCO Group); RNNR, Evidence, 1st Session, 42nd Parliament, 25 October 2017 (Benoit Marcoux, Executive Advisor, System Reliability and Sustainability, S & C Electric); RNNR, Evidence, 1st Session, 42nd Parliament, 16 October 2017 (Chris Benedetti, Principal, Energy and Environment Practice, Sussex Strategy Group Inc.); RNNR, Evidence, 1st Session, 42nd Parliament, 25 October 2017 (François Vitez, Chair, Federal Initiatives Committee, Energy Storage Canada); RNNR, Evidence, 1st Session, 42nd Parliament, 30 October 2017 (Rocco Delvecchio, Vice‑President, Government Affairs, Siemens Canada Limited). [6] Evidence (Delvecchio, Siemens Canada Limited); RNNR, Evidence, 1st Session, 42nd Parliament, 25 September 2017 (Robert Hornung, President, Canadian Wind Energy Association); RNNR, Evidence, 1st Session, 42nd Parliament, 27 September 2017 (Patrick Bateman, Director of Policy and Market Development, Canadian Solar Industries Association). [7] RNNR, Evidence, 1st Session, 42nd Parliament, 30 October 2017 (Judith Bossé, Director General, Innovation and Energy Technology Sector, CanmetENERGY-Varennes, Natural Resources Canada); Evidence (Delvecchio, Siemens Canada Limited); RNNR, Evidence, 1st Session, 42nd Parliament, 25 September 2017 (Etienne Lecompte, President, PowerHub). [9] Evidence (Burpee, as an individual); Evidence (Marcoux, S & C Electric); RNNR, Evidence, 1st Session, 42nd Parliament, 18 October 2017 (Brian Vaasjo, President and Chief Executive Officer, Capital Power Corporation); Evidence (DeMarco, DeMarco Allan); RNNR, Evidence, 1st Session, 42nd Parliament, 16 October 2017 (Louis Thériault, Vice-President, Industry Strategy and Public Policy, Conference Board of Canada); RNNR, Evidence, 1st Session, 42nd Parliament, 4 October 2017 (Paul Acchione, Past President, Energy Task Force Member, Ontario Society of Professional Engineers); RNNR, Evidence, 1st Session, 42nd Parliament, 18 October 2017 (Shelley Milutinovic, Chief Economist, National Energy Board); RNNR, Evidence, 1st Session, 42nd Parliament, 25 September 2017 (Jerry Mossing, Vice-President, Transmission, Alberta Electric System Operator). [10] Evidence (O’Dea, NRCan); RNNR, Evidence, 1st Session, 42nd Parliament, 2 October 2017 (Marvin Shaffer, Adjunct Professor, Simon Fraser University); Evidence (Mossing, Alberta Electric System Operator); RNNR, Evidence, 1st Session, 42nd Parliament, 20 September 2017 (Mark Sidebottom, Chief Operating Officer, Utility, Nova Scotia Power Inc.); RNNR, Evidence, 1st Session, 42nd Parliament, 30 October 2017 (Mike Marsh, President and Chief Executive Officer, SaskPower); RNNR, Evidence, 1st Session, 42nd Parliament, 25 September 2017 (Keith Cronkhite, Senior Vice-President, Business Development and Strategic Planning, New Brunswick Power Corporation); Evidence (Vaasjo, Capital Power); Evidence (Thériault, Conference Board of Canada); Evidence (Milutinovic, National Energy Board); Evidence (Acchione, Ontario Society of Professional Engineers); RNNR, Evidence, 1st Session, 42nd Parliament, 2 October 2017 (Nicholas Martin, Policy Analyst, Canada West Foundation). [13] Evidence (Sidebottom, Nova Scotia Power Inc.); Evidence (Marsh, SaskPower); Evidence (Cronkhite, New Brunswick Power). [14] Evidence (O’Dea, NRCan); Evidence (Vitez, Energy Storage Canada); Evidence (Burpee, as an individual); Evidence (Thériault, Conference Board of Canada); RNNR, Evidence, 1st Session, 42nd Parliament, 2 October 2017 (Marc Brouillette, Principal Consultant, Strategic Policy Economics); Evidence (Bateman, Canadian Solar Industries Association). [19] Evidence (Thériault, Conference Board of Canada); RNNR, Evidence, 1st Session, 42nd Parliament, 25 September 2017 (Steve Coupland, Senior Advisor, Regulatory Affairs, Bruce Power); RNNR, Evidence, 1st Session, 42nd Parliament, 20 September 2017 (David Cormie, Director, Wholesale Power and Operations, Manitoba Hydro); RNNR, Evidence, 1st Session, 42nd Parliament, 23 October 2017 (Derek Stenclik, Manager, Power Systems Strategy, General Electric). [21] Evidence (Acchione, Ontario Society of Professional Engineers); Evidence (Martin, Canada West Foundation); Evidence (Brouillette, Strategic Policy Economics); RNNR, Evidence, 1st Session, 42nd Parliament, 2 October 2017 (James Hinds, as an individual). [23] Evidence (Stensby, ATCO Group); RNNR, Evidence, 1st Session, 42nd Parliament, 27 September 2017 (Bryson Robertson, Adjunct Professor, Institute of Integrated Energy Systems, University of Victoria); Evidence (Hinds, as an individual). [27] RNNR, Evidence, 1st Session, 42nd Parliament, 4 October 2017 (Handan Tezel, Professor, Chemical and Biological Engineering, Faculty of Engineering, University of Ottawa, Energy Task Force Member, Ontario Society of Professional Engineers). [28] Evidence (Cormie, Manitoba Hydro); Evidence (Hinds, as an individual); RNNR, Evidence, 1st Session, 42nd Parliament, 16 October 2017 (Mike MacDougall, Director, Trade Policy, Powerex); Evidence (Robertson, University of Victoria). [32] Evidence (Stenclik, General Electric); Evidence (Mossing, Alberta Electric System Operator); Evidence (O’Dea, NRCan); Evidence (Bateman, Canadian Solar Industries Association); Evidence (Robertson, University of Victoria); RNNR, Evidence, 1st Session, 42nd Parliament, 16 October 2017 (Tom Bechard, Managing Director, Gas and Canadian Power, Powerex); Evidence (Stensby, ATCO Group); Evidence (Martin, Canada West Foundation); Evidence (Benedetti, Sussex Strategy Group); Evidence (Cormie, Manitoba Hydro); Evidence (Coupland, Bruce Power). [35] Evidence (Tezel, Ontario Society of Professional Engineers); Evidence (Shaffer, Simon Fraser University); Evidence (Bechard, Powerex). [36] Evidence (Mossing, Alberta Electric System Operator); Evidence (Shaffer, Simon Fraser University); Evidence (Bechard, Powerex). [37] Evidence (Stenclik, General Electric); Evidence (Stensby, ATCO Group); Evidence (Hinds, as an individual). [40] Evidence (Vitez, Energy Storage Canada); Evidence (Marcoux, S& C Electric); Evidence (Acchione, Ontario Society of Professional Engineers); Evidence (Tezel, Ontario Society of Professional Engineers); Evidence (Bateman, Canadian Solar Industries Association); Evidence (Stenclik, General Electric); Evidence (DeMarco, DeMarco Allan); Evidence (Brouillette, Strategic Policy Economics). [41] Evidence (Vitez, Energy Storage Canada); Evidence (Bateman, Canadian Solar Industries Association); Evidence (Acchione, Ontario Society of Professional Engineers); Evidence (Bossé, NRCan). [43] Evidence (Fox, National Energy Board); Evidence (Marsh, SaskPower); Evidence (Cronkhite, New Brunswick Power). [44] Evidence (Cormie, Manitoba Hydro); Evidence (Burpee, as an individual); Evidence (Thériault, Conference Board of Canada). [46] Evidence (Stensby, ATCO Group); Evidence (Vaasjo, Capital Power); RNNR, Evidence, 1st Session, 42nd Parliament, 4 October 2017 (Jocelyn Bamford, Founder and Vice-President, Automatic Coating Limited, Coalition of Concerned Manufacturers and Businesses of Ontario); Evidence (Stenclik, General Electric). [50] Evidence (Marcoux, S & C Electric); Evidence (Matthiesen, WorleyParsons); Evidence (DeMarco, DeMarco Allan); Evidence (Benedetti, Sussex Strategy Group). [54] Evidence (Shaffer, Simon Fraser University); Evidence (Bechard, Powerex); Evidence (Stensby, ATCO Group); Evidence (Mossing, Alberta Electric System Operator); Evidence (Marsh, SaskPower); Evidence (Cormie, Manitoba Hydro); Evidence (O’Dea, NRCan). [56] Evidence (Shaffer, Simon Fraser University); Evidence (Bechard, Powerex); Evidence (Stensby, ATCO Group); Evidence (Mossing, Alberta Electric System Operator); Evidence (Marsh, SaskPower); Evidence (Cormie, Manitoba Hydro); Evidence (O’Dea, NRCan). [61] Evidence (Stensby, ATCO Group); Evidence (Cormie, Manitoba Hydro); Evidence (Marsh, SaskPower); Evidence (O’Dea, NRCan); Evidence (Metcalfe, Enbala Power Networks). [74] Evidence (Vitez, Energy Storage Canada); Evidence (DeMarco, DeMarco Allan); Evidence (Thériault, Conference Board of Canada). [85] RNNR, Evidence, 1st Session, 42nd Parliament, 2 October 2017 (Tom Adams, Principal, Tom Adams Energy). [90] Evidence (MacDougall, Powerex); Evidence (Brouillette, Strategic Policy Economics); Evidence (Benedetti, Sussex Strategy Group); Evidence (Cormie, Manitoba Hydro); Evidence (Hinds, as an individual); Evidence (Burpee, as an individual); Evidence (O’Dea, NRCan); Evidence (DeMarco, DeMarco Allan); Evidence (Shaffer, Simon Fraser University); Evidence (Robertson, University of Victoria); Evidence (Stensby, ATCO Group). [92] Evidence (Benedetti, Sussex Strategy Group); Evidence (DeMarco, DeMarco Allan); Evidence (Acchione, Ontario Society of Professional Engineers); Evidence (Tezel, Ontario Society of Professional Engineers). [98] Evidence (Shaffer, Simon Fraser University); Evidence (Adams, Tom Adams Energy); Evidence (Burpee, as an individual); Evidence (Stensby, ATCO Group). [100] Evidence (Shaffer, Simon Fraser University); Evidence (Stenclik, General Electric); Evidence (Marsh, SaskPower). [101] Evidence (Cormie, Manitoba Hydro); Evidence (Benedetti, Sussex Strategy Group); Evidence (Stensby, ATCO Group); Evidence (Burpee, as an individual); Evidence (O’Dea, NRCan); Evidence (Bechard, Powerex). [106] Ibid. [107] Evidence (Shaffer, Simon Fraser University); Evidence (O’Dea, NRCan); Evidence (Robertson, University of Victoria); Evidence (Stensby, ATCO Group). [110] Evidence (Benedetti, Sussex Strategy Group); Evidence (DeMarco, DeMarco Allan); Evidence (Bechard, Powerex); Evidence (Adams, Tom Adams Energy); Evidence (Burpee, as an individual). |