CIIT Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Anti-Dumping and Countervailing Duties Being Applied on Certain Canadian Softwood Lumber Products

Introduction

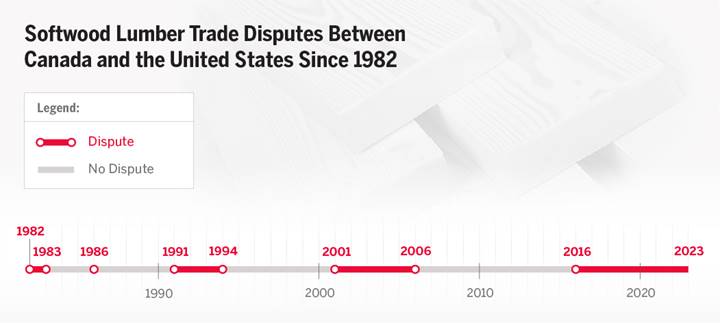

Canada and the United States (U.S.) have had five softwood lumber disputes since 1982, and the United States has periodically applied anti-dumping duties (ADs) and countervailing duties (CVDs) on certain Canadian softwood lumber products (hereafter, the United States’ ADs and CVDs).

Note: The red line indicates a period of time during which Canada and the United States had a softwood lumber trade dispute. Such a period begins when the U.S. Department of Commerce (DoC) initiates an anti-dumping duty (AD) and/or countervailing duty (CVD) investigation, and ends when the DoC takes either of two actions: revokes ADs and/or CVDs applied on imports of certain Canadian softwood lumber products; or, if duties have not been applied, terminates its ADs and/or CVDs investigation. The grey line indicates a period of time during which the two countries did not have a bilateral softwood lumber trade dispute.

Source: Figure prepared by the Library of Parliament.

In October 2022, the House of Commons Standing Committee on International Trade (the Committee) released a report that largely focused on two topics relating to Canada–U.S. trade: softwood lumber and electric vehicles. The report’s chapter on softwood lumber trade summarized witnesses’ comments and contained the Committee’s recommendations to the Government of Canada. Since October 2022, certain U.S. actions have continued to affect softwood lumber trade with Canada.

Specifically, on 1 December 2022, the U.S. Department of Commerce and the U.S. International Trade Commission began their sunset reviews of the AD and CVD orders in relation to certain Canadian softwood lumber products. In the U.S. trade remedy system, sunset reviews result in AD and/or CVD orders being revoked unless: the Department of Commerce determines that revocation would likely cause dumping and/or countervailable subsidies to continue or recur; and the International Trade Commission determines that revocation would likely cause material injury to U.S. producers to continue or recur. On 24 and 31 March 2023, the Department of Commerce determined that revocation of the CVD and AD orders—respectively—would have resulted in a continuation or recurrence of countervailable subsidies and dumping. Although the International Trade Commission’s sunset reviews are expected to take up to one year to complete, on 18 April 2023, it decided to extend its review period by up to 90 days.

Moreover, on 1 August 2023, the Department of Commerce issued the final results of its fourth annual review of the AD and CVD orders regarding certain Canadian softwood lumber products, and calculated average AD and CVD rates of 6.20% and 1.79%, respectively. On 8 September 2023, the Department increased the AD rate to 6.26%. The final duty rates apply only in relation to the Canadian softwood lumber products included in the review; generally, the Department includes firms in a review when requested to do so by a Canadian exporter, the Government of Canada, or a U.S. softwood lumber producer or importer. In response, on 1 September 2023, the Government of Canada announced that it would challenge the AD decision at the U.S. Court of International Trade and the CVD decision through the dispute-settlement process available under Chapter 10 of the Canada–United States–Mexico Agreement (CUSMA).

On 5 October 2023, a North American Free Trade Agreement (NAFTA) dispute-resolution panel published a report concerning the Department of Commerce’s 2017 final dumping determination in relation to certain Canadian softwood lumber products. The report affirmed certain elements of the determination and instructed the Department to reconsider or provide more information to explain other aspects of the determination. For example, the Department should provide additional information regarding its decision to deduct export taxes from the price of certain Canadian softwood lumber exports.

On 30 January 2023, the Committee adopted a motion to study again the United States’ ADs and CVDs. In particular, the motion mentioned a possible bilateral softwood lumber agreement (hereafter, a new bilateral agreement) and the potential impacts of the United States’ ADs and CVDs on Canada. During two meetings held on 11 May and 12 June 2023, Global Affairs Canada officials, as well as representatives of one firm, one organized labour group and three trade associations, appeared as witnesses. Additionally, the BC Lumber Trade Council and Global Affairs Canada submitted a written brief and four documents, respectively.

This report summarizes comments made by these witnesses and contained in the brief and the documents, as well as insights that the Committee gained during a May 2023 fact-finding trip to Washington, D.C. The first section presents general views about the impacts of the United States’ ADs and CVDs on Canadian softwood lumber producers. The following five sections provide witnesses’ perspectives about actual and proposed Government of Canada actions to address the current softwood lumber dispute between Canada and the United States (hereafter, the current dispute). In particular, these sections focus on: the dispute-settlement process at the World Trade Organization (WTO); the dispute-settlement processes under NAFTA and CUSMA; a new bilateral agreement; advocacy and collaboration; and federal supports for the forestry sector. Concerning witnesses’ comments about dispute settlement, their primary objective is to ensure the existence of processes that are fair and impartial, and that lead to timely decisions, including in relation to softwood lumber. The report concludes with the Committee’s thoughts and recommendations.

Impacts of the United States’ Duties on Canadian Softwood Lumber Producers

Global Affairs Canada officials said that, as of 11 May 2023, the United States had applied ADs and CVDs at a combined rate of 8.59% on imports of certain products from most Canadian softwood lumber producers. As well, they underscored that the United States’ annual adjustment of its AD and CVD rates “results in an unpredictable trading environment” for such producers and “billions of dollars in unfairly collected duties.” Similarly, the United Steelworkers characterized the duties as “unfair and damaging.”

According to New Brunswick Lumber Producers, the current dispute is “one of the longest and most expensive in Canadian history.” New Brunswick Lumber Producers estimated that, as of 12 June 2023, Canadian softwood lumber producers had paid cash deposits exceeding $8 billion during this dispute, with its members having paid more than $500 million.[1]

Global Affairs Canada officials described Canadian softwood lumber exports to the United States as “critical to addressing U.S. production shortfalls and housing affordability.” They stated that, in 2021, U.S. producers supplied about 70% of the domestic demand for softwood lumber products, “leaving a 30% shortfall, a gap that was largely filled with Canadian … products.” The BC Lumber Trade Council’s brief mentioned that U.S. imports of European softwood lumber products, regarding which the United States does not apply ADs or CVDs, have “increasingly filled the gap” resulting from insufficient Canadian softwood lumber exports to the United States.

United Steelworkers asserted that Canada is exporting “less and less” softwood lumber to the United States because of competition from European producers unaffected by the United States’ application of “huge” ADs and CVDs. As well, New Brunswick Lumber Producers argued that the United States’ ADs and CVDs “significantly” reduce its members’ “capacity to compete” with U.S. and European softwood lumber producers.

The BC Lumber Trade Council’s brief highlighted the “negative impact” that the United States’ ADs and CVDs are having on Canadian small and medium-sized producers of “high-value” softwood lumber products, and suggested that these producers lack the “financial and borrowing capacity required to engage in prolonged litigation.” Gorman Bros. Lumber agreed that many Canadian firms that export such products to the United States are small or medium in size and “do not always have the same financial and borrowing depth of the larger [softwood lumber] producers.” In the view of Gorman Bros. Lumber, many Canadian small and medium-sized softwood lumber producers “will be stretched beyond acceptable stress levels” if the current dispute continues for “several more years.”

Global Affairs Canada officials emphasized the “harm” that the United States’ ADs and CVDs are inflicting on Canadian softwood lumber producers and their employees. In the opinion of United Steelworkers, these ADs and CVDs can affect whether its members are working and Canadian softwood lumber producers are “staying above water.”

Government Action: Settle Disputes at the World Trade Organization

Global Affairs Canada officials stated that the Government of Canada is “vigorously defending” Canada’s interests through the WTO’s dispute-settlement process, and through the processes available under Chapter 19 of NAFTA and Chapter 10 of CUSMA. They stressed that, as of 11 May 2023, the Government—in partnership with Canadian softwood lumber producers and other litigants—had initiated 10 dispute-settlement proceedings relating to softwood lumber at the WTO and pursuant to these two trade agreements. As well, they indicated that the Government’s objective is the “full refund,” to Canadian softwood lumber producers, of amounts collected because of the United States’ “unjustified and unwarranted” ADs and CVDs.

Concerning the WTO process, Global Affairs Canada officials noted that Canada obtained favourable results in both of its most recent softwood lumber cases against the United States, with a “very strong result at the panel stage” regarding the CVDs and a “somewhat more mixed result” with respect to the ADs. They explained that Canada and the United States appealed the AD and CVD results—respectively—to the WTO’s Appellate Body, which currently lacks quorum due to the United States’ unwillingness to consent to the appointment of members.

Global Affairs Canada officials observed that, during the WTO’s 12th Ministerial Conference, WTO members—including the United States—agreed to work toward restoring a “fully functioning” dispute-settlement process by 2024. Moreover, they outlined that—as of 11 May 2023—WTO members were “at the solutions phase” of negotiations to reform this process, and pointed out that Canada and other like-minded members are “putting forward proposals” with the goal of “restor[ing] effective, impartial adjudication” at the WTO. The Business Council of Canada said that it is “encouraged” that WTO members, including the United States, have agreed to restore the “full functionality” of the WTO’s dispute-settlement process by 2024.

With a focus on the Ottawa Ministerial on WTO Reform Group (the Ottawa Group), Global Affairs Canada officials underlined that, since its establishment in 2018, the Ottawa Group has discussed “modernization and reform” of the WTO dispute-settlement process “in at least some … meetings.” The Business Council of Canada urged the Ottawa Group members to “work closely” with the United States in 2023 to “overcome long-standing concerns” and to “restore” the WTO’s dispute-settlement process. In the Business Council of Canada’s view, the lack of a functioning WTO dispute-settlement process has hindered efforts to resolve the current dispute regarding Canada–U.S. trade in softwood lumber products.

Government Action: Settle Disputes Under Trade Agreements

Global Affairs Canada officials commented that dispute-settlement panels established under Chapter 19 of NAFTA and Chapter 10 of CUSMA consider “whether or not” the United States’ ADs and CVDs are consistent with that country’s laws. Regarding NAFTA, they stated that panels have been constituted, with the AD panel expected to hold its first hearing in June 2023 and the CVD panel anticipated to do so in September 2023. As well, they mentioned that Canada and the United States have “started constituting the CUSMA panels for the first [annual] review” of the ADs and CVDs. They added that, upon the completion of an annual review, Canada can challenge the outcome.

However, the Global Affairs Canada officials highlighted that there are “delays and problems” regarding the nomination of panellists to the NAFTA and CUSMA dispute-settlement panels, and drew attention to the Government of Canada’s commitment to working with the Government of the United States to ensure panellists’ impartiality. They said that panellists should be “qualified, impartial and [able] to render an objective judgment.”

In the opinion of the Alberta Forest Products Association, the United States has “been exceptionally slow” in nominating panellists to the NAFTA and CUSMA dispute-settlement panels, and the panellists that it has nominated lack independence and impartiality. The Alberta Forest Products Association advocated “increased engagement” between the Governments of Canada and the United States to “have highly functioning [dispute-settlement] panels.”

The BC Lumber Trade Council’s brief contended that, during the current dispute, the NAFTA and CUSMA dispute-settlement proceedings have been “delayed for years because of the United States’ failure to appoint panelists.” The brief suggested that, as a priority, the Government of Canada should meet with the Biden administration to address the United States’ “refusal to appoint panelists in a timely fashion.”

New Brunswick Lumber Producers encouraged the Government of Canada to “insist” that the Government of the United States meet the requirements of “the NAFTA and CUSMA [dispute-settlement] procedures, with a goal of meeting all ruling deadlines, as specified in the trade agreements.” As well, New Brunswick Lumber Producers predicted that the result of the procedures will be “favourable” panel decisions requiring the United States to refund a “significant portion of the cash deposits” to Canadian softwood lumber producers.

The Alberta Forest Products Association speculated that the decisions of the dispute-settlement panels established under NAFTA and CUSMA will be “critical” to Canada's interests “because [the decisions will] have direct force of law in the United States.” Furthermore, the Alberta Forest Products Association argued that such decisions can be Canada's “most effective tool” for challenging the United States’ ADs and CVDs.

Government Action: Negotiate a New Bilateral Agreement

Global Affairs Canada officials pointed out that the Government of Canada has “regular engagements and discussions” with the Government of the United States about bilateral softwood lumber trade, but indicated that there have not been any “formal negotiations” for a new bilateral agreement or any indication that the United States is “open to negotiating a settlement.” They underscored that the Government of Canada has “repeatedly conveyed” to the Government of the United States its readiness to have “meaningful conversations about realistic solutions that would be acceptable” to both countries.

As well, Global Affairs Canada officials noted that negotiations between the Governments of Canada and the United States regarding softwood lumber trade occurred in 2016 and 2017, with a focus on renewing or extending the 2006 bilateral agreement. However, they also highlighted that, since 2016, the Government of the United States has not had an “appetite” to “extend or renew” that agreement or to negotiate a new bilateral agreement. During a May 2023 trip to Washington, D.C., the Committee heard that, after the 2006 bilateral agreement expired in 2015, the Government of Canada had no interest in negotiating quotas that would apply to the country’s exports of softwood lumber products to the United States.

In the Business Council of Canada’s view, notwithstanding the Government of Canada’s efforts in recent years concerning the negotiation of a new bilateral agreement, a “renewed effort” is needed. The Business Council of Canada stressed its disappointment with the lack of—or “active negotiations” for—such an agreement. According to the Business Council of Canada, a new bilateral agreement is the “only workable long-term solution to provide certainty and stability” for Canadian softwood lumber producers.

The Business Council of Canada asserted that, in 2022, some members of the U.S. Congress called on the Government of the United States to “return to the negotiating table” for a new bilateral agreement. In that context, the Business Council of Canada proposed that—in 2023—the Government of Canada should “intensify efforts with like-minded partners” in the United States to advance negotiations for such an agreement. New Brunswick Lumber Producers suggested that the Government of Canada should “encourage” the United States Trade Representative “to enter into serious negotiations” to resolve the current dispute.

Global Affairs Canada officials indicated that, under the U.S. Tariff Act of 1930, U.S. softwood lumber producers can influence the “potential start of negotiations” for a new bilateral agreement because the statute gives “any U.S. industry … the right to petition” the Government of the United States to “investigate unfair trade practices that include alleged subsidization and dumping.” They speculated that negotiating such an agreement “wouldn't do anyone any good” if U.S. softwood lumber producers have “a right to [initiate] new [AD and CVD] investigations the next day.”

As well, Global Affairs Canada officials underlined that a “long-term deal” would require the U.S. Lumber Coalition to suspend its statutory right to “petition the U.S. government for a redress of unfair trade practices,” and they pointed out that—as of 11 May 2023—there was no “support within the U.S. [softwood lumber] sector to negotiate a long-lasting settlement.” Similarly, during the trip to Washington, D.C., the Committee was told that a resolution to the current dispute would not occur until U.S. softwood lumber producers give up their right to petition the Government of the United States to initiate AD and CVD investigations. Gorman Bros. Lumber observed that it “understand[s] and appreciate[s]” U.S. softwood lumber producers’ statutory rights, but also advocated “working constructively to … negotiate a solution” to the dispute.

Concerning desired provisions in a new bilateral agreement, Global Affairs Canada officials noted that any agreement should protect the interests of softwood lumber producers throughout Canada. Gorman Bros. Lumber argued that, because the current dispute is “focused mainly on construction lumber,” high-value softwood lumber products should be “considered carefully” and should “receive the same level of attention” as they did during the negotiation of the 2006 bilateral agreement. New Brunswick Lumber Producers mentioned that, in 2006, the United States returned some or all of the CVD-related cash deposits to the Canadian softwood lumber producers that had paid them, and encouraged a similar approach now.

The Business Council of Canada supported the potential designation, by the Government of Canada, of “an individual or individuals” to lead “the effort to fundamentally get U.S. policy-makers on board with” a negotiated settlement to the current softwood lumber dispute. In noting that a decision about whether to appoint a Canadian softwood lumber representative or envoy involves various considerations, Global Affairs Canada officials remarked that the Government has had “mixed success” when it appointed such an envoy during previous disputes.

Government Action: Advocate and Collaborate

Global Affairs Canada officials said that, in March 2023, Prime Minister Justin Trudeau and Canada’s Minister of International Trade, Export Promotion, Small Business and Economic Development[2]—Minister Mary Ng—“raised the issue” of the current dispute “directly” with President Joe Biden. As well, they stressed that Prime Minister Trudeau and Minister Ng emphasized the “harm” that the United States’ ADs and CVDs are inflicting on Canadian softwood lumber producers and employees, their communities and U.S. consumers.

One of the documents that Global Affairs Canada submitted to the Committee highlighted that Minister Ng discusses the current softwood lumber dispute with the United States Trade Representative and the United States Secretary of Commerce “at every opportunity,” and has also engaged with numerous U.S. legislators to advocate for a resolution to the dispute. In the Business Council of Canada’s opinion, some U.S. legislators who support negotiating a new bilateral agreement “could be key allies” for Canada because they “can put pressure on the [U.S.] administration internally.”

Global Affairs Canada officials commented that the Government of Canada has worked with groups in the United States that advocate for affordable housing and with “big-box retailers, such as Home Depot,” to ensure that they have an adequate supply of Canadian softwood lumber products. The Business Council of Canada suggested that, because “many people in politics and policy [in the United States] are focused on affordability,” the Government should “frame” its advocacy efforts in the United States “in the context of improving [home] affordability.”

The Alberta Forest Products Association asserted that resolving the current dispute will require Canadian “political engagement at the highest levels,” including between Prime Minister Trudeau and President Biden. Furthermore, the Alberta Forest Products Association contended that this engagement should focus on ensuring that the NAFTA and CUSMA dispute-settlement processes function as the signatories intended, especially regarding the impartiality of panellists and the timeliness of decisions.

Regarding collaboration, Global Affairs Canada officials drew attention to the “excellent contacts” that the Government of Canada has with the U.S.-based National Association of Home Builders, and indicated that the National Association of Home Builders strongly supports Canada’s position concerning an end to the United States’ ADs and CVDs. However, they added that the U.S. construction sector’s support for an end to these duties is insufficient to resolve the current dispute. While in Washington, D.C., the Committee heard that U.S. consumers and homebuilders are not able to participate directly in litigation relating to softwood lumber trade.

As well, Global Affairs Canada officials stated that the Government of Canada “will continue to work closely” with the Canadian softwood lumber sector and with “all provinces and territories to coordinate and maintain a team Canada approach” to resolving the current dispute. During the trip to Washington, D.C., the Committee was told that Canada’s provinces have differing views about the dispute, with their divergent perspectives resulting in benefits for U.S. softwood lumber producers. New Brunswick Lumber Producers proposed that the Government should work with Canadian softwood lumber producers and their forest-related trade associations, as well as with “all parties of each province,” to “develop a negotiation strategy” for a new bilateral agreement.

Moreover, Global Affairs Canada officials noted that Minister Ng has “held a number of round table discussions” with Canadian softwood lumber producers “over the past few years.” They provided the example of a roundtable discussion held on 9 March 2023 that focused on “industry trends” and the impact of the current dispute on Canadian softwood lumber producers.

New Brunswick Lumber Producers mentioned that, since fall 2022, there have been two roundtable discussions involving Minister Ng, as well as “direct” Government of Canada consultations with Canadian softwood lumber producers and their trade associations. Gorman Bros. Lumber said that it will “continue to work closely” with Minister Ng to ensure that “high-value [softwood lumber] products are specifically recognized in any [future] process or developments” regarding the United States’ ADs and CVDs.

Government Action: Provide Federal Supports

Global Affairs Canada officials pointed out that the Government of Canada supports the domestic forestry sector by “encouraging market diversification,” “supporting sustainable forest management” and promoting the sector’s role in combatting climate change. As well, they commented that “a lot of money and effort over successive [Canadian federal] governments has been put into market development overseas” for Canadian softwood lumber products.

Regarding federal supports for Canada’s softwood lumber sector, Global Affairs Canada officials identified programs that are administered by Natural Resources Canada and Global Affairs Canada. However, they cautioned that a federal support program that would pay the United States’ ADs and CVDs on behalf of Canadian softwood lumber producers affected by the duties would result in the program’s payments being “captured” in the United States’ next administrative review of the AD and CVD orders, and “would result simply in higher duty rates going forward.”

Finally, Global Affairs Canada officials stated their hope that the current dispute will be resolved, thereby making a softwood lumber division unnecessary. Concerning the 2023 federal budget commitment that $51 million will be allocated to support Global Affairs Canada’s response to the United States’ ADs and CVDs, they explained that the funding will not be used to finance “programming” or an “advocacy campaign” in the United States.

The Committee’s Thoughts and Recommendations

As the Committee reported in June 2016 and in October 2022, Canada’s forestry sector makes significant contributions to the country’s gross domestic product, and is the primary source of economic activity in certain communities and regions. The sector’s profitability depends on access to foreign markets, especially the United States. The ADs and CVDs that the United States is currently applying on certain Canadian softwood lumber products are having significant impacts in both countries. These duties reduce the success of Canada’s softwood lumber sector, as well as the sector’s ability to make investments and create jobs in Canada. The duties could also negatively affect home affordability in the United States.

Dispute-settlement processes are typically designed to resolve disputes in a fair, impartial and timely manner. The Committee recognizes that the non-functioning of the WTO’s Appellate Body at this time, as well as delays by the United States in appointing qualified and impartial panellists under Chapter 19 of NAFTA and Chapter 10 of CUSMA, are having the effect of prolonging the current softwood lumber dispute. Fair and timely decisions by impartial WTO and binational dispute-settlement panels could enhance Canadian softwood lumber producers’ prosperity and allow the Government of Canada to focus its resources on addressing other priorities.

A new agreement to govern Canada–U.S. trade in softwood lumber products could help to ensure that Canada has adequate and stable access to the U.S. market, and could lead the United States to return at least some of the amounts collected through ADs and CVDs to the Canadian softwood lumber producers that paid them. The Committee acknowledges that provinces and communities, as well as some Canadian softwood lumber producers and employees, might have a range of views about—and priorities concerning—provisions that should be included in a new bilateral agreement.

Finally, some legislators and firms in the United States share Canada’s interest in ending—or, barring that, reducing—the United States’ ADs and CVDs. Although such individuals and firms have limited opportunities to participate directly in dispute-settlement processes, the Committee is convinced that collaboration between the Government of Canada and supportive individuals and sectors in the United States could help to enhance Canadian softwood lumber producers’ access to the U.S. market, with benefits for both countries, including through the construction of more affordable homes for Americans.

In the context of the foregoing, the Committee recommends:

Recommendation 1

That the Government of Canada continue with and enhance its engagement with the Government of the United States concerning the United States’ anti-dumping and countervailing duties that are currently being applied on certain Canadian softwood lumber products. In part, the engagement should focus on efforts to ensure that dispute-settlement processes both at the World Trade Organization and under trade agreements are fair and impartial, and lead to timely decisions.

Recommendation 2

That the Government of Canada continue with and enhance its collaboration with sectors in the United States that support an end to the anti-dumping and countervailing duties that country is applying on certain Canadian softwood lumber products. As part of this collaboration, the Government should discuss options for effectively advocating in the United States, and should support initiatives that would increase these sectors’ ability to participate directly in dispute-settlement processes.

Recommendation 3

That the Government of Canada appoint an official softwood lumber emissary for Canada to engage with United States officials to enhance Canada’s efforts designed to encourage the U.S. administration to negotiate a resolution to the current softwood lumber dispute.

Recommendation 4

That the Government of Canada acknowledge that achieving an agreement with the United States regarding trade in softwood lumber products ultimately will occur only through direct head-of-government negotiation. Efforts to achieve a fair, reasonable and durable resolution of the current softwood lumber dispute should be made a high-level priority in dealings with the U.S. government at the leader-to-leader level.

Recommendation 5

That the Government of Canada establish a strategy for investment in value-added transformations of wood within Canada.

Recommendation 6

That the Government of Canada ensure recognition of the specific characteristics of Quebec's forestry regime, which—since the implementation of the province’s Sustainable Forest Development Act in 2013—has established a market-based system for the pricing of timber and related products from Quebec's public forests, and has resulted in full compliance with North American free trade rules.

Recommendation 7

That the Government of Canada take immediate actions designed to ensure that products from private forests in Canada are not subject to U.S. anti-dumping or countervailing duties.

[1] Duties imposed by the United States on imported products from Canada are paid by the importer of record: the person or firm responsible for filing customs documents in relation to an imported product. Canada’s Trade Commissioner Service states that the importer of record can be an exporter or its consignee, the purchaser of the imported product or a customs broker. Concerning softwood lumber products, Global Affairs Canada has indicated that, in most cases, the Canadian softwood lumber exporter is listed as the importer of record.

[2] On 26 July 2023, Minister Ng’s title was changed to “Minister of Export Promotion, International Trade and Economic Development.”