PACP Committee Report

If you have any questions or comments regarding the accessibility of this publication, please contact us at accessible@parl.gc.ca.

Access to Benefits for Hard-to-Reach Populations

Key Findings of the Auditor General of Canada

- The Canada Revenue Agency (CRA or the agency) and Employment and Social Development Canada (ESDC or the department) had an incomplete picture of potentially eligible people who were not receiving benefits.

- The agency and department did not know whether most of their targeted outreach activities had helped to increase benefit take‑up rates for hard‑to‑reach populations.

- The agency and department did not have a sufficiently integrated approach for people requiring extra help.

Summary of Committee Recommendations and Timelines

Table 1—Summary of Committee Recommendations and Timelines

Recommendation |

Recommended Action |

Timeline |

Recommendation 1 |

The Canada Revenue Agency, in collaboration with the Privacy Commissioner of Canada, should study the restrictions mandated by privacy laws and the possibility of modifying the legal framework to allow for the better sharing of data between the Canada Revenue Agency, Employment and Social Development Canada, and Statistics Canada, while ensuring that the protection of personal information is maintained. |

N/A |

Recommendation 2 |

CRA, ESDC, and Statistics Canada should provide the House of Commons Standing Committee on Public Accounts with a joint report on the steps taken to improve measurement of the take-up of benefits such as the Canada Child Benefit, the Canada Workers Benefit, the Guaranteed Income Supplement and the Canada Learning Bond, including its assessment of existing data on hard-to-reach populations; the implementation of measures to collect missing data; and actions taken to make better use of these data. |

30 April 2023 and 30 April 2024 |

Recommendation 3 |

CRA and ESDC should provide the Committee with a joint report on actions taken to better measure the effectiveness of outreach approaches, particularly on their key performance indicators; and on pilot projects and cooperation on developing and implementing consistent performance measures. |

30 June 2023 and 30 June 2024 |

Recommendation 4 |

CRA and ESDC should provide the Committee with a joint report on actions taken to improve the integration of their outreach activities and with those of other government departments and agencies, to reach individuals requiring a high level of support to access benefits. |

30 June 2023 and 30 June 2024 |

Recommendation 5 |

ESDC should provide the Committee with a report presenting: 1) the main factors explaining the low Canada Learning Bond take‑up rates, particularly among Indigenous children; 2) actions the department intends to take to improve the Canada Learning Bond take-up rates, particularly among Indigenous children; and 3) the Canada Learning Bond take-up rates among Indigenous and non‑Indigenous children, using the 2021 Census data. |

30 April 2023 |

Introduction

Background

On 31 May 2022, the Reports of the Auditor General of Canada were tabled in the House of Commons and referred to the House of Commons Standing Committee on Public Accounts (the Committee) for consideration, one of which was “Access to Benefits for Hard-to-Reach Populations.”[1] This report summarizes the report of the Office of the Auditor General (OAG) and includes the Committee’s recommendations for the audited organizations.

Audit Parameters

The key parameters of the OAG’s performance audit are summarized in Table 2.

Table 2—Audit Parameters

Audited organizations |

|

Focus of the audit |

To determine whether CRA and ESDC directly, or through leveraging other federal departments and other non‑federal government entities, ensured that hard‑to‑reach populations were made aware of, and could access, the Canada Child Benefit, the Canada Workers Benefit, the Guaranteed Income Supplement, and the Canada Learning Bond (CLB). |

Audit period |

The audit conclusion applies to the period from 1 April 2019 to 31 August 2021. |

Source: Office of the Auditor General of Canada, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada.

Definitions

A few specific terms are defined in Table 3.

Table 3—Definitions

Hard-to-reach or vulnerable populations |

CRA and ESDC have identified several groups in which individuals often have modest incomes and face one or more barriers to receiving benefits. The department and agency sometimes refer to these groups as vulnerable populations. The groups are

|

Barriers |

Research by the department and agency has identified a range of barriers as impediments to accessing benefits. The following lists some typical barriers for hard‑to‑reach individuals:

Notably, an individual might belong to more than one vulnerable population and might experience many of the barriers described. |

Source: Office of the Auditor General of Canada, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada.

Meeting of the House of Commons Standing Committee on Public Accounts

On 25 October 2022, the Committee held a hearing on the OAG’s report with the following in attendance:

- OAG—Karen Hogan, Auditor General of Canada, and Nicholas Swales, Principal

- CRA—Bob Hamilton, Commissioner of Revenue; Maxime Guénette, Assistant Commissioner, Service, Innovation and Integration Branch; and Gillian Pranke, Assistant Commissioner, Assessment, Benefit and Service Branch

- ESDC—Lori MacDonald, Senior Associate Deputy Minister and Chief Operating Officer for Service Canada; Tammy Bélanger, Senior Assistant Deputy Minister, Benefits and Integrated Services Branch; Atiq Rahman, Assistant Deputy Minister, Learning Branch; and Hugues Vaillancourt, Director General, Strategic and Service Policy Branch

- Statistics Canada—Josée Bégin, Director General, Labour Market, Education and Socio-Economic Well-Being, and Andrew Heisz, Director, Centre for Income and Socioeconomic Well-being Statistics[2]

Findings and Recommendations

According to the OAG, “federal organizations have implemented a wide range of outreach approaches and initiatives aimed at encouraging people to apply for benefits for which they may be eligible.”[3] Bob Hamilton, CRA Commissioner, provided the following example:

When it comes to hard-to-reach populations, the agency has taken many steps to continue to reach the most vulnerable. In fact, when many tax clinics that are part of the community volunteer income tax program— the CVITP—were set to close in March 2020, the CRA quickly pivoted to alter processes so as to keep these clinics up and running, many in a virtual format. These approaches remain in place and provide much greater flexibility and access to those in need.[4]

Additionally, Lori McDonald, Senior Associate Deputy Minister, ESDC, and Chief Operating Officer for Service Canada, provided the following example:

In 2020, Service Canada introduced the reaching all Canadians initiative, which is designed specifically to increase benefit-uptake and eliminate barriers to access and delivery. Through this initiative, we have been connecting directly with communities and organizations who can refer clients to us or help us identify new clients who wouldn’t otherwise be known to us.[5]

A. Overview of People Who Were Not Receiving Benefits for Which They Were Potentially Eligible

According to the OAG, CRA and ESDC “did not have a clear and complete picture of the people who were not receiving benefits for which they were potentially eligible.”[6]

1. Incomplete Measurement of Benefit Take-up

The OAG found that CRA and ESDC “did not have a complete estimate of the overall take‑up rates of the selected benefits. Nor did they know the take‑up rates of specific hard‑to‑reach populations known to experience barriers to accessing benefits, such as those who do not have secure housing, newcomers to Canada, people living with disabilities, and Indigenous peoples.”[7]

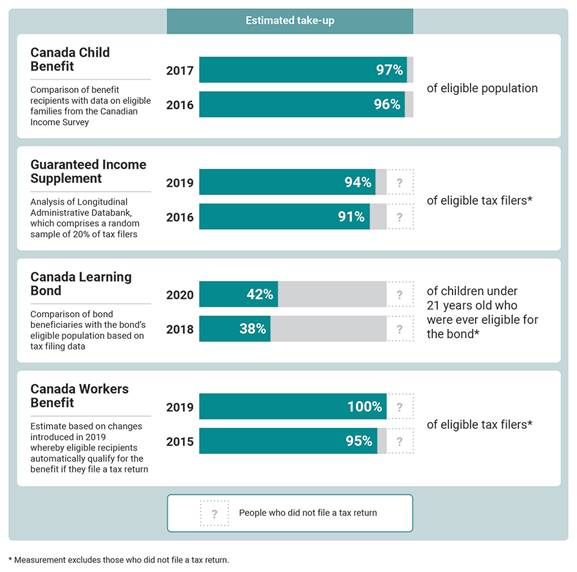

Figure 1 presents the most recent estimates of benefit take-up rates. According to the OAG, these estimates “are an incomplete picture of benefit take‑up because the calculations did not consider people who did not file tax returns.”[8]

Figure 1—Take-Up Rates of Four Benefits

Source: Office of the Auditor General of Canada, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada, Exhibit 1.3.

According to Gillian Pranke, Assistant Commissioner, CRA:

For over five years now, […] we’ve been working with Statistics Canada to conduct what we call linkage studies, where we actually can discreetly link up citizens who complete their census with tax data. It’s anonymized, of course. That gives us an idea as far as individuals who aren’t availing themselves of benefits and credits are concerned.

For the past five years, in the Canada Revenue Agency, we’ve been conducting what we call a non-filer benefit outreach program, where we are in touch with individuals who, according to our records, our holdings, didn’t file a return, but who, according to our data, would be entitled to a benefit or a credit. They would not be in a situation where they’d owe taxes, but they’re entitled to benefits.[9]

During the hearing, there was a discussion about the possibility of automating access to benefits as much as possible, during which Bob Hamilton provided the following:

For the child benefit, we do have an automatic benefit application where we can automatically enrol someone at the time of birth, and that’s been very effective. For the Canada workers benefit, we brought in a number of people to be eligible for that automatically.

We are trying to use that automation where we can but in other cases we’ve used different routes to try to simplify things for people.[10]

However, Atiq Rahman, ESDC, suggested that doing this for the CLB would be more complicated:

Families who want to apply for a Canada Learning Bond have to open an RESP, which can only be opened with a financial institution. That has to be an access point. For the families who have difficulty doing that, we have about 350 community organizations that we work with to help them open RESP accounts with financial institutions. Sometimes we hold events to bring in our partners from CRA, from financial institutions and from provincial governments to help them open an account. Sometimes they need to apply for a social insurance number, and Service Canada will provide a social insurance number on the spot.[11]

As well, privacy legislation makes it challenging to use government databases to identify hard-to-reach populations. According to Bob Hamilton,

This is one of the trade-offs we always face as we try to collect information to help us guide future actions. We face privacy laws, as does every other organization. We also have, within the Income Tax Act, section 241, which declares the confidentiality of information that we receive.[12]

Therefore, the Committee recommends:

Recommendation 1—On the protection of personal information

That the Canada Revenue Agency, in collaboration with the Privacy Commissioner of Canada, study the restrictions mandated by privacy laws and the possibility of modifying the legal framework to allow for the better sharing of data between the Canada Revenue Agency, Employment and Social Development Canada, and Statistics Canada, while ensuring that the protection of personal information is maintained.

2. Lack of a Comprehensive Plan for Improving the Measurement of Benefit Take-up

According to the OAG, CRA and ESDC “did not have a comprehensive plan for improving how benefit take‑up is measured. The department and agency each acknowledged the need to generate more complete, accurate, and timely benefit take‑up data for the Canadian population overall and for those populations at higher risk of not receiving benefits.”[13]

The OAG found “no tangible progress had yet been achieved in data collection, measurement, or analysis of benefit take‑up. [CRA] had not clearly defined responsibilities for improving how benefit take‑up was measured among its benefit program administrators, the departmental outreach function representatives, and its Chief Data Officer. Furthermore, Statistics Canada, [ESDC and CRA] had not clearly defined their respective roles to address their collective challenge of improving how they measure benefit take‑up.”[14] The OAG therefore made the following recommendation:

The Canada Revenue Agency, Employment and Social Development Canada, and Statistics Canada should establish a joint prioritization, planning, monitoring, and reporting process to improve how they measure the take‑up of benefits. This should include

- assessing available and specific data holdings on hard‑to‑reach populations;

- defining and implementing actions to collect additional data on specific hard‑to‑reach populations; and

- improving the use of data in measuring benefit take‑up and the sources of gaps in benefit take‑up.[15]

To address this recommendation, CRA, ESDC and Statistics Canada developed the following plan:

- September to December 2022—CRA, ESDC and Statistics Canada will formalize governance for ongoing prioritization, planning and reporting on the take-up of benefits for hard-to-reach populations.

- January to March 2023—CRA will work with ESDC and Statistics Canada on a second iteration of a project to leverage the most recent Census in order to better understand tendencies in benefit take-up for different segments of the population. ESDC will identify and review the data and methodology currently used to measure benefit take-up among hard-to-reach populations; and create measurement and data acquisition plans by program for hard-to-reach populations determined to be in-scope.

- April to June 2023—ESDC will finalize an assessment of current practices, methodologies and data used in the measurement of the take-up of benefits and identify specific potential improvement to measurements by program.

- July to September 2023—CRA, ESDC and Statistics Canada will finalize an assessment of current practices, methodologies and data used in planning, monitoring and reporting of the take-up of benefits and identify specific opportunities and measures to improve processes, including the alignment of definitions, the clarification of roles and responsibilities, and associated data requirements.

- October to December 2023—CRA and Statistics Canada will implement the plans developed earlier to improve the use of available data and the collection of data, including administrative and qualitative data. ESDC will implement revised methodologies for measuring benefit take-up by program, including measures to improve processes and establish a plan for continuous and consistent reporting of the take-up of benefits.

- January to March 2024—CRA and Statistics Canada plan to assess the work to date and establish a plan for continuous improvement and refinement of measuring take-up of benefits for hard-to-reach populations.[16]

To ensure that this is actually implemented, the Committee recommends:

Recommendation 2—On improving measurement of benefit take-up

That, by 30 April 2023, the Canada Revenue Agency, Employment and Social Development Canada, and Statistics Canada provide the House of Commons Standing Committee on Public Accounts with a joint progress report on the steps taken to improve measurement of the take-up of benefits such as the Canada Child Benefit, the Canada Workers Benefit, the Guaranteed Income Supplement, and the Canada Learning Bond, including its assessment of existing data on hard-to-reach populations; the implementation of measures to collect missing data; and actions taken to make better use of these data. A final joint report must also be presented by 30 April 2024.

B. Impact of Outreach Activities

According to the OAG, CRA and ESDC “did not know whether most of their targeted outreach activities had helped to increase the benefit take‑up rates for specific hard‑to‑reach populations.”[17]

The OAG found that the department and agency “developed limited measures to demonstrate some of the results of targeted outreach efforts:

- Results of targeted outreach visits to First Nations and northern communities. [ESDC] measured the volume of transactions resulting from each visit, for example, how many Canada Child Benefit applications were submitted.

- Response rates for various targeted letter campaigns. [CRA] measured how many individuals who received a letter subsequently filed a tax return. The agency also measured the dollar value of benefits made available to the individual who filed a return after receiving such a letter. [ESDC] measured how many applications for the Guaranteed Income Supplement were received in response to a targeted letter campaign.”[18]

According to the OAG, despite these efforts, “the department and agency had not developed measures to assess the impacts of outreach activities.”[19] In 2021, CRA began analyzing ways to better demonstrate the results of targeted outreach approaches, and ESDC began developing a logic model to inform their approach to measuring the performance and results of their targeted outreach approaches. At the time of the audit, “both of these efforts were at early stages and had not yet resulted in improvements in measuring the impact of outreach approaches.”[20] The OAG therefore made the following recommendation:

To better understand the effectiveness of outreach approaches, the Canada Revenue Agency and Employment and Social Development Canada should develop and implement consistent results‑based performance measures for targeted outreach to hard‑to‑reach populations.[21]

According to its action plan, in spring and summer 2022, CRA established an internal working group to review and refine Benefits Outreach key performance indicators (KPIs) that are to be fully incorporated into the agency’s outreach activities. The agency also developed a pilot project for outreach activities to measure program effectiveness. In winter 2022, CRA is to review the pilot project’s implementation and make any necessary adjustments in preparation for a program-wide rollout.[22]

As for ESDC, between January and March 2023, it plans to establish an internal working group to review and refine the KPIs for Reaching All Canadians, a horizontal initiative to make service delivery improvements across its service channels and benefit programs, specifically to increase benefit program uptake, and eliminate program and service delivery barriers. Between April and June 2023, ESDC plans to implement the KPI pilot for select Outreach and Reaching All Canadians activities. Between April and June 2024, ESDC will develop a status report on pilot implementation.[23]

ESDC and the agency plan to collaborate by developing and implementing a plan to produce standard KPIs, by sharing experiences and revised KPIs, and by further integrating and coordinating performance measures over time.[24] This goal was also expressed during the hearing by agency commissioner Bob Hamilton:

I think it truly is a joint effort between us and ESDC. There are certain programs that ESDC is responsible for—you mentioned [Old Age Security] and [Guaranteed Income Supplement], and certain ones that we are, but we share the same challenge. I don’t think it’s a problem that we have to do it in a partnership. We both feel accountable for this.[25]

The Committee therefore recommends:

Recommendation 3—On measuring the effectiveness of outreach strategies

That, by 30 June 2023, the Canada Revenue Agency and Employment and Social Development Canada provide the House of Commons Standing Committee on Public Accounts with a joint progress report on actions taken to better measure the effectiveness of outreach approaches, particularly on their key performance indicators; and on pilot projects and cooperation on developing and implementing consistent performance measures. A final joint report must also be presented by 30 June 2024.

C. Integrated Strategy For Individuals Requiring Additional Support

According to the OAG, CRA and ESDC “did not have an approach for ensuring a comprehensive and seamless service experience to assist those individuals requiring individualized support from a knowledgeable person to navigate through the various requirements they face to gain access to benefits.”[26]

The OAG found that “service approaches for assisting individuals who required a higher level of support to navigate barriers and process requirements before accessing benefits were not sufficiently integrated between [CRA and ESDC]. Successfully helping these individuals’ access benefits requires personalized and knowledgeable service adapted to their unique circumstances.”[27]

The OAG provided the following example of the lack of integration between the two organizations:

In January 2021, [ESDC] launched the Reaching All Canadians strategy, under the direction of a department-wide steering committee. One element of this strategy was the Community Partnership Access Initiative. Through this pilot initiative, community organizations that provided individualized support for hard‑to‑reach individuals could make referrals to the department regarding specific cases where an individual faced barriers to accessing benefits. A department employee would follow up directly with the referred individual to assist that person in, for example, completing an application for the Guaranteed Income Supplement. We found that although the referral service enabled the department to provide direct assistance, it did not extend to matters involving [CRA]. This meant that if the same individual required support to complete unfiled tax returns, which could be challenging for hard‑to‑reach people, the referral service could not be used to contact the agency to help resolve the individual’s access issues.[28]

In light of this issue, the OAG made the following recommendation:

To improve the integration and effectiveness of targeted outreach, the Canada Revenue Agency and Employment and Social Development Canada should collaborate to establish a seamless client service experience to address the needs of those requiring a high level of support to access benefits.[29]

To address this recommendation, a CRA–ESDC outreach working group was established in spring 2022 to discuss increased collaboration and coordination on outreach activities and to analyze the service flow for various common client groups to determine gaps and propose solutions. Another working group (which also includes Indigenous Services Canada) is focused on concrete options to increase Canada Child Benefit uptake while taking the OAG’s findings and recommendations into consideration. As well, existing CRA–ESDC senior management bilateral meetings now include increasing outreach collaboration and developing a seamless client service experience for those requiring a high level of support as standing agenda items.[30]

By March 2023, the CRA–ESDC working group will prepare a recommendations report for senior management covering opportunities to improve collaboration and address service gaps for those requiring a high level of service. By March 2024, approved working group recommendations will have been implemented in relevant CRA and ESDC programs.[31]

The Committee therefore recommends:

Recommendation 4—On integrating targeted outreach activities

That, by 30 June 2023, the Canada Revenue Agency and Employment and Social Development Canada provide the House of Commons Standing Committee on Public Accounts with a joint progress report on actions taken to improve the integration of their outreach activities and with those of other government departments and agencies, to reach individuals requiring a high level of support to access benefits. A final joint report must also be presented by 30 June 2024.

Supplementary Observation and Recommendation

During the hearing, CRA and ESDC were asked about the low benefit take-up rate, particularly for the CLB, for hard-to-reach populations. According to a written answer received by the Committee, overall, in 2021, “42.6% of children aged 0 to 20 years of age who were eligible for the CLB at least once since 2004 received a CLB payment.”[32] ESDC also stated that the Canada Educations Savings Program linked its administrative data to 2016 Census data for various population sub-groups. That year, 24.7% of children eligible for the CLB received it, and in particular, 6.8% of Indigenous children, compared to 27.7% of non-Indigenous children.[33]

In response to Recommendation 6 of the Committee’s report entitled “Student Financial Assistance” (43rd Parliament, 2nd Session), the department stated that in the fall of 2020, it had started an evaluation of the Canada Education Savings Program to investigate the reasons for low participation in the program, and that “the evaluation is now on track to be completed by March 2023.”[34]

In light of the low CLB take-up, in particular among Indigenous children, the Committee recommends:

Recommendation 5—On Canada Learning Bond Take-up

That, by 30 April 2023, Employment and Social Development Canada provide the House of Commons Standing Committee on Public Accounts with a report presenting: 1) the main factors explaining the low Canada Learning Bond take-up rates, particularly among Indigenous children; 2) actions the department intends to take to improve the Canada Learning Bond take-up rates, particularly among Indigenous children; and 3) the Canada Learning Bond take-up rates among Indigenous and non-Indigenous children, using the 2021 Census data.

Conclusion

The Committee notes that the OAG concluded that CRA and ESDC had not taken sufficient steps to ensure that hard‑to‑reach populations were made aware of and could access the Canada Child Benefit, the Canada Workers Benefit, the Guaranteed Income Supplement and the Canada Learning Bond. Furthermore, although the department and agency had taken steps toward achieving this objective, there remained a significant number of individuals who were not receiving benefits for which they were eligible. Opportunity for improvement exists to address gaps in measuring the take‑up of benefits, in demonstrating results of outreach efforts and in providing seamless support between federal organizations assisting hard‑to‑reach individuals to access their benefits.

Consequently, the Committee is making five recommendations to ensure that the OAG’s recommendations are adequately addressed, and that the department and the agency provide the Committee with evidence of this through progress reports. These recommendations pertain to needed improvements to measuring benefit take-up and the effectiveness of outreach strategies, better coordination between the department and the agency to improve integration and effectiveness of targeted outreach activities, and Canada Learning Bond take-up.

[2] House of Commons, Standing Committee on Public Accounts, Minutes, 1st Session, 44th Parliament, 25 October 2022, Meeting No. 34.

[3] Office of the Auditor General of Canada (OAG), Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada, para. 1.6.

[4] House of Commons, Standing Committee on Public Accounts, Evidence, 1st Session, 44th Parliament, 25 October 2022, Meeting No. 34, 1545.

[5] Ibid., 1555.

[6] OAG, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada, para. 1.15.

[7] Ibid., para. 1.21.

[8] Ibid., para. 1.22.

[9] House of Commons, Standing Committee on Public Accounts, Evidence, 1st Session, 44th Parliament, 25 October 2022, Meeting No. 34, 1620.

[10] Ibid., 1650.

[11] Ibid., 1645.

[12] Ibid., 1635.

[13] OAG, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada, para. 1.27.

[14] Ibid., para. 1.30.

[15] Ibid., para. 1.31.

[16] Canada Revenue Agency (CRA), Detailed Action Plan, pp. 1–2; Employment and Social Development Canada (ESDC), Detailed Action Plan, pp. 1–2; Statistics Canada, Detailed Action Plan, pp. 1–2.

[17] OAG, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada, para. 1.32.

[18] Ibid., para. 1.41.

[19] Ibid., para. 1.42.

[20] Ibid., para. 1.44.

[21] Ibid., para. 1.45.

[22] CRA, Detailed Action Plan, pp. 1–2.

[23] ESDC, Detailed Action Plan, pp. 2–5.

[24] Ibid, p. 3.

[25] House of Commons, Standing Committee on Public Accounts, Evidence, 1st Session, 44th Parliament, 25 October 2022, Meeting No. 34, 1700.

[26] OAG, Access to Benefits for Hard-to-Reach Populations, Report 1 of the 2022 Reports of the Auditor General of Canada, para. 1.46.

[27] Ibid., para. 1.54.

[28] Ibid., para. 1.57.

[29] Ibid., para. 1.59.

[30] CRA, Detailed Action Plan, pp. 2–3.

[31] Ibid., p. 3.

[32] ESDC, ESDC Follow-up Response to October 25 PACP Appearance on Auditor General Report 1 on Access to Benefits for Hard-to-Reach Populations.

[33] Ibid.