RNNR Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

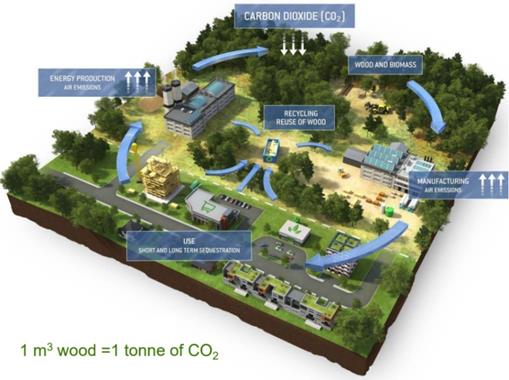

INTRODUCTIONBetween November 2017 and February 2018, the House of Commons Standing Committee on Natural Resources (the committee) conducted a study on the secondary supply chain products in Canada’s forest sector. The committee heard from a wide range of experts about the sector’s role in advancing the Canadian bioeconomy, especially with regard to economic growth, employment creation, the environment and technological innovation. The committee is pleased to table its final report, which presents the study findings and recommendations to the Government of Canada. “Canada has a clear opportunity to leverage its global forest sector leadership into bioproducts, biochemicals, and bioenergy that will lower our greenhouse gas emissions and drive economic growth across Canada and in rural areas in particular.” Glen Mason, Assistant Deputy Minister, Canadian Forest Service The committee heard that Canada’s abundant forests can be the source of a wide range of bioproducts and solutions. Value-added forest product supply chains can create new industries and employment opportunities, while utilizing the forest’s natural carbon sequestration capacity to advance Canada’s transition to a low-carbon economy (Figure 1).[1] In the words of Glen Mason of Natural Resources Canada (NRCan): “The forest sector is increasingly a source of solutions for the challenges society faces. Today Canada has a clear opportunity to leverage its global forest sector leadership into bioproducts, biochemicals, and bioenergy that will lower our greenhouse gas [GHG] emissions and drive economic growth across Canada and in rural areas in particular.” Similarly, Catherine Cobden of Cobden Strategies stated that the bioeconomy represents an opportunity for employment creation, economic growth and trade expansion, especially given Canada’s abundant resources, strong forest management credentials and effectiveness as an exporting country. Figure 1: The Forest Carbon Cycle

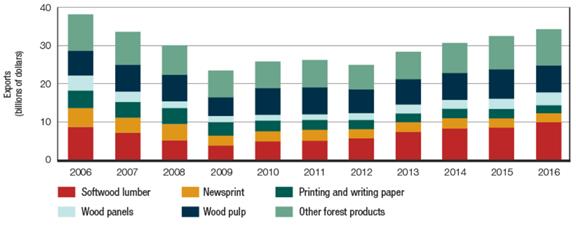

Source: FPInnovations According to the Forest Products Association of Canada (FPAC), the Canadian forest products sector is a $67-billion industry, accounting for approximately 12% of Canada’s manufacturing gross domestic product (GDP). It operates in 600 forest-dependent communities, mainly in rural Canada, and provides direct employment to 230,000 Canadians from coast to coast. According to The State of Canada’s Forests Annual Report 2017 (produced by NRCan), the forest industry harvested approximately 160 million cubic metres of wood to produce 77 million cubic metres of wood products and 23 million tonnes of pulp and paper products. It also supplied 12 million cubic metres of wood residue, mainly used to generate low-carbon electricity. In 2016, the Canadian forest industry exported products valued at more than $34 billion to 180 countries around the world (Figure 2).[2] Figure 2: Exports of Canadian Forest Products, 2006–2016

Source: Natural Resources Canada Over the past decade, innovations in Canadian value-added forest products have led to improved industrial competitiveness and an expanded product and process portfolio – for example, the development and/or production of bioenergy, advanced building systems with a lower carbon footprint, new bio-sourced chemicals and products with renewable properties, and new forest management tools, such as forestry genomics.[3] Citing an NRCan report, Robert Larocque of FPAC told the committee that forest sector investments in the 2000s to generate electricity from wood residues “have sustained more than 14,000 jobs, reduced greenhouse gas emissions by 543,000 tonnes, atmospheric emissions by about 15%, and the water used by mills by the equivalent of 4,000 Olympic-size pools.” According to Mr. Mason, advanced bioeconomy revenue, where measured, “has been shown to grow on average over 10% each year over the past decade, which is much faster than the rest of the economy. The associated employment growth has also been shown to be more rapid [than] other knowledge-driven, technology-based sectors such as finance and insurance, aerospace, and computer hardware.” In September 2017, the Canadian Council of Forest Ministers unanimously endorsed the report, A Forest Bioeconomy Framework for Canada, outlining “a new vision for the future of the forest sector and the role for biomass in the transition to a low-carbon, sustainable economy.”[4] The Framework’s four key pillars include:

According to Mr. Larocque, these pillars align well with the forest industry’s objectives of “establishing new bioeconomy value chains, accelerating disruptive technologies, sustaining rural economies, and improving the environment.” In spite of the aforementioned progress in Canadian value-added forest product development, the committee heard that Canada’s bioeconomy has not yet reached its full potential.[5] In the words of Alexander Marshall of Bioindustrial Innovation Canada: For a sector with such high growth potential and access to vast resources, our bioeconomy is lagging. In 2018, the sector was valued at 6% of GDP, on a per-capita basis, whereas in the U.S. it’s over 8%. Furthermore, Sweden is considered to be a leader in the bioeconomy, with 30% of its natural energy supply fed from biomass, compared to 1% in Canada. The committee also heard that Canada’s forest-sourced industries are facing financial and market challenges that are affecting investments, exports, innovation and talent retention. Witnesses explained that value-added forest product manufacturing is a highly specialized and capital-intensive industry; transformative innovation requires a skilled workforce and access to patient capital.[6] Furthermore, the committee heard that the Canada-U.S. softwood lumber dispute has resulted in fluctuating tariffs, especially for the Canadian remanufacturing sector, leading to investor uncertainty and limiting the access of some businesses to U.S. markets.[7] According to Professor Ning Yan of the University of Toronto: The forest sector contributes significantly to the social and economic prosperity of Canada. With the recent shifts in market demand, increasing trade barriers, and higher competitive pressure for traditional forest products, there is an urgent need for the sector to revitalize and transform to ensure that it remains an economic engine of Canada in the future. The following sections present discussions regarding the challenges and opportunities of advancing Canadian value-added forest products and a forest-sourced bioeconomy. The evidence is organized according to five themes: (1) protecting Canadian forests and primary resources; (2) advancing industrial integration, innovation and talent development; (3) strengthening partnerships with Indigenous peoples; (4) maximizing market opportunities in Canada and abroad; and (5) a case study on building with wood, with a focus on advanced mass timber construction. PROTECTING CANADA’S FORESTS AND PRIMARY RESOURCESThe committee heard that the sustainability of the secondary forest sectors depends on the health of Canadian forests, as well as the stability of forest product supply chains. Witnesses explained that reduced activity at the sawmill will affect the productivity and economic performance of secondary products in downstream industries.[8] According to Mr. Larocque, “one of the key factors for a prosperous forest sector in the future is to ensure a sustainable, stable, and economic access to fibre from our Canadian forests.” “One of the key factors for a prosperous forest sector in the future is to ensure a sustainable, stable, and economic access to fibre from our Canadian forests.” Robert Larocque, Senior Vice President, Forest Products Association of Canada Witnesses discussed several ways to protect the health of Canadian forests and to maximize the economic value of forest resources – for example, by:

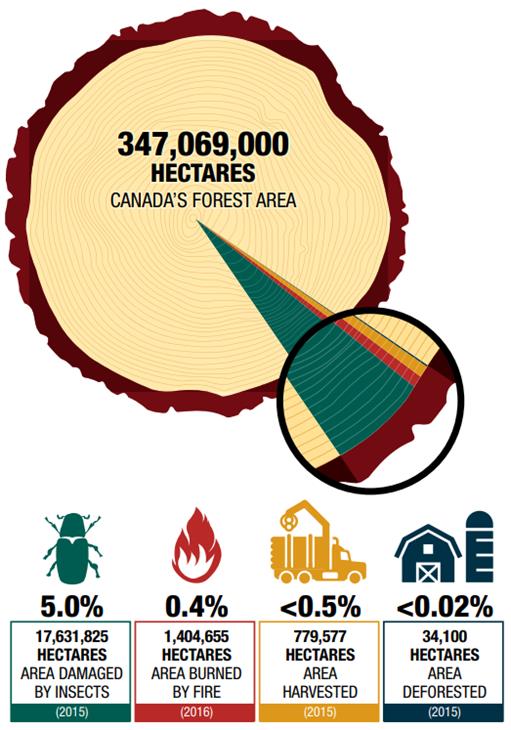

The committee heard that the Canadian forest sector would benefit from increased value-added manufacturing and reduced exports of raw resources.[15] According to Bob Matters of the United Steelworkers, “Wood that is milled offshore has led directly to mill closures and job loss, [thereby reducing the amount of fibre available] for innovative product creation.” He called for further support to retool and revitalize existing mills, as well as national and provincial strategies that “both discourage the excessive export of logs and encourage domestic manufacturing.” Furthermore, Mr. Atkinson stated the following: [R]ecent efforts towards revitalization and innovation [in the forest sector] have missed the mark. Instead of innovation, we seem to be on a continued path of liquidating timber resources for primary manufacturing only, and in some cases, in the west here, we are now even seeing a move backwards, towards increased export of raw logs.… In our efforts to collaborate and work with B.C. and Canada on transitions in the forest sector, including adapting to climate change conditions, [the FNFC has] maintained that the value-added sector or secondary manufacturing is required. Raw resource extraction and primary manufacturing will not provide enough employment and benefit to Canada as the change in the sector unfolds. Mark Mosher of J.D. Irving, Limited, also recommended that Canada “continue to invest and get back into more of the secondary and tertiary value-added products.” Owing to a general decline in demand for traditional pulp and paper products, Mr. Mosher explained that some value-added opportunities in his sector (e.g., tissue and box manufacturing), as well as skilled expertise, have migrated to the United States. He stated that “to really create value from the standing forest, [we] need to keep all those jobs in Canada and go through the entire value chain.” According to Mr. Jeffrey, reducing the amount of Canadian log exports requires increased investment in both primary and secondary manufacturing businesses: “If [we] can’t attract the investment in the manufacturing side of the business, [we’re] going to see a continuation of log exports.” Figure 3: Canadian Forest Disturbance by the Numbers

Source: Natural Resources Canada ADVANCING INDUSTRIAL INTEGRATION, INNOVATION AND TALENT DEVELOPMENT“An important factor that allows for building full innovation capacity is to promote equity and diversity and to empower more women, minorities and Indigenous people to take up senior leadership positions in industry and academia in all areas of the innovation ecosystem.” Ning Yan, Professor, University of Toronto The committee heard that industrial integration, innovation and talent development are key factors for creating state-of-the-art forest-sourced products. According to Ms. Cobden, successful forest product development strategies must take into account the full supply chain, from the collection of feedstock and other raw material, to conversions/refining and, eventually, market delivery and use in Canada or elsewhere. Similarly, Pascale Lagacé of Resolute Forest Products thinks the integration of primary and secondary supply chains would advance the development of forest-sector innovations and value-added products. She stated the following: [Forest] fibre cannot be developed in a linear fashion, not unlike petroleum. To extract maximum economic value out of a harvested tree, the resource has to be refined multiple times through multiple processes and into multiple products. In other words, because of economies of scale and the chemical complexity of forest fibre, we are deeply convinced that the primary supply chain has a role to play in the development of next-generation technologies and non-traditional products. Integration is the best way to extract the most value from each tree. Ms. Ferguson told the committee that many bioproducts projects are locating near primary forest-sector operations because it costs more to transport primary materials (e.g., “a log, a pile of shavings, or a bunch of sawdust”) than it does to convert them to a higher-valued product, “whether that product is a biofuel or advanced chemical.” Witnesses discussed different ways to improve the integration and innovative capacity of Canada’s forest products sector, including the following:

STRENGTHENING PARTNERSHIPS WITH INDIGENOUS GOVERNMENTS AND COMMUNITIESThe committee heard that the bioeconomy represents an opportunity for Canadian governments and the forest industry to strengthen their partnerships with Indigenous communities, 70% of which are in, or adjacent to, forests.[27] In the words of Mr. Atkinson: “utilizing and maximizing Aboriginal people in the forest sector represents a great opportunity to access local labour resources, to bridge socio-economic challenges in First Nations communities, and to build political and corporate relationships, including cultural awareness.” He affirmed that “the rights and title of First Nations people are at the forefront of natural resource management decisions and projects in Canada; … First Nations should be priority partners and decision-makers in the process of considering investment in secondary supply chain products.” “First Nations should be priority partners and decision-makers in the process of considering investment in secondary supply chain products.” Keith Atkinson, Chief Executive Officer, BC First Nations Forestry Council Indigenous peoples are concerned about the sustainability of both forest resources and employment opportunities. According to Paul Kariya of the Coastal First Nations Great Bear Initiative (CFN-GBI): The forest sector is very important to member First Nations for both traditional and new value-added forestry. It is a key topic as we negotiate the next phases of reconciliation with the Government of British Columbia. For CFN-GBI nations, at the heart of the matter is that having made significant strides to protect the environment, they need to fashion a sustainable economy that supports healthy communities and human well-being. Traditional and new forestry play a big role in this, as do fish and fisheries, tourism, and potential opportunities in clean energy. The key is sustainability. Mr. Atkinson told the committee that investing in more forest manufacturing facilities is one way to protect Canadian jobs and primary resources, and to create more sustainable economic opportunities for Indigenous peoples. Furthermore, Mr. Kariya stated that culturally appropriate value-added products from the Great Bear Rainforest (e.g., essential oils) could provide “long-term sustainable and meaningful employment for remote communities, while at the same time protecting the forests.” Mr. Atkinson explained that Indigenous communities “are eager to be part of a new forest sector,” but that increasing their participation requires capacity-building investments in “stewardship and planning, operational and management support, targeted workforce programs, [and] access to capital for … new manufacturing and value-added facilities.” According to David Mackett of the Whitesand First Nation, First Nations are so innate.... If you put in one small heating system, electrical system, or district heating system in a First Nation, you’re creating one, two, three, four, or five jobs. That may not sound like a lot, but in a lot of these communities, that’s the spinoff. The spinoff is that you’re building the economy, capacity and employment opportunities. Several witnesses highlighted the need for targeted training and talent development programs to maximize the employment potential of the bioeconomy for Indigenous peoples, especially in remote areas.[28] The committee heard that bioenergy is of special interest to off-grid Indigenous communities that rely on imported fuel for power. Witnesses discussed the potential for biomass to phase out diesel fuel in remote areas, leading to greater energy independence, economic savings and reductions in GHG emissions.[29] According to Mr. Mason, “research estimates that a remote community that relies on imported oil sees 90% of the energy revenue leave the community, but 75% of revenues from locally produced wood chips are reinvested in the community.” Furthermore, Christopher Struthers, who testified as an individual, explained that “biomass-plus-battery technology offers significant savings in the order of 15¢ to 20¢ per kilowatt hour, [including] the amortization of equipment, things like battery replacements, and the long-term costs.” He added that, depending on the type of renewable feedstock used, some biomass could be considered “almost carbon neutral.” According to Mr. Atkinson, “An obvious business model exists to convert over 65 First Nations communities in British Columbia from diesel generators to bioenergy plants. However, jurisdictional power supply issues and policies have challenged this type of investment.” In Northern Ontario, the Whitesand First Nation has partnered with the federal and provincial governments to develop “a five-megawatt combined heat and power plant from biomass, which will replace diesel electricity.” Based on an analysis conducted by the governments of Canada and Ontario, by the year 2050, Whitesand will be reducing “488,000 tonnes, or 163 tonnes per person, of GHG, compared to Ontario’s target of 26 tonnes per person.” According to Mr. Mackett, the project is “revolutionary,” akin to a bioeconomy village, based on Swedish and Finnish models. Whitesand is also trying to help other First Nations phase out diesel through the use of wood pellets. MAXIMIZING MARKET OPPORTUNITIES IN CANADA AND ABROADThe committee heard that the federal and provincial governments have played an important role in the development of secondary forest product markets in Canada and abroad – namely, through market-access programs like NRCan’s Expanding Market Opportunities and Green Construction through Wood (GCWood); through government procurement policies, such as British Columbia’s Wood First Act; and by promoting Canadian products, technologies and forest-sector practices in international trade missions.[30] According to Robert Jones of NRCan, the Government of Canada is active in facilitating market access for Canadian forest products worldwide. For example, Mr. Jones stated that the federal government recently invested $2.5 million in the development of the Chinese wood building market, including a wide array of activities, “ranging from supporting associations at trade shows to promote Canadian wood products, to working with [Chinese] government officials to change codes to be more amenable to wood, to having construction specialists on site who will help the Chinese builders and developers build with wood.” “[Commercial interest in renewable materials] has moved from a green marketing initiative to a business imperative.” Rod Badcock, Partner, BioApplied Innovation Pathways Éric Baril of the NRC told the committee that the growing interest in bio-based products and solutions is part of a global shift, driven by “an increased desire to be environmentally friendly and questions on the future accessibility and/or depletion of petroleum.”[31] Similarly, Rod Badcock of BioApplied Innovation Pathways stated the following: [There is] indeed a growing commercial interest among global players to integrate renewable materials into their products. I would say that we’ve seen a shift happen. This has moved from a green marketing initiative to a business imperative. These companies have begun to realize that if they want to have business sustainability, then their raw materials and processing inputs need to be sustainable as well, and that an overreliance on raw materials from fossil fuels puts them at risk. In terms of new market development, the committee heard that the forest sector should target both domestic and international markets. According to Mr. Minhas, support for Canadian companies to become early adopters of new forest-based materials would help demonstrate the use and effectiveness of these materials on a large scale, thereby paving the way for market expansion elsewhere. In addition, Mr. Marshall expressed the need for more coordinated market development strategies that balance product development and supply efforts (i.e., “market push”) with demand creation in downstream industries (i.e., “market pull”). Similarly, Mr. Baril stated that one of the challenges of the forest industry is that there has been more investment in upstream forest-sector operations (“the genesis of the raw material”), and less in downstream industries (“the application”). According to Nathalie Legros of the NRC, there is an information gap between developers and end-users of forest-based products in Canada. Mr. Tardif stated that the sector needs to improve its understanding of the value chain “right to the end customer,” especially for “niche” value-added forest products. “Anything you can make from a barrel of oil, you can make from a tree.” Glen Mason, Assistant Deputy Minister, Canadian Forest Service The committee heard that forest-based products can benefit businesses that span the entire Canadian economy – in energy, manufacturing, construction, agricultural, chemical, cosmetic, pharmaceutical and health care industries. Witnesses discussed a wide range of existing and emerging market opportunities for value-added forest products, including:

CASE STUDY: BUILDING WITH WOODThe committee heard that wood construction is undergoing a “global renaissance.”[38] Recent innovations in structural engineered products have enabled the creation of larger and taller wood structures, including hospitals, schools, airports, malls and high-rise buildings.[39] “[Brock Commons is] not only an engineering and architectural showpiece, it is an environmental game-changer, storing close to 1,600 metric tons of carbon dioxide and saving more than 1,000 metric tons in greenhouse gas emissions.” Glen Mason, Assistant Deputy Minister, Canadian Forest Service Wood construction can be grouped into two general categories: 1) lightwood frame construction for small buildings up to six storeys; and 2) mass timber construction for larger structures, including buildings of seven storeys and taller (generally referred to as “tall wood buildings”). In North America, only a handful of tall wood buildings were built recently, including Brock Commons, a new 18-storey student residence at the University of British Columbia (Figure 4), and Origine, a 13-storey building in Quebec City’s Pointe-aux-Lièvres eco-district. The National Building Code of Canada (NBC) currently allows up to six storeys of wood construction. Taller wood buildings require special authorization by an engineer as an “alternative solution” outside the mainstream code.[40] Figure 4: Brock Commons Student Residence (University of British Columbia)

Source: J.D. Irving, Limited Witnesses discussed the following characteristics of building with mass timber:

The committee heard that building codes can be one way for regulators to encourage innovation and help de-risk the adoption of new wood construction products. Several witnesses called for more performance-based codes that set specific safety and environmental outcomes, rather than prescriptive codes that specify what materials or processes should be used by builders.[44] According to Peter Moonen of the Canadian Wood Council, the performance capabilities of newer wood material – “products that weren’t around 20 years ago” – are not reflected in the current NBC. Mr. Jones told the committee that ongoing research and testing may eventually introduce mass timber buildings of up to 12 storys under the NBC.[45] Areas in need of further development include design and safety considerations (e.g., fire performance and noise proofing), as well as commercial elements such as market development and public awareness about the features of mass timber structures.[46] IAFF representatives called for “more thorough discussion of firefighter and public safety considerations against the backdrop … of inadequate fire protection in many communities and the prospect that any given municipality may reduce its fire protection capabilities in the future.” Furthermore, Mr. Foster cautioned against building codes that impact the affordability of home building, urging industry and governments to find innovations that can achieve desired outcomes while maintaining or reducing construction costs. Considering that between 90% and 98% of North American houses are already built out of wood, the committee heard that the biggest potential for domestic market expansion is for mass timber construction in large public, commercial and high-rise buildings. The United States remains the biggest and most convenient market for Canadian wood products due to its proximity, while European markets have been harder to penetrate owing to greater automation in Europe’s fabrication plants, and a well-developed Scandinavian forest products sector. The biggest growth opportunities for Canadian mass timber exporters overseas are in China, followed by Japan, Taiwan, South Korea and India, as well as emerging markets like Turkey and Brazil.[47] Witnesses talked about growing interest in transforming wood construction from a craft-based industry to a more mainstream manufacturing process. The committee heard that prefabrication in a factory environment would make wood construction more cost-competitive and less wasteful, with greater potential for automation, customization and design accuracy. Furthermore, it would allow Canadian businesses to manufacture and export more value-added wood products, such as cross-laminated timber, prefabricated timber products or entire building systems. Currently, most Canadian wood exports supply the U.S. single-family home market in the form of lumber.[48] Finally, the committee heard that there is a skill shortage in Canada for wood architects and engineers, as well as in areas like building prefabrication, hybrid design systems, retrofitting and renovation.[49] According to Mr. Karsh, “as the price of timber buildings comes in line with concrete … demand will grow very rapidly, [leading to a shortage of expertise] not just in design but in manufacturing and construction.” He stated that most Canadian engineers and architects who start designing with wood are self-taught, adding that the Canadian industry needs to prepare for greater demand for wood construction “throughout the delivery chain, including in education.” [1] Standing Committee on Natural Resources (RNNR), Evidence, 1st Session, 42nd Parliament (Evidence): Glen Mason (Assistant Deputy Minister, Canadian Forest Service, Natural Resources Canada [NRCan]); Robert Larocque (Senior Vice-President, Forest Products Association of Canada [FPAC]); Sandy Ferguson (Vice-President, Corporate Development, Conifex Timber Inc. [Conifex]); Bruno Marcoccia (Director of Research and Development, Pulp and Paper Division, Domtar Inc. [Domtar]); and Catherine Cobden (President, Cobden Strategies). [5] RNNR Evidence: Alexander Marshall (Executive Director, Bioindustrial Innovation Canada); Timothy Priddle (President, The WoodSource Inc. [The WoodSource]); Larocque (FPAC); Mason (NRCan); Cobden (Cobden Strategies); Ning Yan (Professor, University of Toronto); Marcoccia (Domtar); Rick Jeffery (President and Chief Executive Officer, Coast Forest Products Association [Coast Forest]); Keith Atkinson (Chief Executive Officer, BC First Nations Forestry Council [FNFC]); and Paul Kariya (Senior Policy Advisor, Coastal First Nations Great Bear Initiative [CFN-GBI]). [6] RNNR Evidence: Yan (University of Toronto); Antoine Charbonneau (Vice-President, Business Development, CelluForce Inc. [CelluForce]); Jeffery (Coast Forest); Marshall (Bioindustrial Innovation Canada); and Marcoccia (Domtar). [7] RNNR Evidence: Rick Ekstein (Founder, Chief Executive Officer of Weston Forest, Association of Lumber Remanufacturers of Ontario); Greg Stewart (President, Sinclair Group Forest Products Ltd.); Atkinson (FNFC); Charles Tardif (Vice-President, Corporate Development and Procurement, Maibec); and Denis Lebel (Chief Executive Officer, Quebec Forest Industry Council [QFIC]). [8] RNNR Evidence: Marcoccia (Domtar); Jeffery (Coast Forest); Tardif (Maibec); and Rod Badcock (Partner, BioApplied Innovation Pathways [BioApplied]). [9] RNNR Evidence: Atkinson (FNFC); Kariya (CFN-GBI); and Bob Matters (Chair, Steelworkers – Wood Council, United Steelworkers). [11] RNNR Evidence: Lebel (QFIC); Atkinson (FNFC); Jerome Pelletier (Vice-President, Sawmills, J.D. Irving, Limited [J.D. Irving]); and Larocque (FPAC). [13] RNNR Evidence: Badcock (BioApplied); Ferguson (Conifex); and Pascale Lagacé (Vice-President, Environment, Innovation and Energy, Resolute Forest Products). [15] RNNR Evidence: Mark Mosher (Vice-President, Pulp and Paper Division, J.D. Irving); Matters (United Steelworkers); and Atkinson (FNFC). [16] RNNR Evidence: Priddle (The WoodSource); Peter Moonen (Manager, National Sustainability, Canadian Wood Council); William Downing (President, Structurlam Products LP [Structurlam]); and Michael Green (Principal, Michael Green Architecture). [17] RNNR Evidence: Jeffery (Coast Forest); Larocque (FPAC); Priddle (The WoodSource); and Mason (NRCan). [18] RNNR Evidence: Yan (University of Toronto); Marshall (Bioindustrial Innovation Canada); Gurminder Minhas (Managing Director, Performance BioFilaments Inc. [Performance BioFilaments]); and Marcoccia (Domtar). [19] The commercialization gap (also known as “the valley of death”) refers to the period between a technology’s research and development phase and large-scale commercialization, when companies are expected to start making a profit. [21] RNNR Evidence: Yan (University of Toronto); Charbonneau (CelluForce); and Marshall (Bioindustrial Innovation Canada). [22] RNNR Evidence: Charbonneau (CelluForce); Marcoccia (Domtar); and Ferguson (Conifex). [23] RNNR Evidence: David Boulard (President, Ensyn Technologies Inc. [Ensyn Technologies]); Badcock (BioApplied); Minhas (Performance BioFilaments); Marcoccia (Domtar); Charbonneau (CelluForce); and Dan Madlung (Chief Executive Officer, BioComposites Group Inc.). [26] RNNR Evidence: Tardif (Maibec); Yan (University of Toronto); Marcoccia (Domtar); Minhas (Performance BioFilaments); and Badcock (BioApplied). [28] RNNR Evidence: Christopher Struthers (as an individual); Green (Michael Green Architecture); and David Mackett (Community Development, Whitesand First Nation). [29] RNNR Evidence: Mason (NRCan); Kariya (CFN-GBI); Mackett (Whitesand First Nation); and Atkinson (FNFC). [30] RNNR Evidence: Larocque (FPAC); Cobden (Cobden Strategies); Mason (NRCan); Jeffery (Coast Forest); Green (Michael Green Architecture); Downing (Structurlam); and Frédéric Verreault (Director, Corporate Affairs and Communication, Chantiers Chibougamau). [31] RNNR Evidence: Éric Baril (Acting Director General, Automotive and Surface Transportation, National Research Council of Canada [NRC]). [32] Wood pellets are made of compressed wood fibre that would otherwise be wasted (e.g., sawdust shavings or logging remains), and can be used as a biofuel to produce heat or electricity. [33] RNNR Evidence: Gordon Murray (Executive Director, Wood Pellet Association of Canada). [34] RNNR Evidence: Pierre Lapointe (President and Chief Executive Officer, FPInnovations); Ferguson (Conifex); Boulard (Ensyn Technologies); and Struthers (as an individual). [35] RNNR Evidence: Mosher (J.D. Irving); Marcoccia (Domtar); and Lagacé (Resolute Forest Products). [37] RNNR Evidence: Steve Price (Executive Director of Bioindustrial Innovation, Alberta Innovates); Charbonneau (CelluForce); Cobden (Cobden Strategies); Marcoccia (Domtar); Baril (NRC); Nathalie Legros (Research Council Officer, Automotive and Surface Transportation, NRC); and Lagacé (Resolute Forest Products). [39] RNNR Evidence: Eric Karsh (Principal, Structural Engineering, Equilibrium Consulting Inc. [Equilibrium Consulting]); and Jeffery (Coast Forest). [42] RNNR Evidence: Downing (Structurlam); Green (Michael Green Architecture); Moonen (Canadian Wood Council); David Foster (Director of Communications, Canadian Home Builders’ Association); and Verreault (Chantiers Chibougamau). [44] RNNR Evidence: Foster (Canadian Home Builders’ Association); Verreault (Chantiers Chibougamau); Green (Michael Green Architecture); Moonen (Canadian Wood Council); and Karsh (Equilibrium Consulting). [45] According to NRCan, “provinces and territories have jurisdiction over the construction and design of new housing and buildings. As such, the adoption and enforcement of the National Model Construction Codes is voluntary. A province or territory may choose to adopt the [National Building Code], with or without changes, or publish their own provincial code based on it.” [47] RNNR Evidence: Mason (NRCan); Jeffery (Coast Forest); Robert Jones (Acting Director General, Trade, Economics and Industry Branch, Canadian Forest Service, NRCan); Pelletier (J.D. Irving); Downing (Structurlam); and Green (Michael Green Architecture). |